Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is all the information I was given refer to all photos the information provided is all i have. you calculate the ratios etc using

this is all the information I was given refer to all photos

the information provided is all i have. you calculate the ratios etc using the information that is provided in the photos

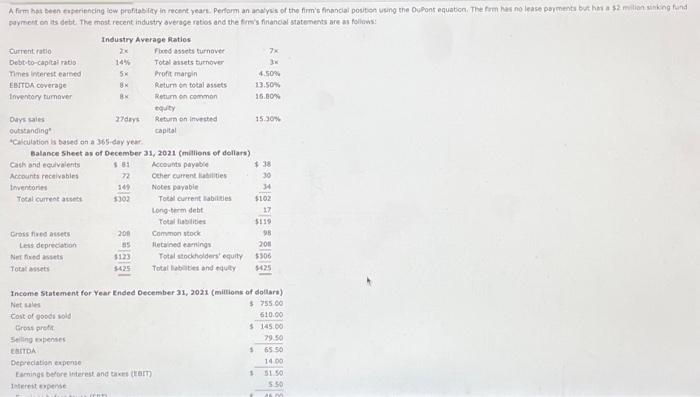

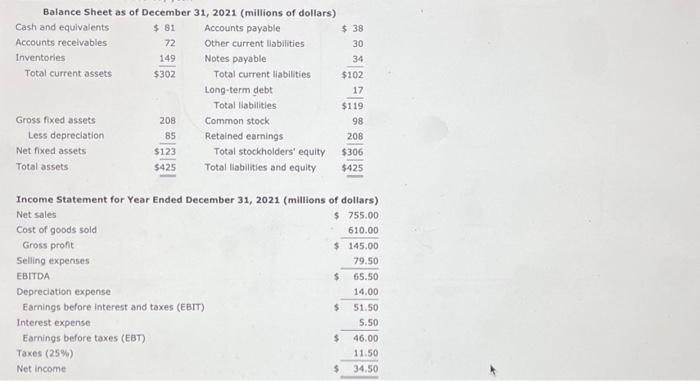

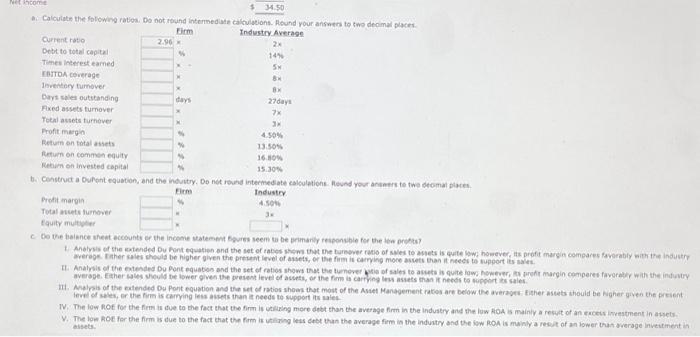

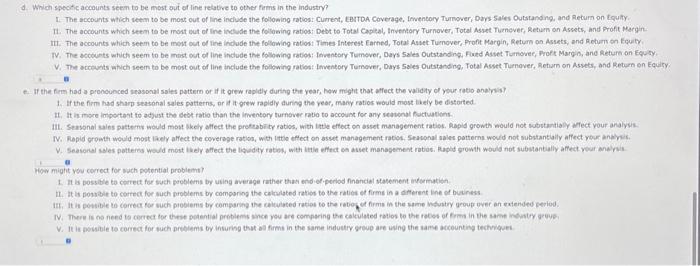

parmest on its debt. The mbst recent industry average ratios and the firm's financal sratements are as follows: Inceme statement for Year Ended December 31,2021 (miltions of dollare) Balance Sheet as of December 31.2021 (millions of dollars) wi Calculate the folowing raties. Do not resind internedate caltulucions. Heund your answen to swo decimal places. Industry Average 2x 14% 5x 8x 8x 27day1 7x 3x 4.50% 13.50% 16.56% 15.30% Protit margin Tutal atsets lumper tauity multiger Industry 4sin6 3 c bo the bainnce theat eccounts of the income satempat Egures seen tu be brimarily responsbie for the lew orpats? averege. Tater sales shevis be higher given the prepent level of assets, or the firm is carrying move ascets than it heecs to support its aaks. teve of sales, or the firs is cerring less aspets than it needs to support its salec d. Which spechic accounts seem to be most aut of line relative to other fems in the industry? 11. The aocounts which seem to be most eut of ine ivelvie the folowing ratips, Debe to Total captal, Inventory Turnover, Total Asset Tamover, Retum on Assets, and Proft Mergin- Iit. The accounts which seem to be most out of ine indvde the folowing ratiost Times interest Earhed, Tota! Asset Tuenover, Profit Margin, Retym on Assets, and Retum on Ecuity. V. The acceunts atich seem to be most out of ine include the folbwing ratios: Imventory Tumover, Days Sales Outstanding, Total Asset Tumover, Rehurn on Aspets, ahd Retim en Equiry 2. If the firm had a pronounced sedsonal soles pattem of if it orew rapldy during the year, now might that affect the validity of yeur ratio analpls? 1. If the firm had sharp seasonal sales patterns, or it it grew rapidy during the yeor, many ratios would most liely be distorted. 14. It is more iolportant to adjust the debt ratio than the imentory turnover ratio to accoust for any seavenal fuctuations. 11. Seasonal cales pittems would most lkely affect the pretsabirty ratios, with ittle eftect on asset maragenent raties. Mapid growth would not subvtantialy whect vour anslysis. N. Ropid cromth would most laely affect the coverage ration, with ittie cffect of bsuet management rabis, seaconal sales potterna would not substantally alfect yeur anphis. How might wow cerrect for wuch potential problemst? 1. It is possible to correct fos such pooblems by uting iverage rather thas end of peribd niancial statement ivtermatioh. 11. it is possber to correct for such problems by componoy the catcalated ratios to the raties et firms in a dirterent ine of businss parmest on its debt. The mbst recent industry average ratios and the firm's financal sratements are as follows: Inceme statement for Year Ended December 31,2021 (miltions of dollare) Balance Sheet as of December 31.2021 (millions of dollars) wi Calculate the folowing raties. Do not resind internedate caltulucions. Heund your answen to swo decimal places. Industry Average 2x 14% 5x 8x 8x 27day1 7x 3x 4.50% 13.50% 16.56% 15.30% Protit margin Tutal atsets lumper tauity multiger Industry 4sin6 3 c bo the bainnce theat eccounts of the income satempat Egures seen tu be brimarily responsbie for the lew orpats? averege. Tater sales shevis be higher given the prepent level of assets, or the firm is carrying move ascets than it heecs to support its aaks. teve of sales, or the firs is cerring less aspets than it needs to support its salec d. Which spechic accounts seem to be most aut of line relative to other fems in the industry? 11. The aocounts which seem to be most eut of ine ivelvie the folowing ratips, Debe to Total captal, Inventory Turnover, Total Asset Tamover, Retum on Assets, and Proft Mergin- Iit. The accounts which seem to be most out of ine indvde the folowing ratiost Times interest Earhed, Tota! Asset Tuenover, Profit Margin, Retym on Assets, and Retum on Ecuity. V. The acceunts atich seem to be most out of ine include the folbwing ratios: Imventory Tumover, Days Sales Outstanding, Total Asset Tumover, Rehurn on Aspets, ahd Retim en Equiry 2. If the firm had a pronounced sedsonal soles pattem of if it orew rapldy during the year, now might that affect the validity of yeur ratio analpls? 1. If the firm had sharp seasonal sales patterns, or it it grew rapidy during the yeor, many ratios would most liely be distorted. 14. It is more iolportant to adjust the debt ratio than the imentory turnover ratio to accoust for any seavenal fuctuations. 11. Seasonal cales pittems would most lkely affect the pretsabirty ratios, with ittle eftect on asset maragenent raties. Mapid growth would not subvtantialy whect vour anslysis. N. Ropid cromth would most laely affect the coverage ration, with ittie cffect of bsuet management rabis, seaconal sales potterna would not substantally alfect yeur anphis. How might wow cerrect for wuch potential problemst? 1. It is possible to correct fos such pooblems by uting iverage rather thas end of peribd niancial statement ivtermatioh. 11. it is possber to correct for such problems by componoy the catcalated ratios to the raties et firms in a dirterent ine of businss Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started