Answered step by step

Verified Expert Solution

Question

1 Approved Answer

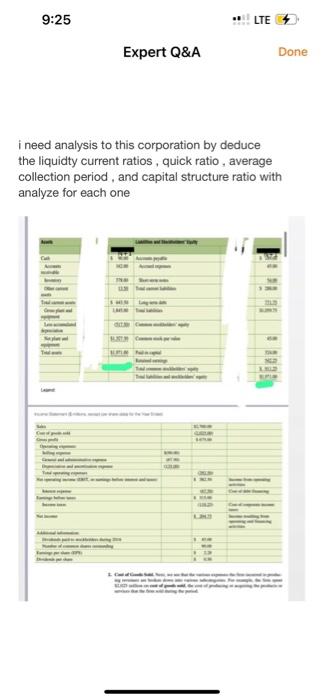

this course is about financial management so please i need a pro financial management instructor please i need a balance sheet and income statements for

this course is about financial management so please i need a pro financial management instructor

please i need a balance sheet and income statements for real company from you with full analysis of comapanies by :

1- liquidity ratios number with analysis if good or no

2- asset managment

3- debt managment

4- profitability ratios / return managment

5- market analysis

please this is project so i need deatils for every part and full ratios with analysis for all corporation in general and also analysis for every single ratio

i

i'll show you example look this corporation but i need other corporation from you and analyze it like this by raytios and theres many more ratioss

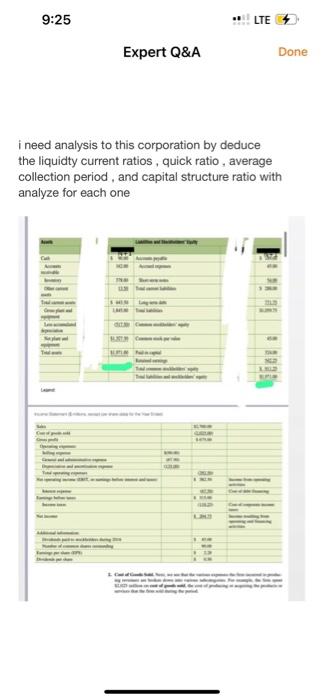

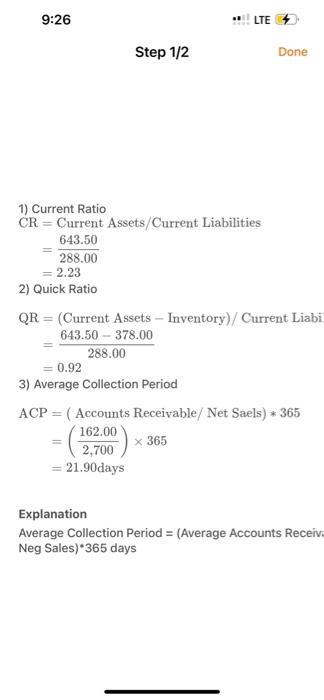

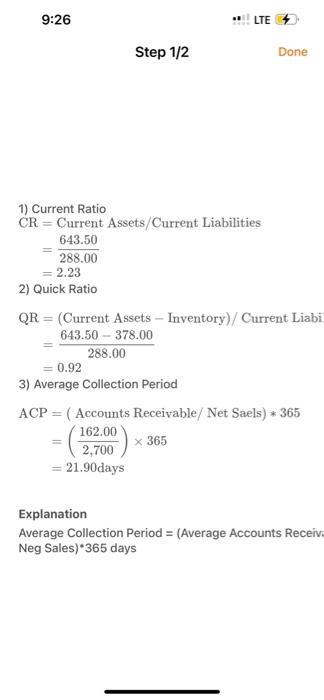

i need analysis to this corporation by deduce the liquidty current ratios, quick ratio, average collection period, and capital structure ratio with analyze for each one 1) Current Ratio CR= Current Assets/Current Liabilities =288.00643.50=2.23 2) Quick Ratio QR=(CurrentAssets-Inventory)/CurrentLiabi=288.00643.50378.00=0.92 3) Average Collection Period ACP=(AccountsReceivable/NetSaels)365=(2,700162.00)365=21.90days Explanation Average Collection Period = (Average Accounts Receiv, Neg Sales)*365 days i need analysis to this corporation by deduce the liquidty current ratios, quick ratio, average collection period, and capital structure ratio with analyze for each one 1) Current Ratio CR= Current Assets/Current Liabilities =288.00643.50=2.23 2) Quick Ratio QR=(CurrentAssets-Inventory)/CurrentLiabi=288.00643.50378.00=0.92 3) Average Collection Period ACP=(AccountsReceivable/NetSaels)365=(2,700162.00)365=21.90days Explanation Average Collection Period = (Average Accounts Receiv, Neg Sales)*365 days

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started