Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a quantitative methods challenge for all the reference issues how would i solve this challenge using microsoft excel Tracking Insurance Claims at CABC

This is a quantitative methods challenge for all the reference issues

how would i solve this challenge using microsoft excel

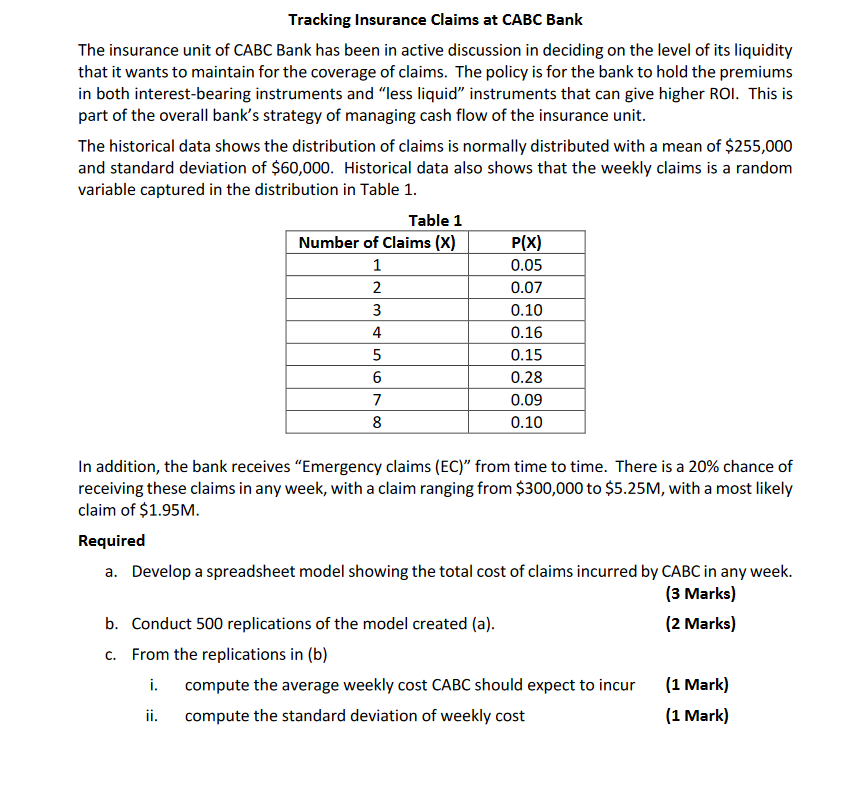

Tracking Insurance Claims at CABC Bank The insurance unit of CABC Bank has been in active discussion in deciding on the level of its liquidity that it wants to maintain for the coverage of claims. The policy is for the bank to hold the premiums in both interest-bearing instruments and "less liquid" instruments that can give higher ROI. This is part of the overall bank's strategy of managing cash flow of the insurance unit. The historical data shows the distribution of claims is normally distributed with a mean of $255,000 and standard deviation of $60,000. Historical data also shows that the weekly claims is a random variable captured in the distribution in Table 1. In addition, the bank receives "Emergency claims (EC)" from time to time. There is a 20% chance of receiving these claims in any week, with a claim ranging from $300,000 to $5.25M, with a most likely claim of $1.95M. Required a. Develop a spreadsheet model showing the total cost of claims incurred by CABC in any week. (3 Marks) b. Conduct 500 replications of the model created (a). (2 Marks) c. From the replications in (b) i. compute the average weekly cost CABC should expect to incur (1 Mark) ii. compute the standard deviation of weekly cost (1 Mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started