Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is all I have can you just go with what is shown TULLIUM WOULD 1. They have asked you to prepare managerial accounting data

this is all I have can you just go with what is shown

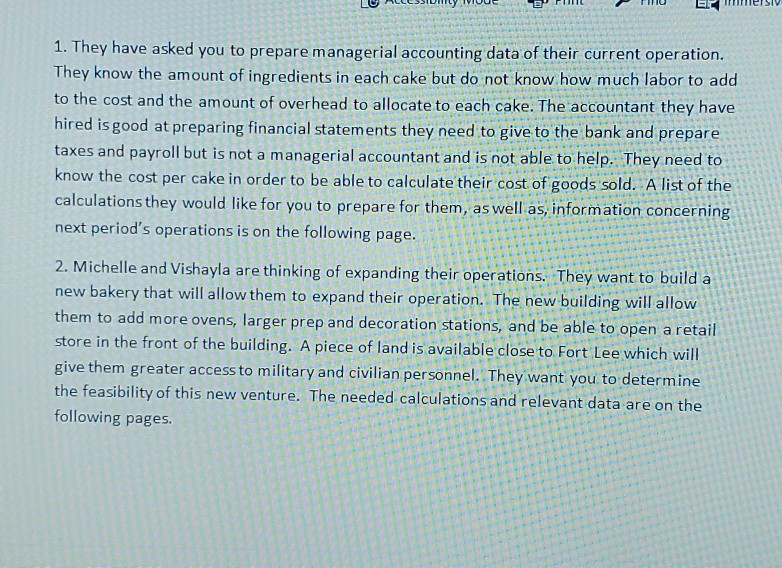

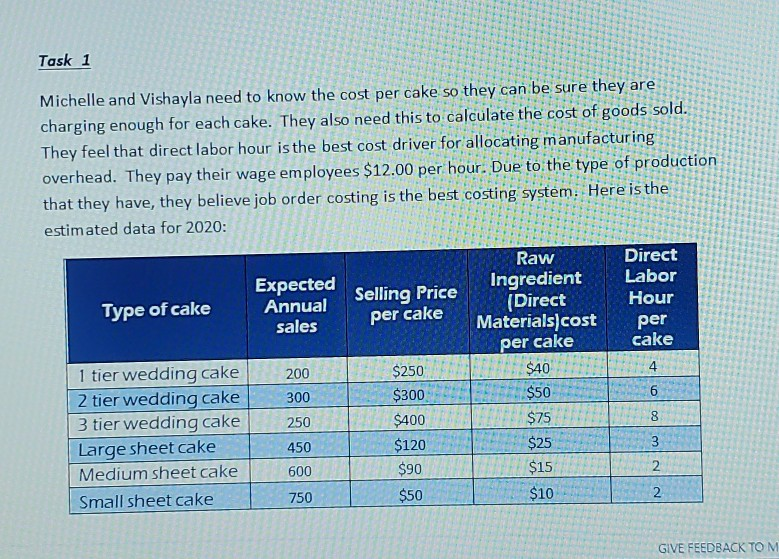

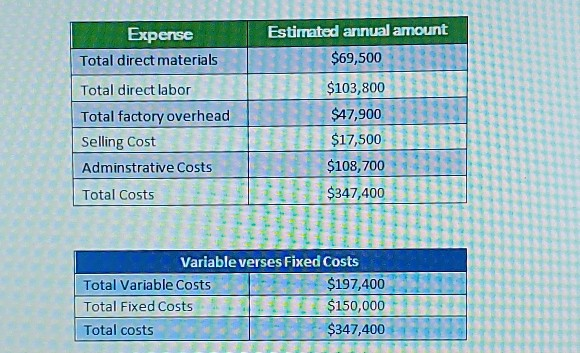

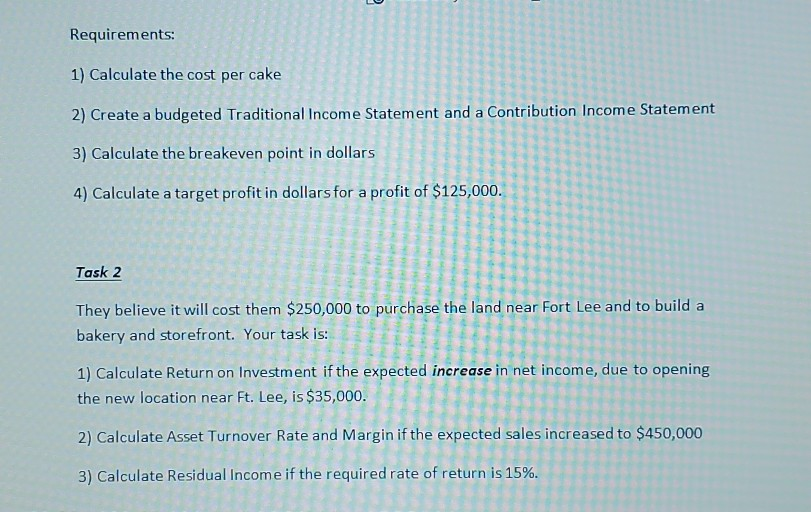

TULLIUM WOULD 1. They have asked you to prepare managerial accounting data of their current operation. They know the amount of ingredients in each cake but do not know how much labor to add to the cost and the amount of overhead to allocate to each cake. The accountant they have hired is good at preparing financial statements they need to give to the bank and prepare taxes and payroll but is not a managerial accountant and is not able to help. They need to know the cost per cake in order to be able to calculate their cost of goods sold. A list of the calculations they would like for you to prepare for them, as well as, information concerning next period's operations is on the following page. . 2. Michelle and Vishayla are thinking of expanding their operations. They want to build a new bakery that will allow them to expand their operation. The new building will allow them to add more ovens, larger prep and decoration stations, and be able to open a retail store in the front of the building. A piece of land is available close to Fort Lee which will give them greater access to military and civilian personnel. They want you to determine the feasibility of this new venture. The needed calculations and relevant data are on the following pages. Task 1 Michelle and Vishayla need to know the cost per cake so they can be sure they are charging enough for each cake. They also need this to calculate the cost of goods sold. They feel that direct labor hour is the best cost driver for 'allocating manufacturing overhead. They pay their wage employees $12.00 per hour. Due to the type of production that they have, they believe job order costing is the best costing system. Here is the estimated data for 2020: Expected Annual sales Type of cake Raw Ingredient (Direct Selling Price per cake Direct Labor Hour per cake Materials) cost 4 6 1 tier wedding cake 2 tier wedding cake 3 tier wedding cake Large sheet cake Medium sheet cake Small sheet cake 200 300 250 450 600 750 $250 $300 $400R $120 $90 $50 per cake $ 40 $ 50 $ 75 $ 25 $ 15 $10 3 2 . GIYE FEEDBACK TOM Expense Total direct materials Total direct labor Total factory overhead Selling Cost Adminstrative Costs Total Costs Estimated annual amount $69,500 $103,800 S$47,900 $17,500 $108,700 $347,4001 Variable verses Fixed Costs Total Variable Costs $197,400 Total Fixed Costs $150,000 Total costs $347,400 Requirements: 1) Calculate the cost per cake 2) Create a budgeted Traditional Income Statement and a Contribution Income Statement 3) Calculate the breakeven point in dollars 4) Calculate a target profit in dollars for a profit of $125,000. Task 2 They believe it will cost them $250,000 to purchase the land near Fort Lee and to build a bakery and storefront. Your task is: 1) Calculate Return on Investment if the expected increase in net income, due to opening the new location near Ft. Lee, is $35,000. 2) Calculate Asset Turnover Rate and Margin if the expected sales increased to $450,000 3) Calculate Residual income if the required rate of return is 15%. You will prepare a three page paper that should include your recommendations and calculations. There needs to be two pages of text with the last page being charts and graphs. GIVE FEEDBAStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started