Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is all the info (13.2) When interest rates rise from 10% to 30% after 5 years, please fill out the blanks in the following

this is all the info

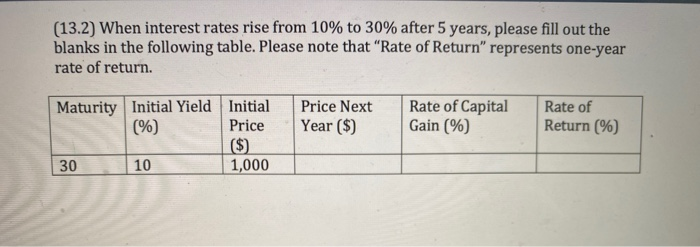

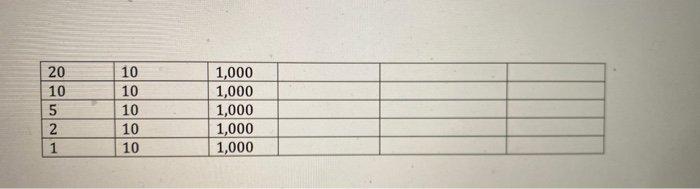

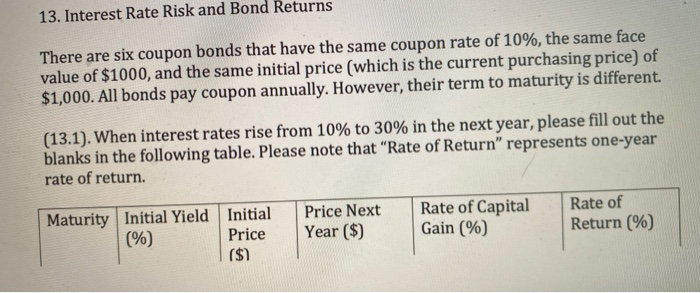

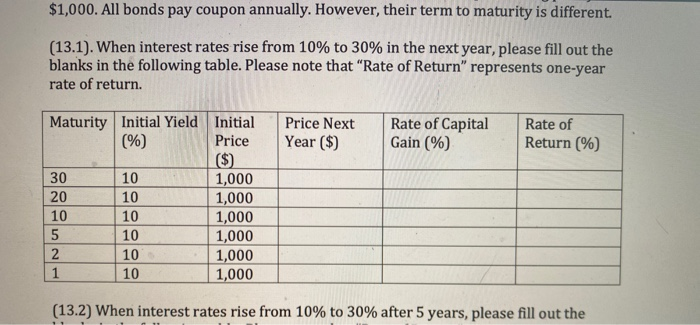

(13.2) When interest rates rise from 10% to 30% after 5 years, please fill out the blanks in the following table. Please note that Rate of Return represents one-year rate of return. Maturity Initial Yield Initial (%) Price ($) 30 10 1,000 Price Next Year ($) Rate of Capital Gain (%) Rate of Return (%) 20 10 5 2 1 10 10 10 10 10 1,000 1,000 1,000 1,000 1,000 13. Interest Rate Risk and Bond Returns There are six coupon bonds that have the same coupon rate of 10%, the same face value of $1000, and the same initial price (which is the current purchasing price) of $1,000. All bonds pay coupon annually. However, their term to maturity is different. (13.1). When interest rates rise from 10% to 30% in the next year, please fill out the blanks in the following table. Please note that "Rate of Return represents one-year rate of return. Maturity Initial Yield Initial (%) Price ($) Price Next Year ($) Rate of Capital Gain (%) Rate of Return (%) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started