Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a question about T-accounts and recording entries in a general journal. With this question I was looking more for explanation than answers as

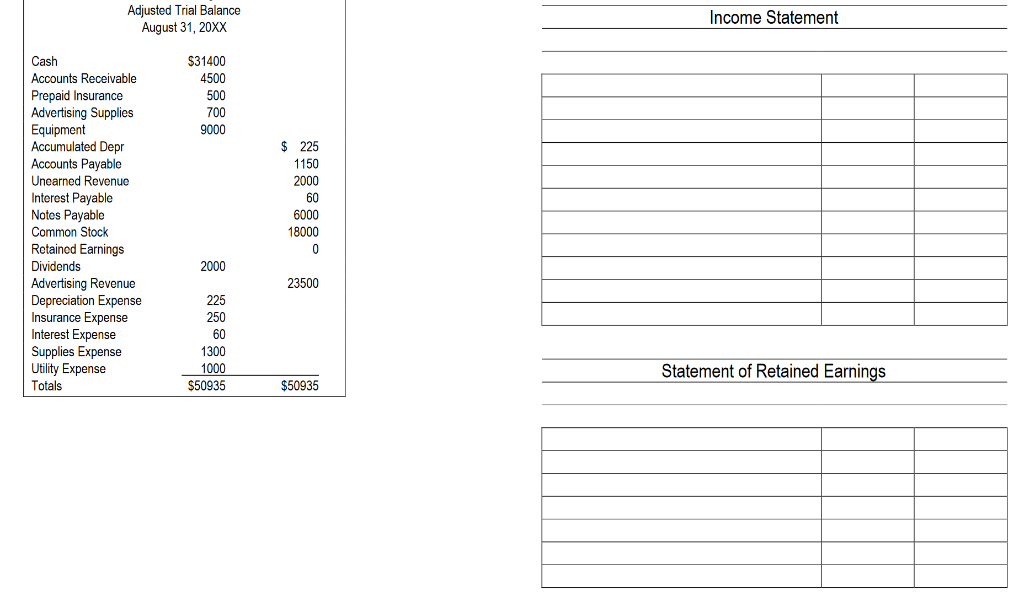

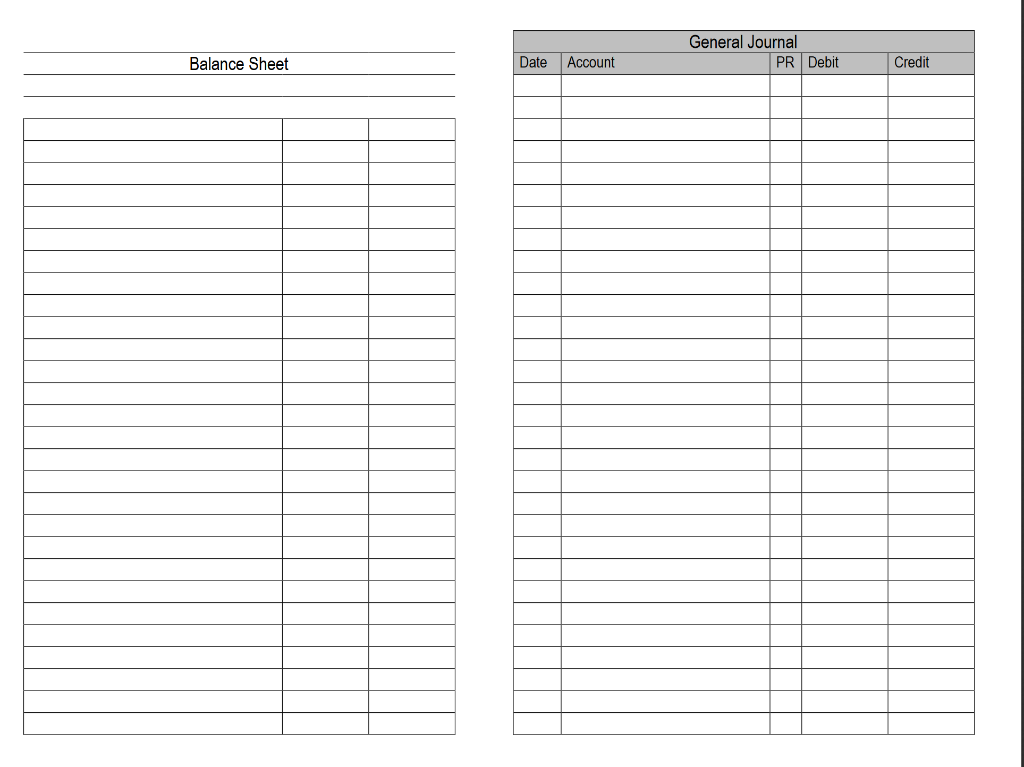

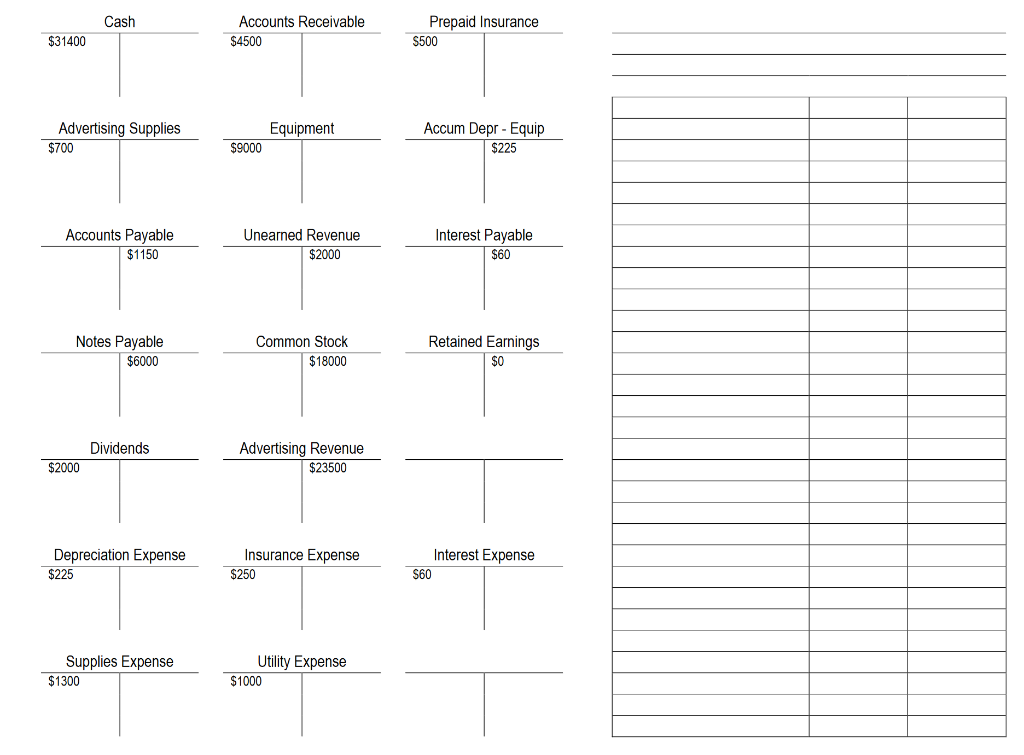

This is a question about T-accounts and recording entries in a general journal. With this question I was looking more for explanation than answers as I am trying to learn how to do it. Prepare an Income Statement, Statement of Retained Earnings, and a Balance Sheet. Then prepare closing entries, post them to t-accounts, and prepare a post-closing trial balance.

Adjusted Trial Balance August 31, 20XX Income Statement $31400 4500 500 700 9000 Cash Accounts Receivable Prepaid Insurance Advertising Supplies Equipment Accumulated Depr Accounts Payable Unearned Revenue Interest Payable Notes Payable Common Stock Retained Earnings Dividends Advertising Revenue Depreciation Expense Insurance Expense Interest Expense Supplies Expense Utility Expense Totals $ 225 1150 2000 60 6000 18000 2000 23500 225 250 60 1300 1000 $50935 Statement of Retained Earnings $50935 General Journal PR Debit Balance Sheet Date Account Credit Cash Accounts Receivable $4500 Prepaid Insurance $500 $31400 Advertising Supplies $700 Equipment Accum Depr - Equip $225 $9000 Accounts Payable $1150 Unearned Revenue $2000 Interest Payable $60 Notes Payable $6000 Common Stock $18000 Retained Earnings $0 Dividends Advertising Revenue $23500 $2000 Depreciation Expense $225 Insurance Expense $250 Interest Expense S60 Supplies Expense $1300 Utility Expense $1000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started