Answered step by step

Verified Expert Solution

Question

1 Approved Answer

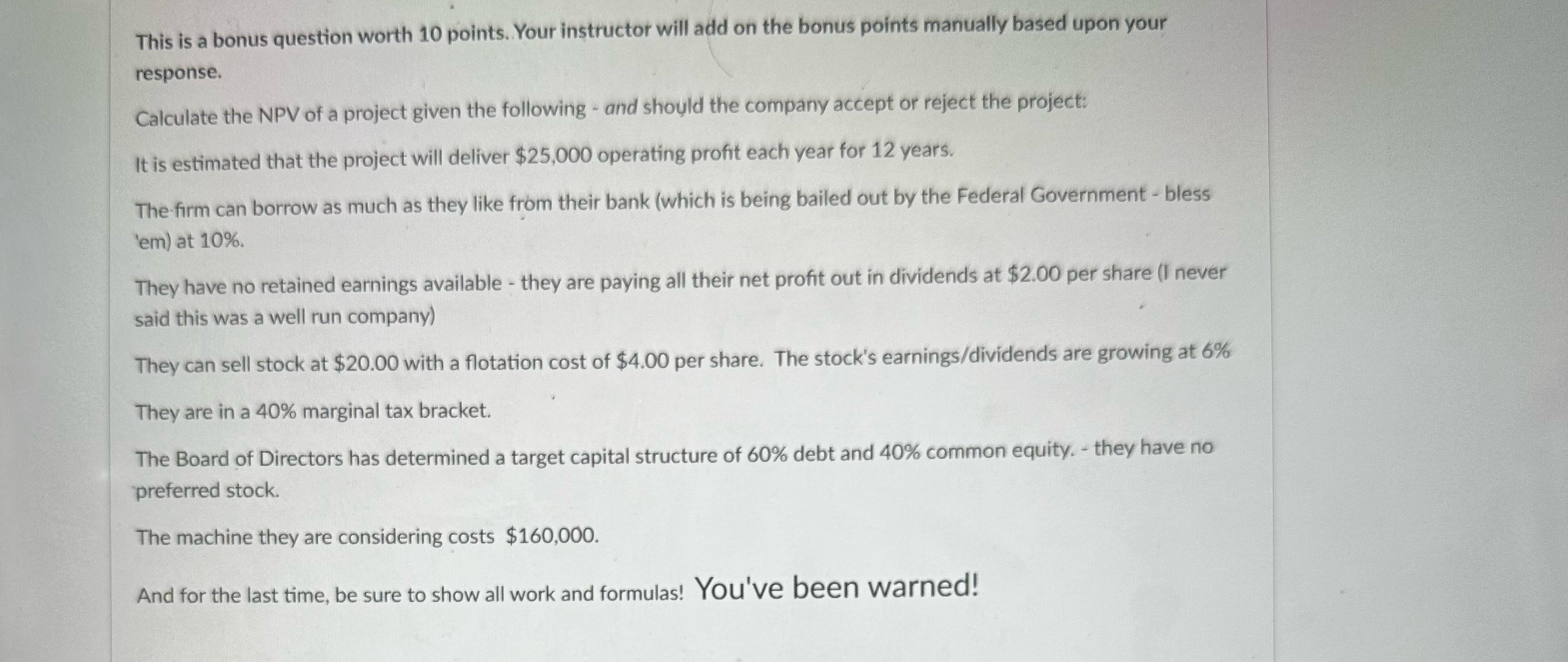

This is a bonus question worth 1 0 points. Your instructor will add on the bonus points manually based upon your response. Calculate the NPV

This is a bonus question worth points. Your instructor will add on the bonus points manually based upon your response.

Calculate the NPV of a project given the following and should the company accept or reject the project:

It is estimated that the project will deliver $ operating profit each year for years.

Thefirm can borrow as much as they like from their bank which is being bailed out by the Federal Government bless em at

They have no retained earnings available they are paying all their net profit out in dividends at $ per share I never said this was a well run company

They can sell stock at $ with a flotation cost of $ per share. The stock's earningsdividends are growing at They are in a marginal tax bracket.

The Board of Directors has determined a target capital structure of debt and common equity. they have no preferred stock.

The machine they are considering costs $

And for the last time, be sure to show all work and formulas! You've been warned!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started