Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a LAW Question, but the degree is for Bcom Financial Management PROJECT 4: COMMERCIAL LAW (20) QUESTION 1 Insolvency relates to financial affairs

This is a LAW Question, but the degree is for Bcom Financial Management

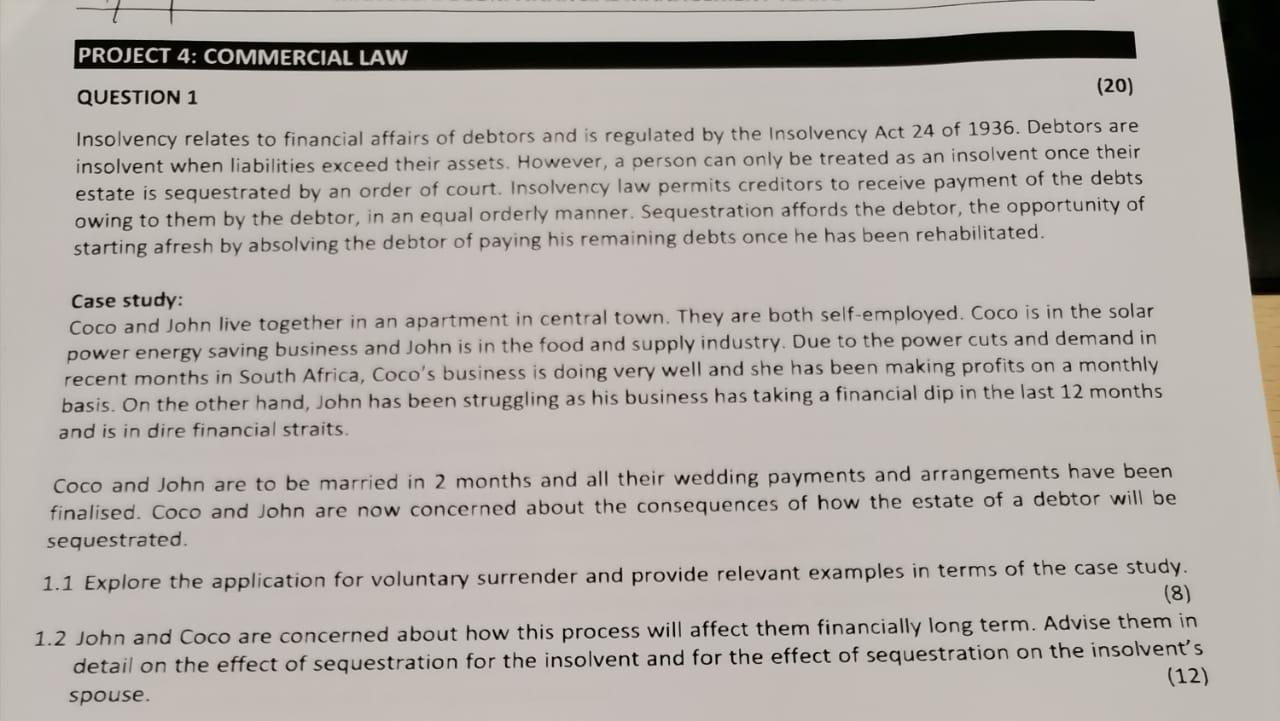

PROJECT 4: COMMERCIAL LAW (20) QUESTION 1 Insolvency relates to financial affairs of debtors and is regulated by the Insolvency Act 24 of 1936. Debtors are insolvent when liabilities exceed their assets. However, a person can only be treated as an insolvent once their estate is sequestrated by an order of court. Insolvency law permits creditors to receive payment of the debts owing to them by the debtor, in an equal orderly manner. Sequestration affords the debtor, the opportunity of starting afresh by absolving the debtor of paying his remaining debts once he has been rehabilitated. Case study: Coco and John live together in an apartment in central town. They are both self-employed. Coco is in the solar power energy saving business and John is in the food and supply industry. Due to the power cuts and demand in recent months in South Africa, Coco's business is doing very well and she has been making profits on a monthly basis. On the other hand, John has been struggling as his business has taking a financial dip in the last 12 months and is in dire financial straits. Coco and John are to be married in 2 months and all their wedding payments and arrangements have been finalised. Coco and John are now concerned about the consequences of how the estate of a debtor will be sequestrated. 1.1 Explore the application for voluntary surrender and provide relevant examples in terms of the case study. (8) 1.2 John and Coco are concerned about how this process will affect them financially long term. Advise them in detail on the effect of sequestration for the insolvent and for the effect of sequestration on the insolvent's spouse. (12) PROJECT 4: COMMERCIAL LAW (20) QUESTION 1 Insolvency relates to financial affairs of debtors and is regulated by the Insolvency Act 24 of 1936. Debtors are insolvent when liabilities exceed their assets. However, a person can only be treated as an insolvent once their estate is sequestrated by an order of court. Insolvency law permits creditors to receive payment of the debts owing to them by the debtor, in an equal orderly manner. Sequestration affords the debtor, the opportunity of starting afresh by absolving the debtor of paying his remaining debts once he has been rehabilitated. Case study: Coco and John live together in an apartment in central town. They are both self-employed. Coco is in the solar power energy saving business and John is in the food and supply industry. Due to the power cuts and demand in recent months in South Africa, Coco's business is doing very well and she has been making profits on a monthly basis. On the other hand, John has been struggling as his business has taking a financial dip in the last 12 months and is in dire financial straits. Coco and John are to be married in 2 months and all their wedding payments and arrangements have been finalised. Coco and John are now concerned about the consequences of how the estate of a debtor will be sequestrated. 1.1 Explore the application for voluntary surrender and provide relevant examples in terms of the case study. (8) 1.2 John and Coco are concerned about how this process will affect them financially long term. Advise them in detail on the effect of sequestration for the insolvent and for the effect of sequestration on the insolvent's spouse. (12)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started