Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is all one question it has 3 parts Mallard Incorporated (MI) is a small manufacturing company that makes model trains to sell to toy

this is all one question it has 3 parts

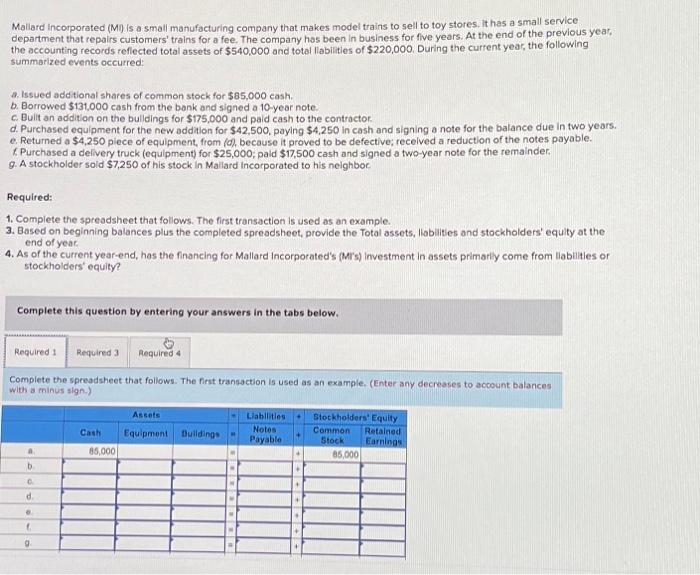

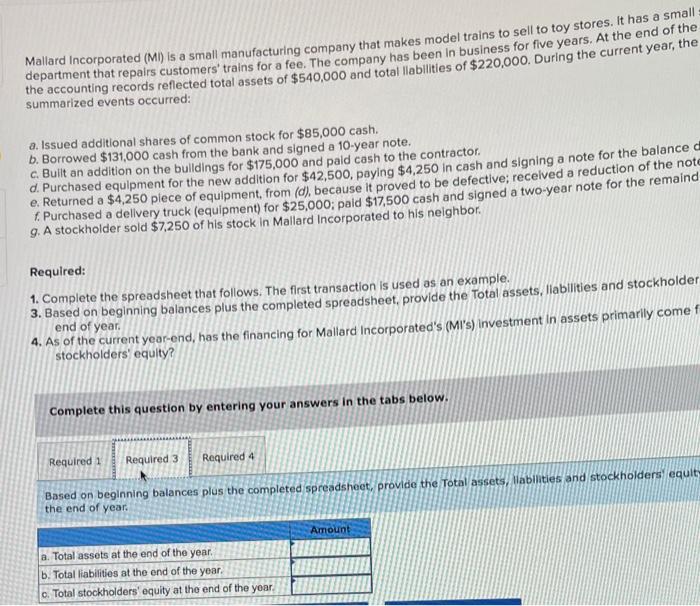

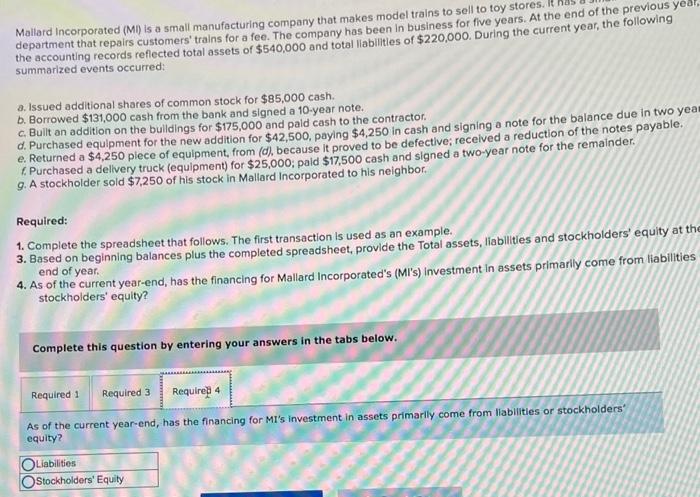

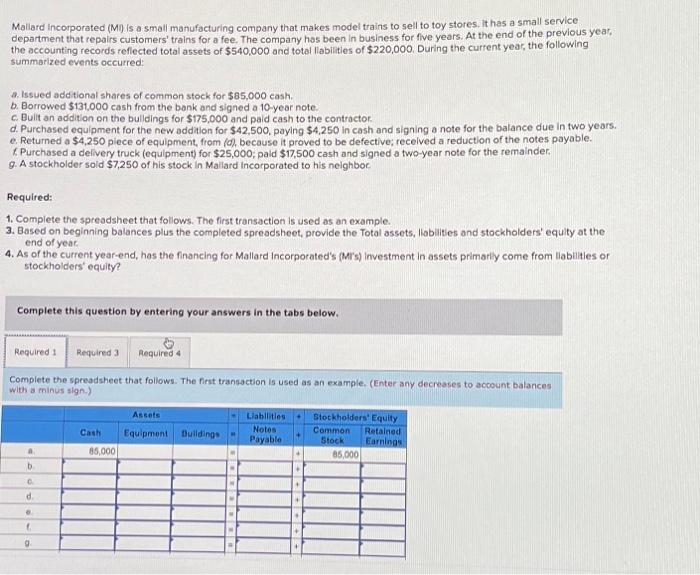

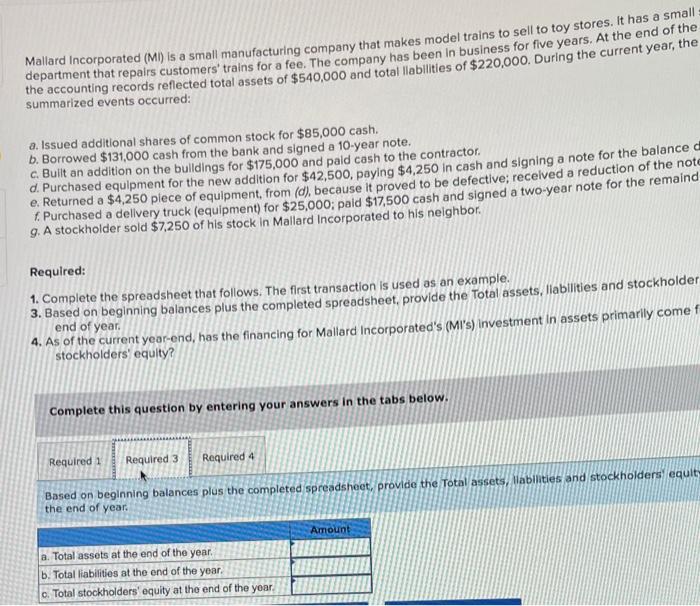

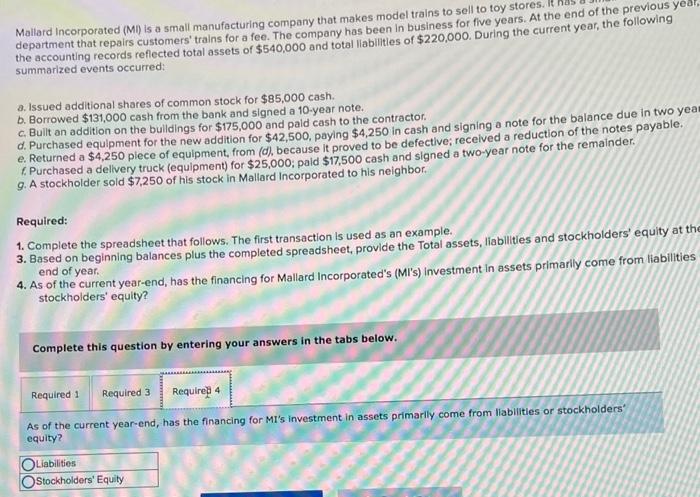

Mallard Incorporated (MI) is a small manufacturing company that makes model trains to sell to toy stores. It has a small department that repairs customers' trains for a fee. The company has been in business for five years. At the end of the the accounting records reflected total assets of $540,000 and total llablities of $220,000. During the current year, the summarized events occurred: a. Issued additional shares of common stock for $85,000 cash. b. Borrowed $131,000 cash from the bank and signed a 10 -year note. c. Bullt an addition on the bulldings for $175,000 and paid cash to the contractor. d. Purchased equipment for the new addition for $42,500, paying $4,250 in cash and signing a note for the balance e. Returned a $4,250 plece of equipment, from (d), because it proved to be defective; recelved a reduction of the not f. Purchased a dellvery truck (equipment) for $25,000; paid $17,500 cash and signed a two-year note for the remainc g. A stockholder sold $7,250 of his stock in Mallard Incorporated to his neighbor. Required: 1. Complete the spreadsheet that follows. The first transaction is used as an example. 3. Based on beginning balances plus the completed spreadsheet, provide the Total assets, liabilities and stockholde end of year. 4. As of the current year-end, has the financing for Mallard Incorporated's (MI's) investment in assets primarily come stockholders' equity? Complete this question by entering your answers in the tabs below. Based on beginning balances plus the completed spreadsheet, provide the Total assets, Mabilities and stockholders' equit the end of year. Maliard incorporated (Mi) is a small manufacturing company that makes model trains to sell to toy stores, it has a small service department that repairs customers' trains for a fee. The company has been in business for five years. At the end of the previous year. the accounting records reflected total assets of $540,000 and total liabilitios of $220,000. During the curfent year, the following summarized events occurred: a. Issued additional shares of common stock for $85,000 cash. b. Borrowed $131,000 cash from the bank and signed a 10 -year note. c. Built an addition on the buliding 5 for $175,000 and paid cash to the contractor. d. Purchased equipment for the new addition for $42,500, paying $4,250 in cash and signing a note for the balance due in two years. e. Returned a $4,250 piece of equipment, from (d), because it proved to be defective; recelved a reduction of the notes payable. x Purchased a delivery truck (equipment) for $25,000; paid $17,500 cash and signed a two-year note for the remainder. g. A stockholder sold $7,250 of his stock in Mallard incorporated to his neighbor Required: 1. Complete the spreadsheet that follows. The first transaction is used as an example. 3. Based on beginning balances plus the completed spreadsheet, provide the Total assets, llablilies and stockholders' equity at the end of year. 4. As of the current year-end, has the financing for Mallard Incorporated's (Mirs) investment in assets primarly come from liabilities or stockholders' equity? Complete this question by entering your answers in the tabs below. Complete the spreadsheet that follows. The first transaction is used as an example. (Enter any decreases to account balances with a minus sign.) Mallard Incorporated (MI) is a small manufacturing company that makes model trains to sell to toy department that repairs customers' trains for a fee. The company has been in business for flve years. At the end of the previous the accounting records reflect: a. Issued additional shares of common stock for $85,000 cash. b. Borrowed $131,000 cash from the bank and signed a 10 -year note. c. Bullt an addition on the bulldings for $175,000 and paid cash to the contractor. d. Purchased equipment for the new addition for $42,500, paying $4,250 in cash and signing a note for the balance due in two yea e. Returned a $4,250 piece of equipment, from (d), because it proved to be defective; recelved a reduction of the notes payable. f. Purchased a delivery truck (equipment) for $25,000; paid $17,500 cash and signed a two-year note for the remainder. g. A stockholder sold $7,250 of his stock in Mallard Incorporated to his neighbor. Required: 1. Complete the spreadsheet that follows. The first transaction is used as an example. 3. Based on beginning balances plus the completed spreadsheet, provide the Total assets, liablities and stockholders' equity at th end of year. 4. As of the current year-end, has the financing for Mallard Incorporated's (MI's) investment in assets primarily come from liabilities stockholders' equity? Complete this question by entering your answers in the tabs below. As of the current year-end, has the financing for MI's investment in assets primarlly come from llabilities or stockholders' equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started