This is a whole question, please answer all of them since I have no more post chance

I will definitely rate you if you answer all of them. Thank you !!

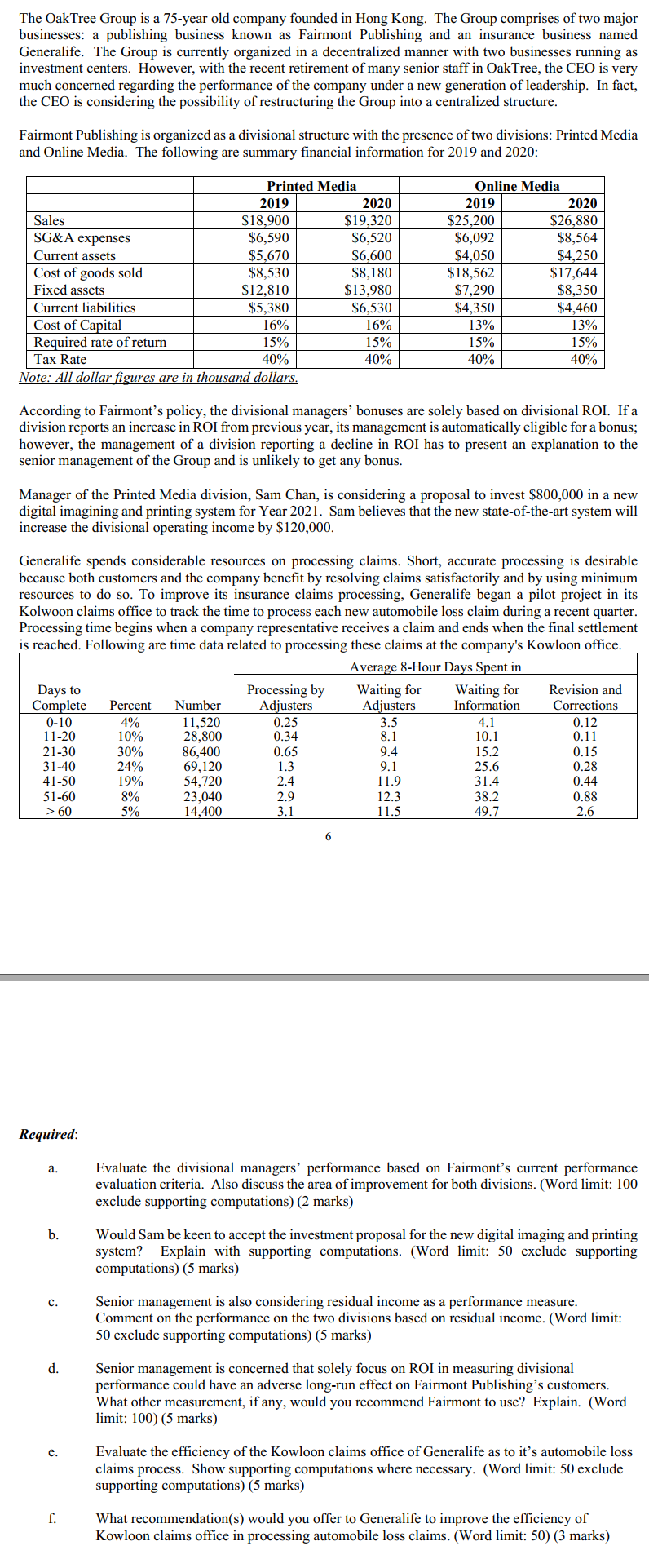

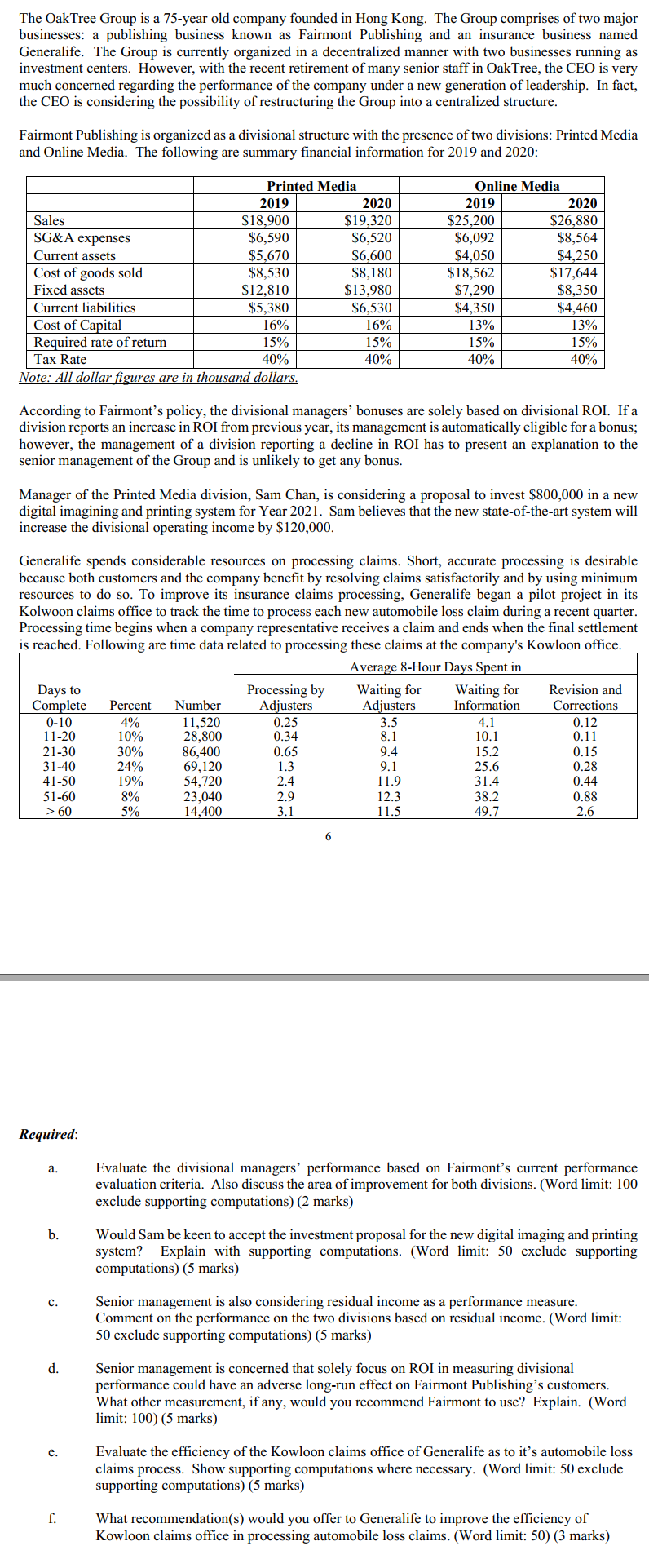

The OakTree Group is a 75-year old company founded in Hong Kong. The Group comprises of two major businesses: a publishing business known as Fairmont Publishing and an insurance business named Generalife. The Group is currently organized in a decentralized manner with two businesses running as investment centers. However, with the recent retirement of many senior staff in Oak Tree, the CEO is very much concerned regarding the performance of the company under a new generation of leadership. In fact, the CEO is considering the possibility of restructuring the Group into a centralized structure. Fairmont Publishing is organized as a divisional structure with the presence of two divisions: Printed Media and Online Media. The following are summary financial information for 2019 and 2020: Sales SG&A expenses Current assets Cost of goods sold Fixed assets Current liabilities Cost of Capital Required rate of return Tax Rate All dollar figures are in Printed Media 2019 2020 $18,900 $19,320 $6,590 $6,520 $5,670 $6,600 $8,530 $8,180 $12,810 $13,980 $5,380 $6,530 16% 16% 15% 15% 40% 40% dollars. Online Media 2019 2020 $25,200 $26,880 $6,092 $8,564 $4,050 $4,250 $18,562 $ 17,644 $7,290 $8,350 $4,350 $4,460 13% 13% 15% 15% 40% 40% According to Fairmont's policy, the divisional managers' bonuses are solely based on divisional ROI. If a division reports an increase in ROI from previous year, its management is automatically eligible for a bonus; however, the management of a division reporting a decline in ROI has to present an explanation to the senior management of the Group and is unlikely to get any bonus. Manager of the Printed Media division, Sam Chan, is considering a proposal to invest $800,000 in a new digital imagining and printing system for Year 2021. Sam believes that the new state-of-the-art system will increase the divisional operating income by $120,000. Generalife spends considerable resources on processing claims. Short, accurate processing is desirable because both customers and the company benefit by resolving claims satisfactorily and by using minimum resources to do so. To improve its insurance claims processing, Generalife began a pilot project in its Kolwoon claims office to track the time to process each new automobile loss claim during a recent quarter. Processing time begins when a company representative receives a claim and ends when the final settlement is reached. Following are time data related to processing these claims at the company's Kowloon office. Average 8-Hour Days Spent in Days to Processing by Waiting for Waiting for Revision and Complete Percent Number Adjusters Adjusters Information Corrections 0-10 4% 11,520 0.25 3.5 4.1 0.12 11-20 10% 28,800 0.34 8.1 10.1 0.11 21-30 30% 86,400 0.65 9.4 15.2 0.15 31-40 24% 69,120 1.3 9.1 25.6 0.28 41-50 19% 54,720 2.4 11.9 31.4 0.44 51-60 8% 23,040 2.9 12.3 38.2 0.88 >60 5% 14,400 3.1 11.5 49.7 2.6 6 Required: a. Evaluate the divisional managers' performance based on Fairmont's current performance evaluation criteria. Also discuss the area of improvement for both divisions. (Word limit: 100 exclude supporting computations) (2 marks) b. Would Sam be keen to accept the investment proposal for the new digital imaging and printing system? Explain with supporting computations. (Word limit: 50 exclude supporting computations) (5 marks) c. Senior management is also considering residual income as a performance measure. Comment on the performance on the two divisions based on residual income. (Word limit: 50 exclude supporting computations) (5 marks) d. Senior management is concerned that solely focus on ROI in measuring divisional performance could have an adverse long-run effect on Fairmont Publishing's What other measurement, if any, would you recommend Fairmont to use? Explain. (Word limit: 100) (5 marks) e. Evaluate the efficiency of the Kowloon claims office of Generalife as to it's automobile loss claims process. Show supporting computations where necessary. (Word limit: 50 exclude supporting computations) (5 marks) f. What recommendation(s) would you offer to Generalife to improve the efficiency of Kowloon claims office in processing automobile loss claims. (Word limit: 50) (3 marks) The OakTree Group is a 75-year old company founded in Hong Kong. The Group comprises of two major businesses: a publishing business known as Fairmont Publishing and an insurance business named Generalife. The Group is currently organized in a decentralized manner with two businesses running as investment centers. However, with the recent retirement of many senior staff in Oak Tree, the CEO is very much concerned regarding the performance of the company under a new generation of leadership. In fact, the CEO is considering the possibility of restructuring the Group into a centralized structure. Fairmont Publishing is organized as a divisional structure with the presence of two divisions: Printed Media and Online Media. The following are summary financial information for 2019 and 2020: Sales SG&A expenses Current assets Cost of goods sold Fixed assets Current liabilities Cost of Capital Required rate of return Tax Rate All dollar figures are in Printed Media 2019 2020 $18,900 $19,320 $6,590 $6,520 $5,670 $6,600 $8,530 $8,180 $12,810 $13,980 $5,380 $6,530 16% 16% 15% 15% 40% 40% dollars. Online Media 2019 2020 $25,200 $26,880 $6,092 $8,564 $4,050 $4,250 $18,562 $ 17,644 $7,290 $8,350 $4,350 $4,460 13% 13% 15% 15% 40% 40% According to Fairmont's policy, the divisional managers' bonuses are solely based on divisional ROI. If a division reports an increase in ROI from previous year, its management is automatically eligible for a bonus; however, the management of a division reporting a decline in ROI has to present an explanation to the senior management of the Group and is unlikely to get any bonus. Manager of the Printed Media division, Sam Chan, is considering a proposal to invest $800,000 in a new digital imagining and printing system for Year 2021. Sam believes that the new state-of-the-art system will increase the divisional operating income by $120,000. Generalife spends considerable resources on processing claims. Short, accurate processing is desirable because both customers and the company benefit by resolving claims satisfactorily and by using minimum resources to do so. To improve its insurance claims processing, Generalife began a pilot project in its Kolwoon claims office to track the time to process each new automobile loss claim during a recent quarter. Processing time begins when a company representative receives a claim and ends when the final settlement is reached. Following are time data related to processing these claims at the company's Kowloon office. Average 8-Hour Days Spent in Days to Processing by Waiting for Waiting for Revision and Complete Percent Number Adjusters Adjusters Information Corrections 0-10 4% 11,520 0.25 3.5 4.1 0.12 11-20 10% 28,800 0.34 8.1 10.1 0.11 21-30 30% 86,400 0.65 9.4 15.2 0.15 31-40 24% 69,120 1.3 9.1 25.6 0.28 41-50 19% 54,720 2.4 11.9 31.4 0.44 51-60 8% 23,040 2.9 12.3 38.2 0.88 >60 5% 14,400 3.1 11.5 49.7 2.6 6 Required: a. Evaluate the divisional managers' performance based on Fairmont's current performance evaluation criteria. Also discuss the area of improvement for both divisions. (Word limit: 100 exclude supporting computations) (2 marks) b. Would Sam be keen to accept the investment proposal for the new digital imaging and printing system? Explain with supporting computations. (Word limit: 50 exclude supporting computations) (5 marks) c. Senior management is also considering residual income as a performance measure. Comment on the performance on the two divisions based on residual income. (Word limit: 50 exclude supporting computations) (5 marks) d. Senior management is concerned that solely focus on ROI in measuring divisional performance could have an adverse long-run effect on Fairmont Publishing's What other measurement, if any, would you recommend Fairmont to use? Explain. (Word limit: 100) (5 marks) e. Evaluate the efficiency of the Kowloon claims office of Generalife as to it's automobile loss claims process. Show supporting computations where necessary. (Word limit: 50 exclude supporting computations) (5 marks) f. What recommendation(s) would you offer to Generalife to improve the efficiency of Kowloon claims office in processing automobile loss claims. (Word limit: 50)