Answered step by step

Verified Expert Solution

Question

1 Approved Answer

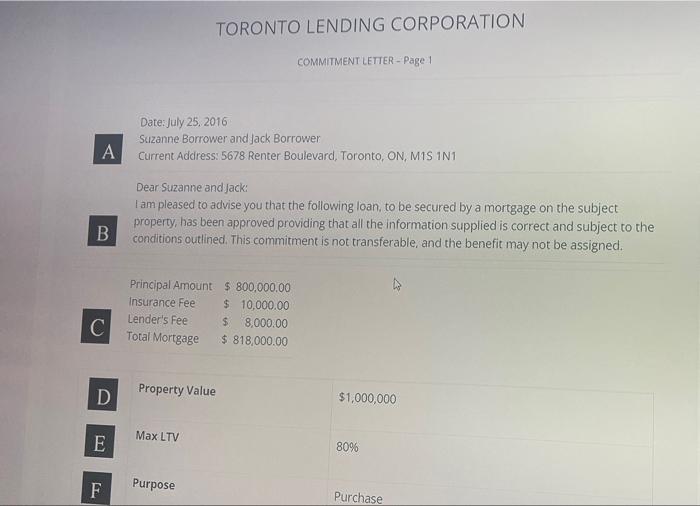

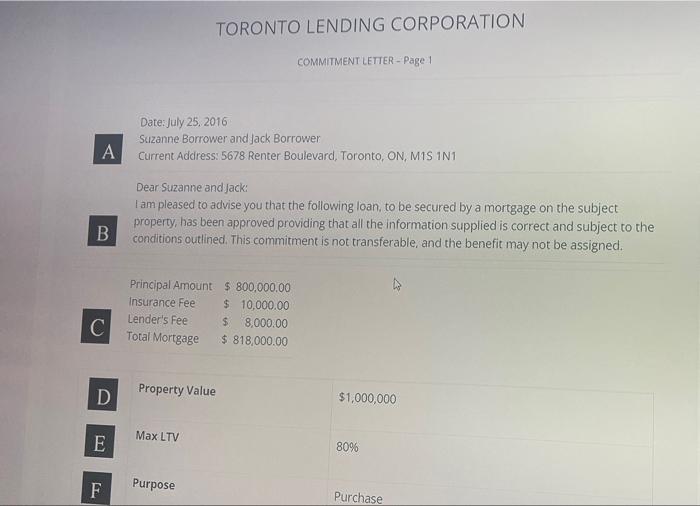

This is a case stidy two part question TORONTO LENDING CORPORATION COMMITMENT LETTER - Page 1 Date: July 25, 2016 Suzanne Borrower and Jack Borrower

This is a case stidy two part question

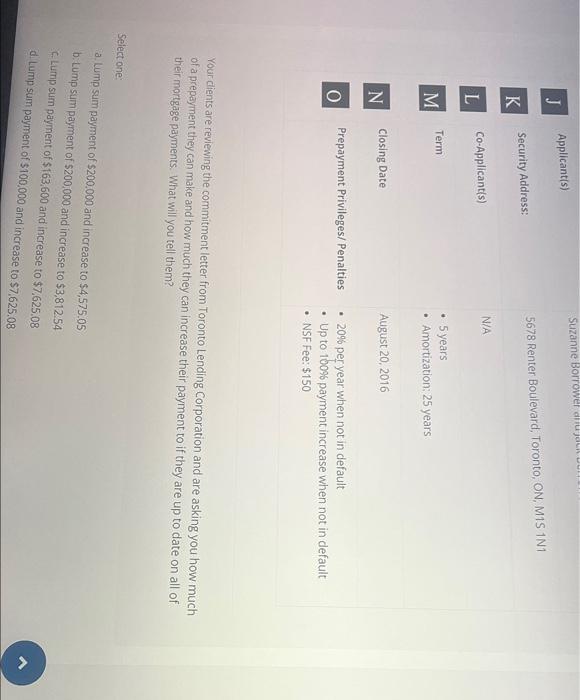

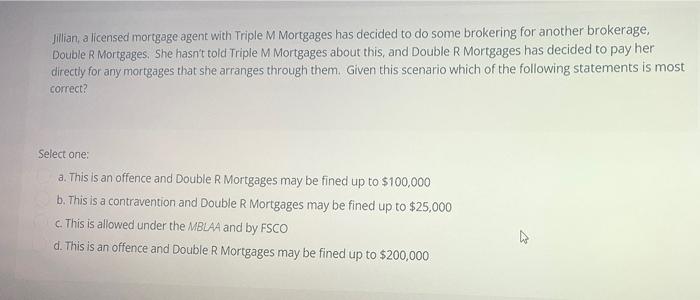

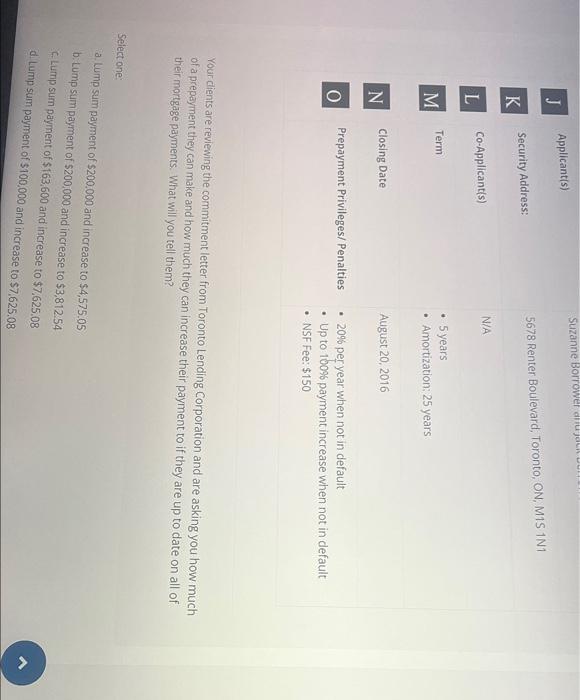

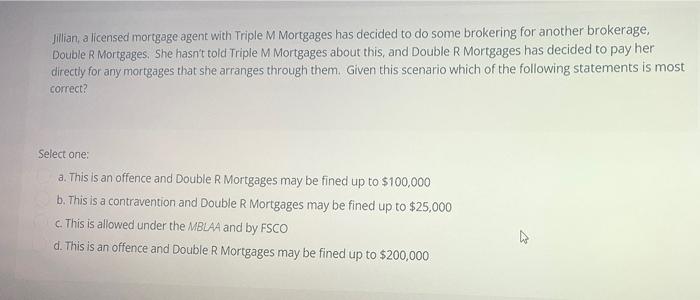

TORONTO LENDING CORPORATION COMMITMENT LETTER - Page 1 Date: July 25, 2016 Suzanne Borrower and Jack Borrower Current Address: 5678 Renter Boulevard, Toronto, ON, MIS 1N1 A Dear Suzanne and Jack: I am pleased to advise you that the following loan to be secured by a mortgage on the subject property, has been approved providing that all the information supplied is correct and subject to the conditions outlined. This commitment is not transferable, and the benefit may not be assigned. B Principal Amount $ 800,000.00 Insurance Fee $ 10,000.00 Lender's Fee $ 8,000.00 Total Mortgage $ 818,000.00 C D Property Value $1,000,000 Max LTV E 80% F Purpose Purchase Suzanne Borrowel dituju J Applicants) 5678 Renter Boulevard, Toronto, ON, MIS 1N1 K Security Address: N/A L Co-Applicant(s) Term . 5 years Amortization: 25 years N Closing Date August 20, 2016 0 Prepayment Privileges/ Penalties 20% per year when not in default Up to 100% payment increase when not in default NSF Fee: $150 . Your clients are reviewing the commitment letter from Toronto Lending Corporation and are asking you how much of a prepayment they can make and how much they can increase their payment to if they are up to date on all of their mortgage payments. What will you tell them? Select one a. lump sum payment of $200,000 and increase to $4,575.05 b. Lumpsum payment of $200,000 and increase to $3,812.54 Lump sur payment of $ 163,600 and increase to $7,625.08 d. Lumpsum payment of $100,000 and increase to $7.625.08 > Jillian, a licensed mortgage agent with Triple M Mortgages has decided to do some brokering for another brokerage, Double R Mortgages. She hasn't told Triple M Mortgages about this, and Double R Mortgages has decided to pay her directly for any mortgages that she arranges through them. Given this scenario which of the following statements is most correct? Select one: a. This is an offence and Double R Mortgages may be fined up to $100,000 b. This is a contravention and Double R Mortgages may be fined up to $25,000 c. This is allowed under the MBLAA and by FSCO d. This is an offence and Double R Mortgages may be fined up to $200,000 TORONTO LENDING CORPORATION COMMITMENT LETTER - Page 1 Date: July 25, 2016 Suzanne Borrower and Jack Borrower Current Address: 5678 Renter Boulevard, Toronto, ON, MIS 1N1 A Dear Suzanne and Jack: I am pleased to advise you that the following loan to be secured by a mortgage on the subject property, has been approved providing that all the information supplied is correct and subject to the conditions outlined. This commitment is not transferable, and the benefit may not be assigned. B Principal Amount $ 800,000.00 Insurance Fee $ 10,000.00 Lender's Fee $ 8,000.00 Total Mortgage $ 818,000.00 C D Property Value $1,000,000 Max LTV E 80% F Purpose Purchase Suzanne Borrowel dituju J Applicants) 5678 Renter Boulevard, Toronto, ON, MIS 1N1 K Security Address: N/A L Co-Applicant(s) Term . 5 years Amortization: 25 years N Closing Date August 20, 2016 0 Prepayment Privileges/ Penalties 20% per year when not in default Up to 100% payment increase when not in default NSF Fee: $150 . Your clients are reviewing the commitment letter from Toronto Lending Corporation and are asking you how much of a prepayment they can make and how much they can increase their payment to if they are up to date on all of their mortgage payments. What will you tell them? Select one a. lump sum payment of $200,000 and increase to $4,575.05 b. Lumpsum payment of $200,000 and increase to $3,812.54 Lump sur payment of $ 163,600 and increase to $7,625.08 d. Lumpsum payment of $100,000 and increase to $7.625.08 > Jillian, a licensed mortgage agent with Triple M Mortgages has decided to do some brokering for another brokerage, Double R Mortgages. She hasn't told Triple M Mortgages about this, and Double R Mortgages has decided to pay her directly for any mortgages that she arranges through them. Given this scenario which of the following statements is most correct? Select one: a. This is an offence and Double R Mortgages may be fined up to $100,000 b. This is a contravention and Double R Mortgages may be fined up to $25,000 c. This is allowed under the MBLAA and by FSCO d. This is an offence and Double R Mortgages may be fined up to $200,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started