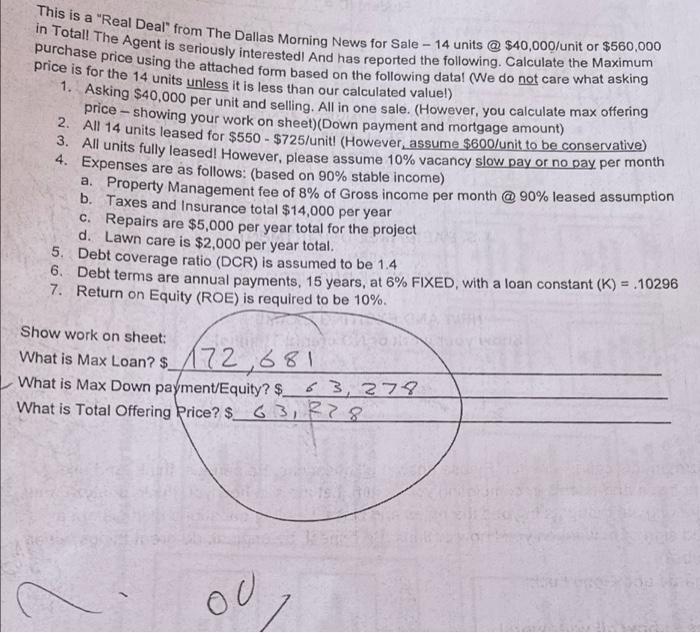

This is a "Real Deal" from The Dallas Morning News for Sale - 14 units @ $40,000/unit or $560,000 in Total! The Agent is seriously interested. And has reported the following. Calculate the Maximum price is for the 14 units unless it is less than our calculated valuel) 1. Asking $40,000 per unit and selling. All in one sale. (However, you calculate max offering price - showing your work on sheet)(Down payment and mortgage amount) ?. All 14 units leased for $550 - $725/unit! (However, assume $600/unit to be conservative) 3. All units fully leased! However, please assume 10% vacancy slow pay or no pay per month 4. Expenses are as follows: (based on 90% stable income) a. Property Management fee of 8% of Gross income per month @ 90% leased assumption b. Taxes and Insurance total $14,000 per year C. Repairs are $5,000 per year total for the project d. Lawn care is $2,000 per year total. 5. Debt coverage ratio (DCR) is assumed to be 1.4 6. Debt terms are annual payments, 15 years, at 6% FIXED, with a loan constant (K) = 10296 7. Return on Equity (ROE) is required to be 10%. Show work on sheet: What is Max Loan? $_172,681 _ What is Max Down payment/Equity? $_63, 279 What is Total Offering Price? $ 63, R38 ou This is a "Real Deal" from The Dallas Morning News for Sale - 14 units @ $40,000/unit or $560,000 in Total! The Agent is seriously interested. And has reported the following. Calculate the Maximum price is for the 14 units unless it is less than our calculated valuel) 1. Asking $40,000 per unit and selling. All in one sale. (However, you calculate max offering price - showing your work on sheet)(Down payment and mortgage amount) ?. All 14 units leased for $550 - $725/unit! (However, assume $600/unit to be conservative) 3. All units fully leased! However, please assume 10% vacancy slow pay or no pay per month 4. Expenses are as follows: (based on 90% stable income) a. Property Management fee of 8% of Gross income per month @ 90% leased assumption b. Taxes and Insurance total $14,000 per year C. Repairs are $5,000 per year total for the project d. Lawn care is $2,000 per year total. 5. Debt coverage ratio (DCR) is assumed to be 1.4 6. Debt terms are annual payments, 15 years, at 6% FIXED, with a loan constant (K) = 10296 7. Return on Equity (ROE) is required to be 10%. Show work on sheet: What is Max Loan? $_172,681 _ What is Max Down payment/Equity? $_63, 279 What is Total Offering Price? $ 63, R38 ou