This is a cost allocation problem for a merchandising firm. Since merchandising firms do not have overhead, you must allocate "operating costs" instead of "overhead costs." Also, the allocations in this problem are to a department, not to a product or job. Nonetheless, the allocation process is the same.

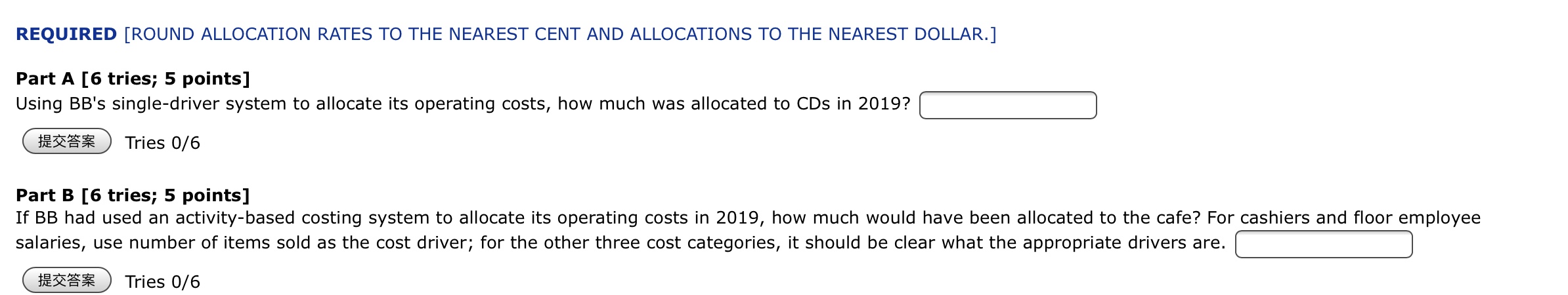

This is a cost allocation problem for a merchandising firm. Since merchandising firms do not have overhead, you must allocate "operating costs" instead of "overhead costs." Also, the allocations in this problem are to a department, not to a product or job. Nonetheless, the allocation process is the same. Just follow the three steps used in the lectures: 1. Read the problem and question carefully to determine the cost driver. 2. Compute the "overhead" rate - budgeted operating costs / budgeted driver. 3. Allocate to the specific department - overhead rate X driver for the specific department. Remember that with activity-based costing (Part B), there is more than one driver and more than one rate, and the allocation to a department is the sum of several individual allocations. Each part of the problem is worth five points, and you get six tries per part. Books and Brew (BB) is a large city bookstore that sells books and music CDs, and also has a cafe. Currently, BB uses a single-driver system to allocate its operating costs to each of its three product lines, using the number of items sold as the single cost driver. But BB's management is concerned that this allocation system may not be providing the best information for making a variety of pricing decisions. BB's operating costs for 2019 were as follows: Purchasing department $490,000 Receiving department $421,000 Shelf-stocking employee salaries $499,000 Cashiers and floor employee salaries $135,000 2019 information about 55's product lines is also available: Books CDs Cafe Revenue $3,626,000 $2,015,000 $789,000 Cost of merchandise $2,544,000 $1,510,000 $565,000 Number of purchase orders placed 2,640 2,460 1,930 Number of deliveries received 1,310 1,800 1,700 Hours of shelf stocking time 15,900 13,600 10,900 Number of items sold 123,000 118,000 275,000 REQUIRED [ROUND ALLOCATION RATES TO THE NEAREST CENT AND ALLOCATIONS TO THE NEAREST DOLLAR.] Part A [6 tries; 5 points] Using BB's single-driver system to allocate its operating costs, how much was allocated to CDs in 2019? [: Tries 0/6 Part B [6 tries; 5 points] If BB had used an activity-based costing system to allocate its operating costs in 2019, how much would have been allocated to the cafe? For cashiers and floor employee salaries, use number of items sold as the cost driver; for the other three cost categories, it should be clear what the appropriate drivers are. [: Tries 0/6