Answered step by step

Verified Expert Solution

Question

1 Approved Answer

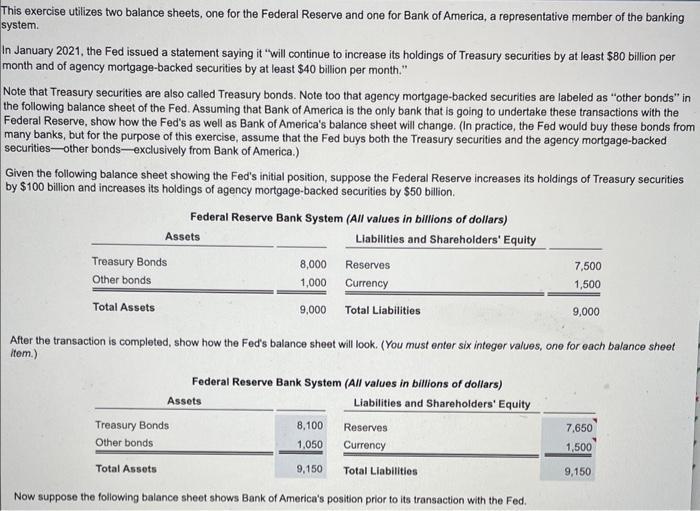

This exercise utilizes two balance sheets, one for the Federal Reserve and one for Bank of America, a representative member of the banking system.

This exercise utilizes two balance sheets, one for the Federal Reserve and one for Bank of America, a representative member of the banking system. In January 2021, the Fed issued a statement saying it "will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month." Note that Treasury securities are also called Treasury bonds. Note too that agency mortgage-backed securities are labeled as "other bonds" in the following balance sheet of the Fed. Assuming that Bank of America is the only bank that is going to undertake these transactions with the Federal Reserve, show how the Fed's as well as Bank of America's balance sheet will change. (In practice, the Fed would buy these bonds from many banks, but for the purpose of this exercise, assume that the Fed buys both the Treasury securities and the agency mortgage-backed securities-other bonds-exclusively from Bank of America.) Given the following balance sheet showing the Fed's initial position, suppose the Federal Reserve increases its holdings of Treasury securities by $100 billion and increases its holdings of agency mortgage-backed securities by $50 billion. Treasury Bonds Other bonds Total Assets Federal Reserve Bank System (All values in billions of dollars) Liabilities and Shareholders' Equity Assets 8,000 1,000 9,000 Assets Reserves Currency Total Liabilities Federal Reserve Bank System (All values in billions of dollars) Liabilities and Shareholders' Equity After the transaction is completed, show how the Fed's balance sheet will look. (You must enter six integer values, one for each balance sheet item.) Treasury Bonds Other bonds Total Assets Now suppose the following balance sheet shows Bank of America's position prior to its transaction with the Fed. 8,100 1,050 9,150 Reserves Currency 7,500 1,500 Total Liabilities 9,000 7,650 1,500 9,150. Now suppose the following balance sheet shows Bank of America's position prior to its transaction with the Fed Bank of America (All values in billions of dollars) Assets Reserves Deposits and other liabilities Shareholders' equity 2,300 400 Bonds and other investments Total Assets Liabilities + Shareholders' equity 2,700 After its transaction with the Fed is completed, show how Bank of America's balance sheet will look. (You must enter six infeger values, one for each balance sheet item.) Assets Liabilities and Shareholders' Equity 300 2.400 2,700 Reserves Bonds and other investments Total Assets Bank of America (All values in billions of dollars) Liabilities and Shareholders' Equity Deposits and other labilities. Shareholders' equity Liabilities + Shareholders' equity

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Federal Reserve Bank System all Values in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started