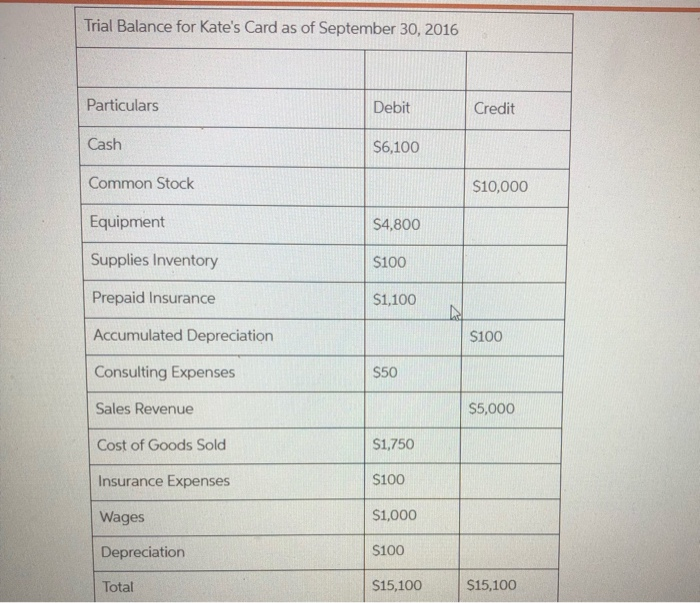

This is a continuation of the Serial Problem. KUre s Caras Jm np Getting ready for the upcoming holiday season is traditionally a busy time for greeting card c panies, and it was no exception for Kate. The following transactions occurred during the month d October: Hired an assistant at an hourly rate of $10 per hour to help with some of the computer layout ad 1. administrative chores. 2. Supplements her business by teaching a class to aspiring card designers. She charges and receins a total of $450. 3. Delivers greeting cards to several new customers. She bills them a total of $3,500. 4. Pays a utility bill in the amount of $250 that she determines is the business portion of her unilty bill. 5. Receives an advance deposit of $500 for a new set of cards she is designing for a new customer. 6 Pays her assistant $200 for the work done this month. 7 Determines that the assistant has worked 10 additional hours this month that have not yet been paid 8Ordered and receives additional supplies in the amount of $1,000. These were paid for during the month. 9. Counts her remaining inventory of supplies at the end of the month and determines the balance to be $300. Don't forget to consider the supplies inventory balance at September 30, from Chapter 2. (Hint: This expense will be a debit to Cost of Goods Sold.) 10. Records the adjusting entries for depreciation and insurance expense for the month. 11. Pays herself a salary of $1,000. 12. Paid monthly rent of $1,200 in cash. 13. Receives her next utility bill during December and determines $85 applies to October's operations. 14. Deciding she needs a little more cash, Kate pays herself a $100 dividend. Required Using the information that you gathered and the general ledger accounts that you prepared through Chapter 2, plus the new information above, complete the following: a. Journalize the above transactions and adjusting entries. b. Post the October transactions and adjusting entries. (Use the general ledger accounts prepared in Chapter 2 and add any new accounts that you may need.) Prepare a trial balance as of October 31, 2018. d. Prepare an income statement and a statement of stockholders' equity for the two-month period ending October 31, 2018, and a balance sheet as of October 31, 2018 Prepare the closing entries as of October 31, 2018 J Prepare a post-closing trial balance. . . Trial Balance for Kate's Card as of September 30, 2016 Particulars Debit Credit Cash $6,100 Common Stock $10,000 Equipment $4,800 Supplies Inventory $100 Prepaid Insurance $1,100 Accumulated Depreciation $100 Consulting Expenses $50 Sales Revenue $5,000 $1,750 Cost of Goods Sold $100 Insurance Expenses $1,000 Wages S100 Depreciation $15,100 S15,100 Total