Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This data I need full answers Il. Finance The Coca-Cola Company The Coca-Cola Company, a beverage company, manufactures and distributes various nonalcoholic beverages worldwide. The

This data I need full answers

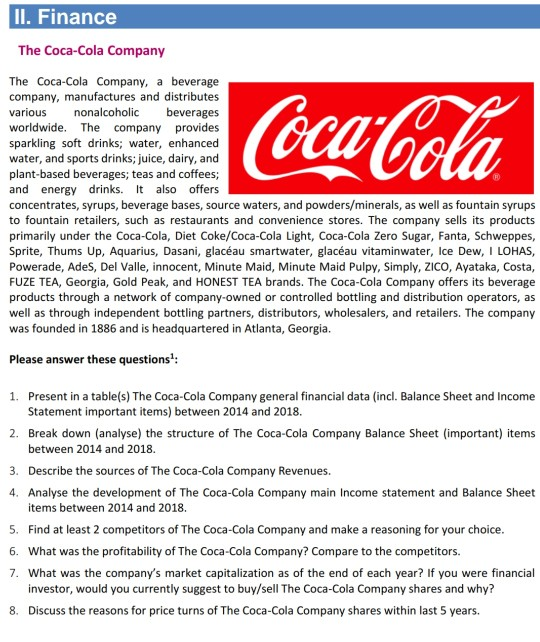

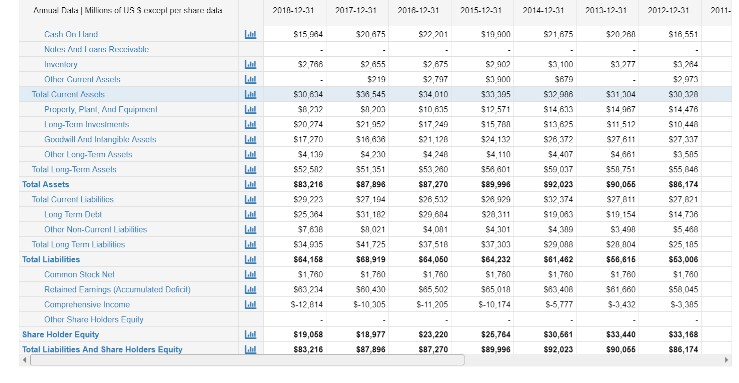

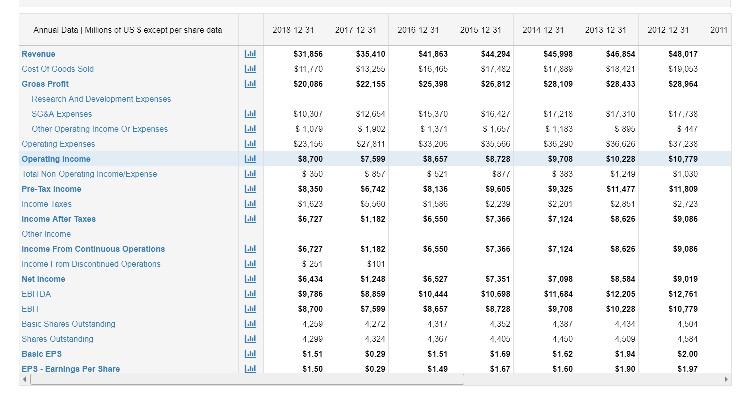

Il. Finance The Coca-Cola Company The Coca-Cola Company, a beverage company, manufactures and distributes various nonalcoholic beverages worldwide. The company provides sparkling soft drinks; water, enhanced water, and sports drinks; juice, dairy, and plant-based beverages; teas and coffees; and energy drinks. It also offers concentrates, syrups, beverage bases, source waters, and powders/minerals, as well as fountain syrups to fountain retailers, such as restaurants and convenience stores. The company sells its products primarily under the Coca-Cola, Diet Coke/Coca-Cola Light, Coca-Cola Zero Sugar, Fanta, Schweppes, Sprite, Thums Up, Aquarius, Dasani, glacau smartwater, glacau vitaminwater, Ice Dew, I LOHAS, Powerade, AdeS, Del Valle, innocent, Minute Maid, Minute Maid Pulpy, Simply, ZICO, Ayataka, Costa, FUZE TEA, Georgia, Gold Peak, and HONEST TEA brands. The Coca-Cola Company offers its beverage products through a network of company-owned or controlled bottling and distribution operators, as well as through independent bottling partners, distributors, wholesalers, and retailers. The company was founded in 1886 and is headquartered in Atlanta, Georgia. Please answer these questions: 1. Present in a table(s) The Coca-Cola Company general financial data (incl. Balance Sheet and Income Statement important items) between 2014 and 2018. 2. Break down (analyse) the structure of The Coca-Cola Company Balance Sheet (important) items between 2014 and 2018. Describe the sources of The Coca-Cola Company Revenues. Analyse the development of The Coca-Cola Company main Income statement and Balance Sheet items between 2014 and 2018 Find at least 2 competitors of The Coca-Cola Company and make a reasoning for your choice. What was the profitability of The Coca-Cola Company? Compare to the competitors. What was the company's market capitalization as of the end of each year? If you were financial investor, would you currently suggest to buy/sell The Coca-Cola Company shares and why? Discuss the reasons for price turns of The Coca-Cola Company shares within last 5 years. 3. 4. 5. 6. 7. 8. 7-12-31 2016-1.3215-12-1 2014-12-31 1-12- 2017 2014-17-31013-12-31 2012-12-31 2011. Pioperly, Plani, Andqiaprnenl Olher Lang-Term Asss Tolal ong-Term Assel Total Assets Tolal Cuend instbiic Olhar Non-Current iabli Tolal Long Teibilitins Total Liabilities Relisined Earnings (Acrinulaled Dficil) Cmprhive Inco Other Share Hoiders Equily Total Liabilities And Share HoldersE 2018 12 3 20 12 31 201 12 3 201 12 31211 12 31 2013 12 3 22 1231 2011 S31,856 35.410 $41,863 Revenue $45,998 Cost Goods Sold $20,086 $28,108 528.433 $22.155 S25,398 IResearch And Developmen txpenses 10$126S1b3$1218 1310S11.138 Cther Operatng Income Or Expenses Operating Exenses Operating Income lotel Non Operating Incometxpense Pre-Tax Income Income laxes Income ATter Taxee 5582050.6 $8,657 521,811 $10.228 8,700 $7.599 11.477$11,809 $8,350 $8,136 $5,742 $6,550 57,124 $9,086 $1.182 6,727 $6,550 $7,124 Income From Continuoue Operations Income I rom Discontnued Operatons Net Income $1.248 $6,527 $7,098 $11,684 9,708 58.859 $10,444 9,786 8,700 $10.688 $12.205512,751 $10.228 $8,657 $7.589 1,298 $1.51 $1.50 $0.29 $0.29 B8alc EPs EPS-Earninge Per Snare $1.62 $1.94 Il. Finance The Coca-Cola Company The Coca-Cola Company, a beverage company, manufactures and distributes various nonalcoholic beverages worldwide. The company provides sparkling soft drinks; water, enhanced water, and sports drinks; juice, dairy, and plant-based beverages; teas and coffees; and energy drinks. It also offers concentrates, syrups, beverage bases, source waters, and powders/minerals, as well as fountain syrups to fountain retailers, such as restaurants and convenience stores. The company sells its products primarily under the Coca-Cola, Diet Coke/Coca-Cola Light, Coca-Cola Zero Sugar, Fanta, Schweppes, Sprite, Thums Up, Aquarius, Dasani, glacau smartwater, glacau vitaminwater, Ice Dew, I LOHAS, Powerade, AdeS, Del Valle, innocent, Minute Maid, Minute Maid Pulpy, Simply, ZICO, Ayataka, Costa, FUZE TEA, Georgia, Gold Peak, and HONEST TEA brands. The Coca-Cola Company offers its beverage products through a network of company-owned or controlled bottling and distribution operators, as well as through independent bottling partners, distributors, wholesalers, and retailers. The company was founded in 1886 and is headquartered in Atlanta, Georgia. Please answer these questions: 1. Present in a table(s) The Coca-Cola Company general financial data (incl. Balance Sheet and Income Statement important items) between 2014 and 2018. 2. Break down (analyse) the structure of The Coca-Cola Company Balance Sheet (important) items between 2014 and 2018. Describe the sources of The Coca-Cola Company Revenues. Analyse the development of The Coca-Cola Company main Income statement and Balance Sheet items between 2014 and 2018 Find at least 2 competitors of The Coca-Cola Company and make a reasoning for your choice. What was the profitability of The Coca-Cola Company? Compare to the competitors. What was the company's market capitalization as of the end of each year? If you were financial investor, would you currently suggest to buy/sell The Coca-Cola Company shares and why? Discuss the reasons for price turns of The Coca-Cola Company shares within last 5 years. 3. 4. 5. 6. 7. 8. 7-12-31 2016-1.3215-12-1 2014-12-31 1-12- 2017 2014-17-31013-12-31 2012-12-31 2011. Pioperly, Plani, Andqiaprnenl Olher Lang-Term Asss Tolal ong-Term Assel Total Assets Tolal Cuend instbiic Olhar Non-Current iabli Tolal Long Teibilitins Total Liabilities Relisined Earnings (Acrinulaled Dficil) Cmprhive Inco Other Share Hoiders Equily Total Liabilities And Share HoldersE 2018 12 3 20 12 31 201 12 3 201 12 31211 12 31 2013 12 3 22 1231 2011 S31,856 35.410 $41,863 Revenue $45,998 Cost Goods Sold $20,086 $28,108 528.433 $22.155 S25,398 IResearch And Developmen txpenses 10$126S1b3$1218 1310S11.138 Cther Operatng Income Or Expenses Operating Exenses Operating Income lotel Non Operating Incometxpense Pre-Tax Income Income laxes Income ATter Taxee 5582050.6 $8,657 521,811 $10.228 8,700 $7.599 11.477$11,809 $8,350 $8,136 $5,742 $6,550 57,124 $9,086 $1.182 6,727 $6,550 $7,124 Income From Continuoue Operations Income I rom Discontnued Operatons Net Income $1.248 $6,527 $7,098 $11,684 9,708 58.859 $10,444 9,786 8,700 $10.688 $12.205512,751 $10.228 $8,657 $7.589 1,298 $1.51 $1.50 $0.29 $0.29 B8alc EPs EPS-Earninge Per Snare $1.62 $1.94

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started