this is a practice hw

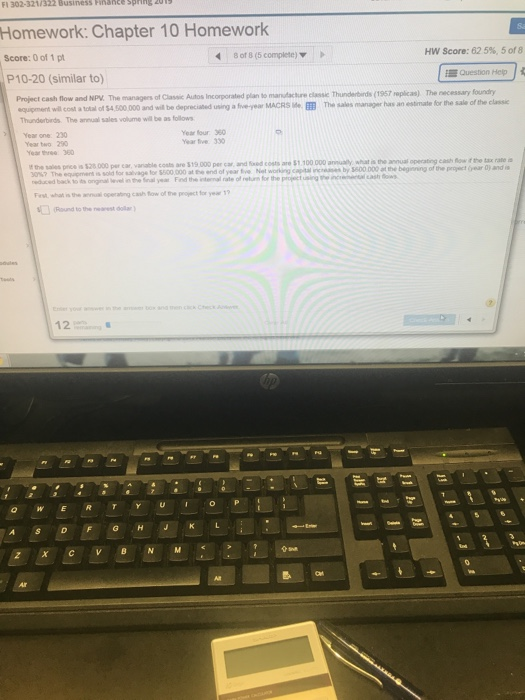

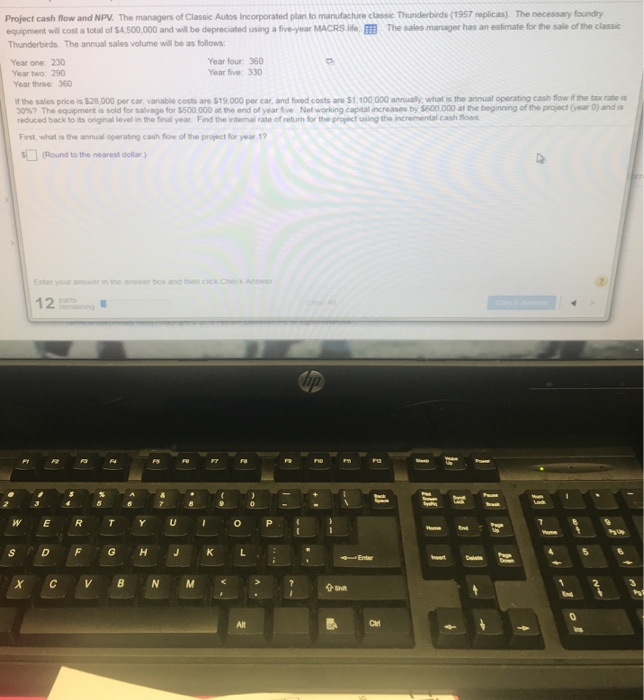

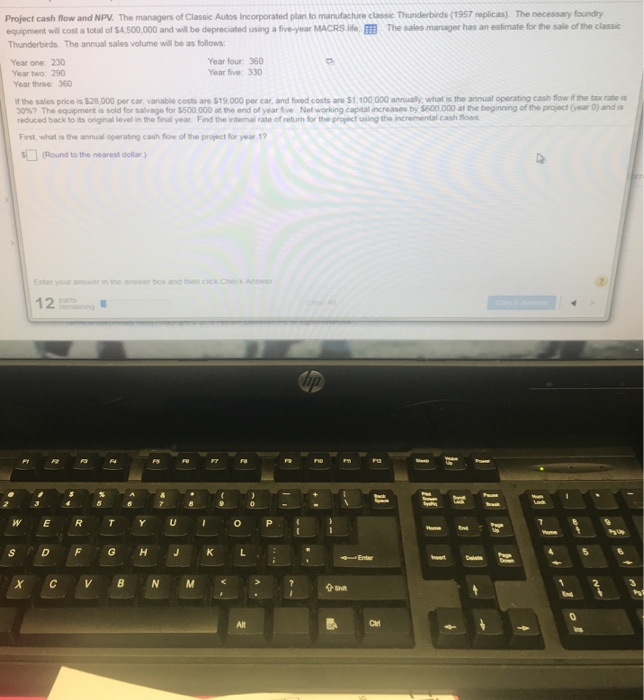

FI 302-321/322 Business Finance spring 20' Homework: Chapter 10 Homework Score: 0 of 1 pt P10-20 (similar to) HW Score: 62 5%, 5 of 8 4 8 of8 (5 complete) Question Help Project cash flow and NPV. The managers of Classic Autos Incorporated plan to manufacture classie Thundertirds (1957 replicas) The necessary foundry The sales manager has an estimate for equipment will cost a total of 54 500 000 and ill be depreciabed using a five-year MACRSE Thunderbirds. The annual sales volume will be as follow Year one 230 Year two 290 Year three 360 Year four 360 Year ive 330 costs are $19 000 per car and fxed costs are $1.100 000 aaly what is the anual opercating cash fow if the tax rate a ie Net working capital by 5600 000 at the beginning of the project (ear 0) and is t the sales pree is $28 000 per car varable c 0%7 The equipment is sold for salivage for $500,000 at the end of year Frst what is the l operating cash fow of the peoject for year 1? Round to the earest dlla 12 S DFGH A e Project cash flow and NPV. The managers of Classic Autos Incorporated plan to manufacture classic Thuniderbids (1957 replicas) The necessary foundry equipment will cost a total of $4,500,000 and will be depreciated using a five-year MACRS Ife The sales manager has an estimate for the sale of the classic Thunderbirds The annual sales volume will be as follows Year one 230 Year two: 290 Year three: 360 Year four 360 Year five 330 the sales price is S28,000 per car, varable costs are $19.000 per car, and fired costs are $1.100.000 annualy, what is the annual operating cash flow if the tax rate is 30%? The equgnert is sold for salvage for S500000 at the end of year five Networking capdal increases by se oo00 at the begr nng ofthe propoct0ear O) and is reduced back to its original level in the final year. Find the internal rate of retun for the project using the incremental cash ows First, what is the annual operating cash flow of the project for year 1? (Round to the neareat dollar) Enter your answer in the answer box ano tnen cick check Answer S D F GH J KL N M> FI 302-321/322 Business Finance spring 20' Homework: Chapter 10 Homework Score: 0 of 1 pt P10-20 (similar to) HW Score: 62 5%, 5 of 8 4 8 of8 (5 complete) Question Help Project cash flow and NPV. The managers of Classic Autos Incorporated plan to manufacture classie Thundertirds (1957 replicas) The necessary foundry The sales manager has an estimate for equipment will cost a total of 54 500 000 and ill be depreciabed using a five-year MACRSE Thunderbirds. The annual sales volume will be as follow Year one 230 Year two 290 Year three 360 Year four 360 Year ive 330 costs are $19 000 per car and fxed costs are $1.100 000 aaly what is the anual opercating cash fow if the tax rate a ie Net working capital by 5600 000 at the beginning of the project (ear 0) and is t the sales pree is $28 000 per car varable c 0%7 The equipment is sold for salivage for $500,000 at the end of year Frst what is the l operating cash fow of the peoject for year 1? Round to the earest dlla 12 S DFGH A e Project cash flow and NPV. The managers of Classic Autos Incorporated plan to manufacture classic Thuniderbids (1957 replicas) The necessary foundry equipment will cost a total of $4,500,000 and will be depreciated using a five-year MACRS Ife The sales manager has an estimate for the sale of the classic Thunderbirds The annual sales volume will be as follows Year one 230 Year two: 290 Year three: 360 Year four 360 Year five 330 the sales price is S28,000 per car, varable costs are $19.000 per car, and fired costs are $1.100.000 annualy, what is the annual operating cash flow if the tax rate is 30%? The equgnert is sold for salvage for S500000 at the end of year five Networking capdal increases by se oo00 at the begr nng ofthe propoct0ear O) and is reduced back to its original level in the final year. Find the internal rate of retun for the project using the incremental cash ows First, what is the annual operating cash flow of the project for year 1? (Round to the neareat dollar) Enter your answer in the answer box ano tnen cick check Answer S D F GH J KL N M>