Question

this is all the information I got. use those for example. Suppose DuPont is considering an investment that would extend the life of one of

this is all the information I got. use those for example.

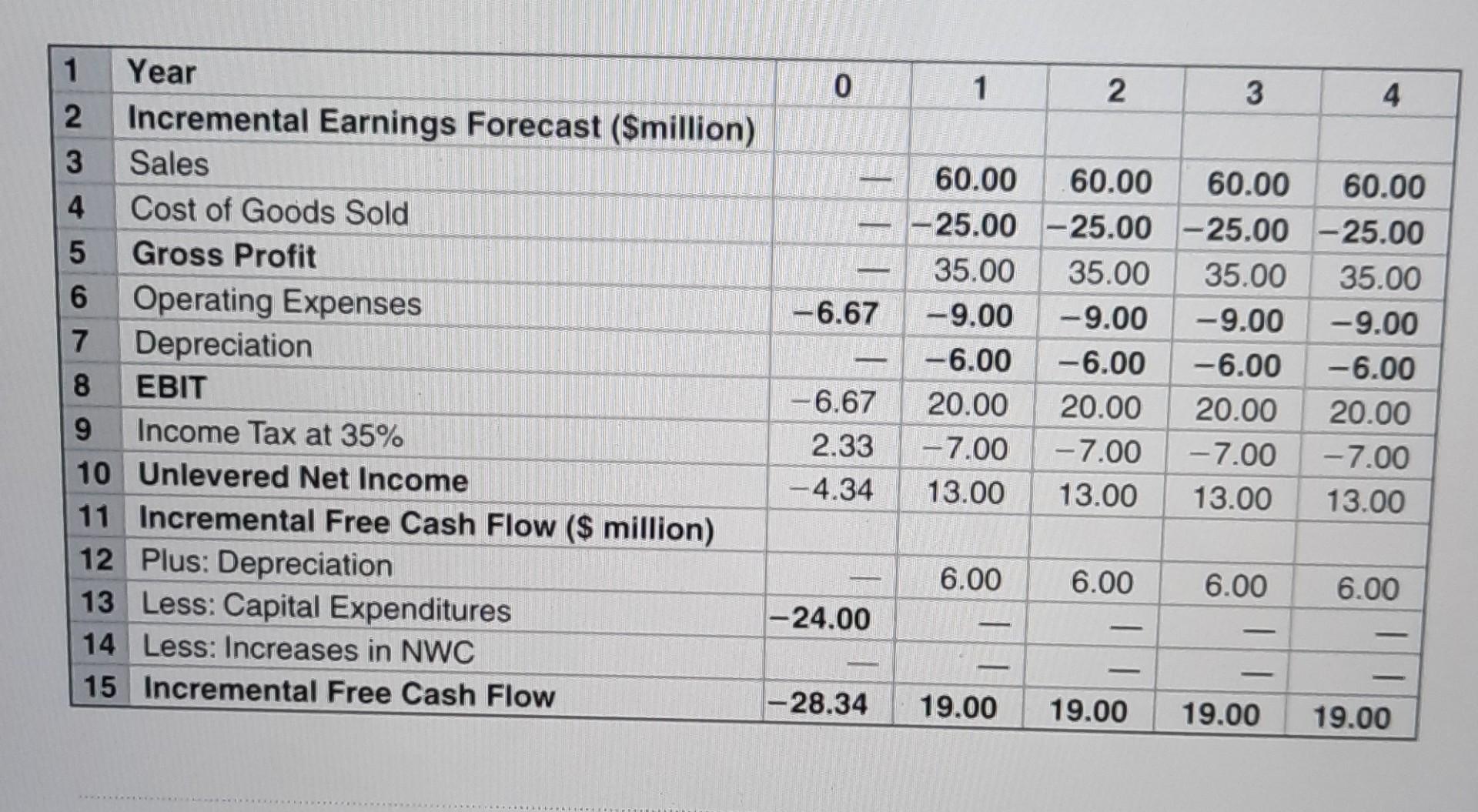

Suppose DuPont is considering an investment that would extend the life of one of its chemical facilities for four years The project would require upfront costs of $6.67 million plus a $24 million investment in equipment The equipment will be obsolete in four years and will be depreciated via straight-line over that period.

During the next four years, however, DuPont expects annual sales of $60 million per year from this facility Material costs and operating expenses are expected to total $25 million and $9 million, respectively, per year DuPont expects no net working capital requirements for the project, and it pays a tax rate of 35%. How do you think it would affect Duponts Income Statement? Does this project has a positive NPV?

(This is the Picture Part)

Taking in consideration the investment (after the effect of taxes), and the new sales, the NPV of the decision would be: 46 = . +( /. )+ ( / . ) + ( / . )+ ( / . ) = $.

1) Assume the equity beta for Johnson \& Johnson (ticker: JNJ) is 0.55. The yield on 10-year treasuries is 4%, and you estimate the market risk premium to be 6%. Furthermore, Johnson \& Johnson issues dividends at an annual rate of $3.81. Its current stock price is $92.00, and you expect dividends to increase at a constant rate of 4% per year. The market values of the common stock, preferred stock, and debt were $46,240 million, \$1350 million, and $16,000 million, respectively. The debt is trading at 90%, with a quarterly coupon payment with a Coupon rate of 13.27% and their corporate taxes are 32%. Assume the maturity is in 10 years. The price of the preferred stock is two dollars less than the common stock, with dividends of $6.00 dollars. The Company intends to invest in a project that will cost 11.1M and will increment the cash flows by 4.5M. Estimate J\&J's WACC in two ways, using CAPM and CDGM and determine if they should take the project. 2) Suppose DuPont is considering an investment that would extend the life of one of its chemical facilities for four years. The project would requirc upfront costs of $6.67 million plus a $24 million investment in equipment. The equipment will be obsolete in 4 years and will be depreciated via straight-line over that period. During the next four years, however, DuPont expects annual sales of $60 million per year from this facility. Material costs and operating expenses are expected to total $25 million and $9 million, respectively, per year. DuPont expects no net working capital requirements for the project, and it pays a tax rate of 35%. \begin{tabular}{|l|l|r|r|r|r|r|} \hline 1 & Year & 0 & 1 & 2 & 3 & 4 \\ \hline 2 & Incremental Earnings Forecast (\$million) & & & & & \\ \hline 3 & Sales & & 60.00 & 60.00 & 60.00 & 60.00 \\ \hline 4 & Cost of Goods Sold & & 25.00 & 25.00 & 25.00 & 25.00 \\ \hline 5 & Gross Profit & & 35.00 & 35.00 & 35.00 & 35.00 \\ \hline 6 & Operating Expenses & 6.67 & 9.00 & 9.00 & 9.00 & 9.00 \\ \hline 7 & Depreciation & & 6.00 & 6.00 & 6.00 & 6.00 \\ \hline 8 & EBIT & 6.67 & 20.00 & 20.00 & 20.00 & 20.00 \\ \hline 9 & Income Tax at 35\% & 2.33 & 7.00 & 7.00 & 7.00 & 7.00 \\ \hline 10 & Unlevered Net Income & 4.34 & 13.00 & 13.00 & 13.00 & 13.00 \\ \hline 11 & Incremental Free Cash Flow (\$ million) & & & & & \\ \hline 12 & Plus: Depreciation & & 6.00 & 6.00 & 6.00 & 6.00 \\ \hline 13 & Less: Capital Expenditures & 24.00 & & & & \\ \hline 14 & Less: Increases in NWC & & & & & \\ \hline 15 & Incremental Free Cash Flow & 28.34 & 19.00 & 19.00 & 19.00 & 19.00 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started