Question

This is a two column bank reconciliation problem. I have been agonizing over this for over two hours. I cannot for the life of me

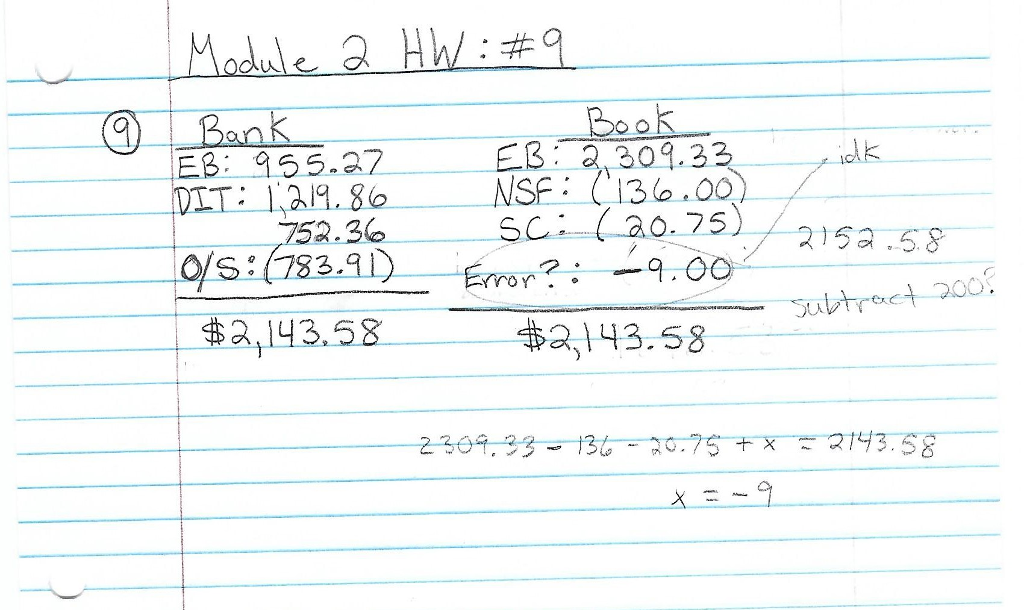

This is a two column bank reconciliation problem. I have been agonizing over this for over two hours. I cannot for the life of me figure out where the error is. The $15 NSF fee? The $260 difference in beginning balances? The extra deposit in transit? Did I miss an error somewhere? I'm pretty sure I have the bank side correct but I can't for the life of me figure out how to balance the book side to match. Or did I just mess EVERYTHING up because that is most definitely a possibility. I have attached the problem and my work that I am absolutely certain of. Thank you to the angel that can figure out what it is that I have been passing over for the greater part of my afternoon. ANYTHING is much appreciated! (EB = Ending Balance, DIT = Deposit in Transit, O/S = Outstanding Checks) And just an FYI I put parentheses around numbers I would subtract. Also I don't know the answer to this problem so it probably isn't $2,143.58.

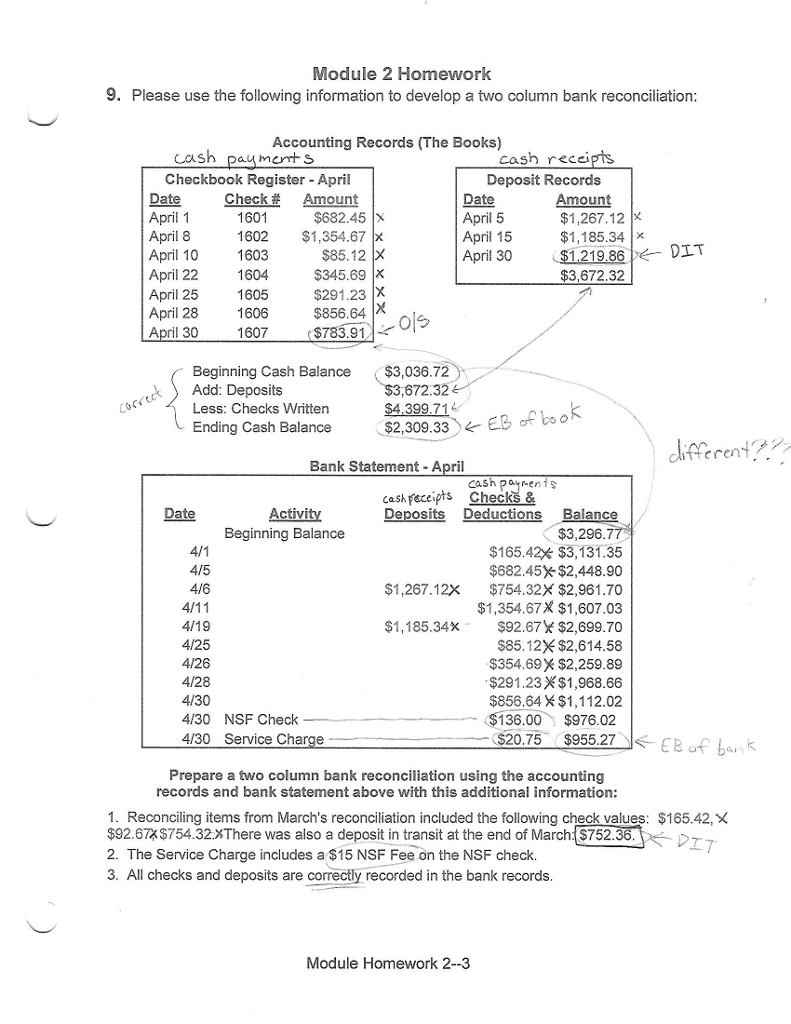

Module 2 Homework 9. Please use the following information to develop a two column bank reconciliation: Accounting Records (The Books) cash cash recei Checkbook Register April Deposit Records Date Check Amount Date Amount April 1 1601 $682.45 April 5 $1,267.12 x 1602 $1,354.67 x $1,185.34 x April 8 April 15 121986 DIT esi $85.12 X April 10 1603 April 30 April 22 1604 $345.69 x $3,672.32 $291.23 x April 25 1605 $856.64 X April 28 1606 April 30 1607 $783.91 Beginning Cash Balance $3,036.72 Add: Deposits Less: Checks Written Ending Cash Balance $2,309.33 Bank Statement April cash eceipts Checks & ate ctivi Deposits Deductions Balance Beginning Balance $3,296.7 $165.42* $3,131.35 4/5 $682.45 $2,448.90 4/6 $1,267.12X $754.32 X $2,961.70 $1,354.67X $1,607.03 4/19 $1,185.34x $92.67 Y $2,699.70 4/25 $85.12x $2,614.58 4126 $354,69X $2,259.89 4/28 $291.23) $1,968.66 4/30 $856.64 X$1,112.02 136.00 $976.02 4130 NSF Check S20,75 4130 Service Charge $955.27 SEB of b Prepare a two column bank reconciliation using the accounting records and bank statement above with this additional information: 1. Reconciling items from March's reconciliation included the following check values: $165.42.X $92.67X$754.32.XThere was also a deposit in transit at the end of March S752.3 2. The Service Charge includes a $15 NSF Fee on the NSF check. 3. All checks and deposits are correctly recorded in the bank records. Module Homework 2--3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started