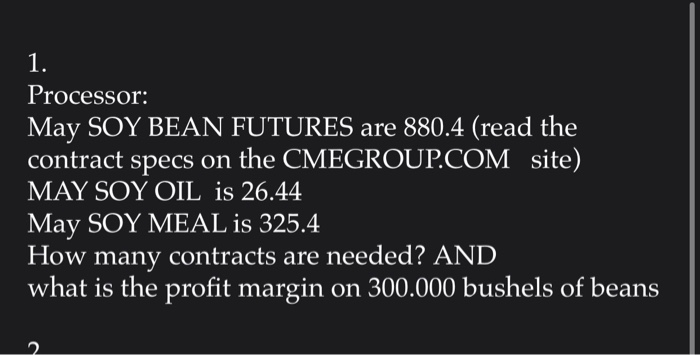

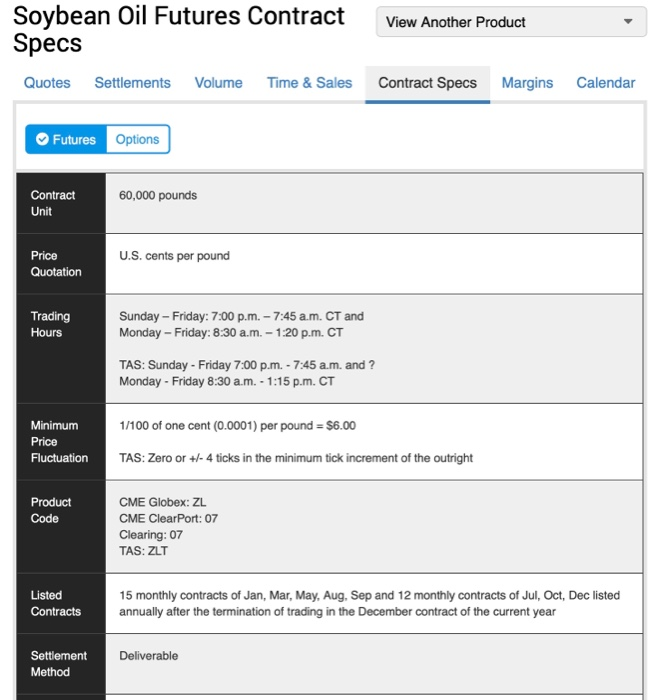

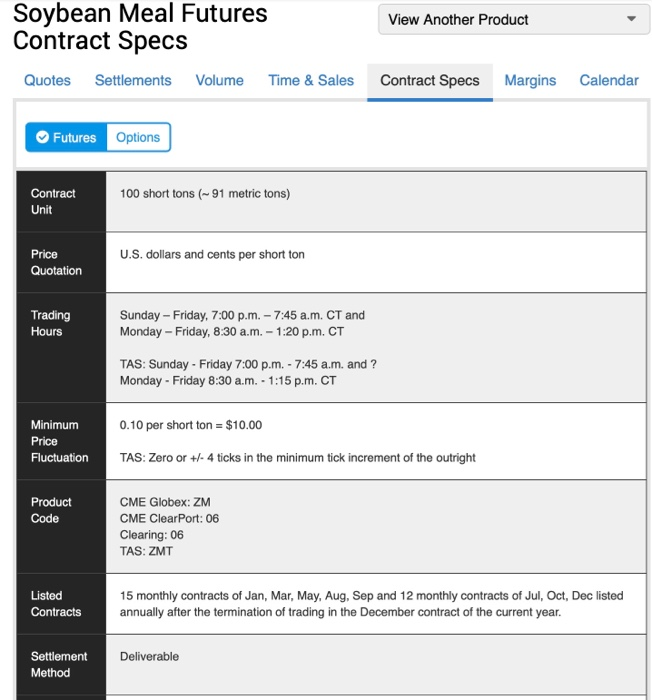

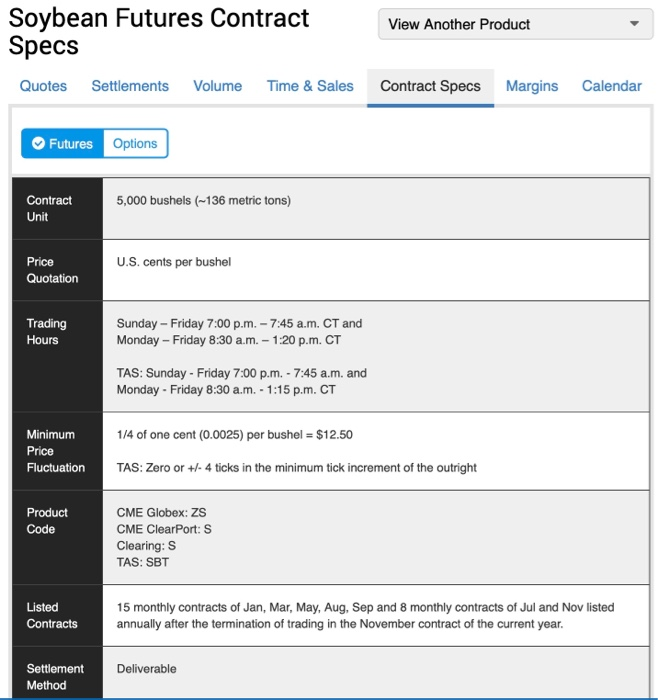

Processor: May SOY BEAN FUTURES are 880.4 (read the contract specs on the CMEGROUP.COM site) MAY SOY OIL is 26.44 May SOY MEAL is 325.4 How many contracts are needed? AND what is the profit margin on 300.000 bushels of beans Soybean Oil Futures Contract Specs View Another Product Quotes Settlements Volume Time & Sales Contract Specs Margins Calendar Futures Options 60,000 pounds Contract Unit U.S. cents per pound Price Quotation Trading Sunday - Friday: 7:00 p.m. - 7:45 a.m. CT and Monday - Friday: 8:30 a.m. - 1:20 p.m. CT Hours TAS: Sunday - Friday 7:00p.m. - 7:45 a.m. and ? Monday - Friday 8:30 a.m. - 1:15 p.m. CT 1/100 of one cent (0.0001) per pound = $6.00 Minimum Price Fluctuation TAS: Zero or +/- 4 ticks in the minimum tick increment of the outright Product Code CME Globex: ZL CME ClearPort: 07 Clearing: 07 TAS: ZLT Listed Contracts 15 monthly contracts of Jan, Mar, May, Aug. Sep and 12 monthly contracts of Jul, Oct, Dec listed annually after the termination of trading in the December contract of the current year Deliverable Settlement Method Soybean Meal Futures Contract Specs View Another Product Quotes Settlements Volume Time & Sales Contract Specs Margins Calendar Futures Options Contract Unit 100 short tons (91 metric tons) U.S. dollars and cents per short ton Price Quotation Trading Hours Sunday - Friday, 7:00 p.m. - 7:45 a.m. CT and Monday - Friday, 8:30 a.m. - 1:20 p.m. CT TAS: Sunday - Friday 7:00 pm - 7:45 a.m. and ? Monday - Friday 8:30 a.m. - 1:15 p.m. CT 0.10 per short ton = $10.00 Minimum Price Fluctuation TAS: Zero or +/- 4 ticks in the minimum tick increment of the outright Product Code CME Globex: ZM CME ClearPort: 06 Clearing: 06 TAS: ZMT Listed Contracts 15 monthly contracts of Jan, Mar, May, Aug. Sep and 12 monthly contracts of Jul, Oct, Dec listed annually after the termination of trading in the December contract of the current year. Deliverable Settlement Method Soybean Futures Contract Specs View Another Product Quotes Settlements Volume Time & Sales Contract Specs Margins Calendar Futures Options 5,000 bushels (-136 metric tons) Contract Unit U.S. cents per bushel Price Quotation Trading Hours Sunday - Friday 7:00 p.m. - 7:45 a.m. CT and Monday - Friday 8:30 a.m. - 1:20 p.m. CT TAS: Sunday - Friday 7:00 p.m. - 7:45 a.m. and Monday - Friday 8:30 a.m. - 1:15 p.m. CT 1/4 of one cent (0.0025) per bushel = $12.50 Minimum Price Fluctuation TAS: Zero or +/- 4 ticks in the minimum tick increment of the outright Product Code CME Globex: ZS CME ClearPort: S Clearing: S TAS: SBT Listed Contracts 15 monthly contracts of Jan, Mar, May, Aug, Sep and 8 monthly contracts of Jul and Nov listed annually after the termination of trading in the November contract of the current year. Deliverable Settlement Method Processor: May SOY BEAN FUTURES are 880.4 (read the contract specs on the CMEGROUP.COM site) MAY SOY OIL is 26.44 May SOY MEAL is 325.4 How many contracts are needed? AND what is the profit margin on 300.000 bushels of beans Soybean Oil Futures Contract Specs View Another Product Quotes Settlements Volume Time & Sales Contract Specs Margins Calendar Futures Options 60,000 pounds Contract Unit U.S. cents per pound Price Quotation Trading Sunday - Friday: 7:00 p.m. - 7:45 a.m. CT and Monday - Friday: 8:30 a.m. - 1:20 p.m. CT Hours TAS: Sunday - Friday 7:00p.m. - 7:45 a.m. and ? Monday - Friday 8:30 a.m. - 1:15 p.m. CT 1/100 of one cent (0.0001) per pound = $6.00 Minimum Price Fluctuation TAS: Zero or +/- 4 ticks in the minimum tick increment of the outright Product Code CME Globex: ZL CME ClearPort: 07 Clearing: 07 TAS: ZLT Listed Contracts 15 monthly contracts of Jan, Mar, May, Aug. Sep and 12 monthly contracts of Jul, Oct, Dec listed annually after the termination of trading in the December contract of the current year Deliverable Settlement Method Soybean Meal Futures Contract Specs View Another Product Quotes Settlements Volume Time & Sales Contract Specs Margins Calendar Futures Options Contract Unit 100 short tons (91 metric tons) U.S. dollars and cents per short ton Price Quotation Trading Hours Sunday - Friday, 7:00 p.m. - 7:45 a.m. CT and Monday - Friday, 8:30 a.m. - 1:20 p.m. CT TAS: Sunday - Friday 7:00 pm - 7:45 a.m. and ? Monday - Friday 8:30 a.m. - 1:15 p.m. CT 0.10 per short ton = $10.00 Minimum Price Fluctuation TAS: Zero or +/- 4 ticks in the minimum tick increment of the outright Product Code CME Globex: ZM CME ClearPort: 06 Clearing: 06 TAS: ZMT Listed Contracts 15 monthly contracts of Jan, Mar, May, Aug. Sep and 12 monthly contracts of Jul, Oct, Dec listed annually after the termination of trading in the December contract of the current year. Deliverable Settlement Method Soybean Futures Contract Specs View Another Product Quotes Settlements Volume Time & Sales Contract Specs Margins Calendar Futures Options 5,000 bushels (-136 metric tons) Contract Unit U.S. cents per bushel Price Quotation Trading Hours Sunday - Friday 7:00 p.m. - 7:45 a.m. CT and Monday - Friday 8:30 a.m. - 1:20 p.m. CT TAS: Sunday - Friday 7:00 p.m. - 7:45 a.m. and Monday - Friday 8:30 a.m. - 1:15 p.m. CT 1/4 of one cent (0.0025) per bushel = $12.50 Minimum Price Fluctuation TAS: Zero or +/- 4 ticks in the minimum tick increment of the outright Product Code CME Globex: ZS CME ClearPort: S Clearing: S TAS: SBT Listed Contracts 15 monthly contracts of Jan, Mar, May, Aug, Sep and 8 monthly contracts of Jul and Nov listed annually after the termination of trading in the November contract of the current year. Deliverable Settlement Method