This is a bookkeeping question. Please answer with all the accounts as necessary.

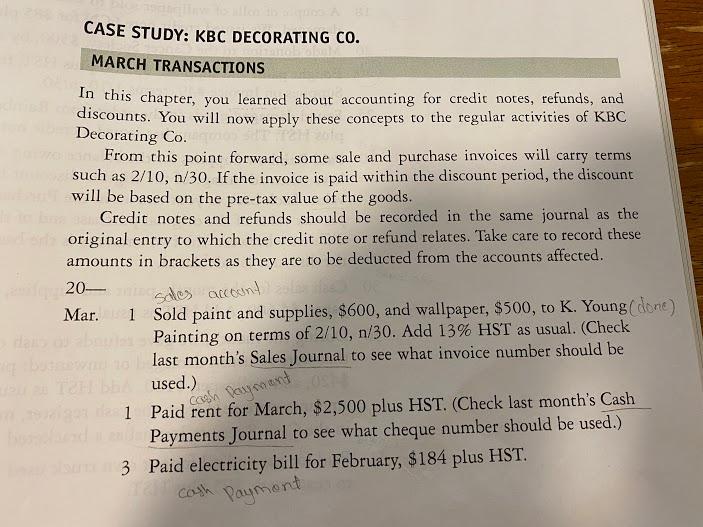

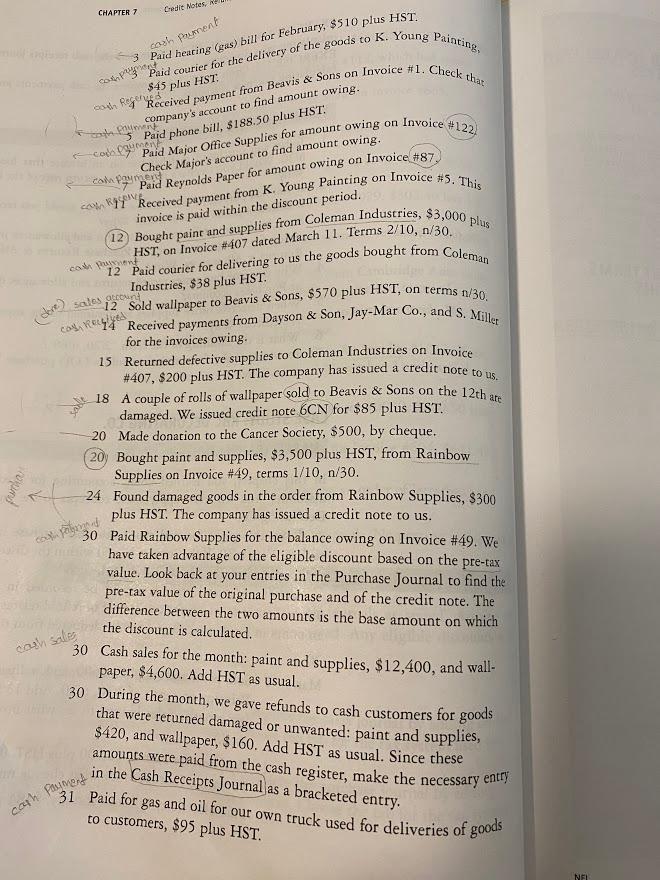

CASE STUDY: KBC DECORATING CO. MARCH TRANSACTIONS In this chapter, you learned about accounting for credit notes, refunds, and discounts. You will now apply these concepts to the regular activities of KBC Decorating Co. From this point forward, some sale and purchase invoices will carry terms such as 2/10, n/30. If the invoice is paid within the discount period, the discount will be based on the pre-tax value of the goods. BeCredit notes and refunds should be recorded in the same journal as the original entry to which the credit note or refund relates. Take care to record these amounts in brackets as they are to be deducted from the accounts affected. 20 Mar. 1 Sold paint and supplies, $600, and wallpaper, $500, to K. Young (dont) Painting on terms of 2/10, n/30. Add 13% HST as usual. (Check last month's Sales Journal to see what invoice number should be used.) 1 Paid rent for March, $2,500 plus HST. (Check last month's Cash Payments Journal to see what cheque number should be used.) 3 Paid electricity bill for February, $184 plus HST. sales account .ch Payment cash Payment CHAPTER 7 Credit Nodes. cosh Payment cos 3 Paid hearing (gas) bill for February, $510 plus HST. Paid courier for the delivery of the goods to K. Young Painting, payment from Beavis & Sons on Invoice #1. Check that Paid Major Office Supplies for amount owing on Invoice #122 $45 plus HST: Rogo Received both company's account to find amount owing. Paid phone bill, $188.50 plus HST. Cox Check Major's account to find amount owing. Pad Reynolds Paper for amount owing on Invoice #87 97 Received payment from K. Young Painting invoice is paid within the discount period. cal paymer on Invoice #5. This 12 Bought paint and supplies from Coleman Industries, $3,000 plus HST, on Invoice #407 dated March 11. Terms 2/10, n/30. 12 Paid courier for delivering to us the goods bought from Coleman cond Industries, $38 plus HST. sales cos Reyed Invoice 12 Sold wallpaper to Beavis & Sons, $570 plus HST, on terms 1/30. 14 Received payments from Dayson & Son, Jay-Mar Co., and S. Millet for the invoices owing. 15 Returned defective supplies to Coleman Industries on #407, $200 plus HST. The company has issued a credit note to us. 18 A couple of rolls of wallpaper sold to Beavis & Sons on the 12th at damaged. We issued credit note 6CN for $85 plus HST. 20 Made donation to the Cancer Society, $500, by cheque. 20) Bought paint and supplies, $3,500 plus HST, from Rainbow Supplies on Invoice #49, terms 1/10, n/30. 24 Found damaged goods in the order from Rainbow Supplies, $300 plus HST. The company has issued a credit note to us. 30 Paid Rainbow Supplies for the balance owing on Invoice #49. We have taken advantage of the eligible discount based on the pre-tax value. Look back at your entries in the Purchase Journal to find the pre-tax value of the original purchase and of the credit note. The difference between the two amounts is the base amount on which the discount is calculated. further Volgen cash sales 30 Cash sales for the month: paint and supplies, $12,400, and wall- paper, $4,600. Add HST as usual. 30 During the month, we gave refunds to cash customers for goods that were returned damaged or unwanted: paint and supplies, $420, and wallpaper, $160. Add HST as usual. Since these amounts were paid from the cash register, make the necessary entry in the Cash Receipts Journal as a bracketed entry. 31 Paid for gas and oil for our own truck used for deliveries of goods cath Payment to customers, $95 plus HST. NEL CHAPTER 7 Credit Notes, Refunds, and Discounts 127 AT MONTH-END (a) Total, balance, and rule the special journals. When adding up the col- umns, be sure to subtract any amounts that are in brackets. (b) Post all entries to the ledger accounts. (c) Prepare a trial balance on March 31, 20. Be sure to double-check that the total of the schedule of Accounts Receivable is equal to the balance in the Accounts Receivable Control account. As well, check to see that the total of the schedule of Accounts Payable is equal to the balance in the Accounts Payable Control account