This is all the information I was given to complete the assignment.

Overview

Analyzing the financial performance of a company is crucial for any business at any given point of time, but especially when the company is heading in a new direction.

You are aware that your company has made the strategic decision to move to a triple bottom line-focused business model. You have already collaborated with various departments within your organization to understand their perspectives.

Now you will review the current financial performance of your organization and evaluate whether the operational plan aligns with key performance indicators of the finance department.

Prompt

Using the financial records of the health and beauty company that you work for, as well as the financial records for Amazon to create a consulting report outlining the following criteria:

- Identify key financial performance indicators that various stakeholders would use, including:

- Employees

- Shareholders

- Community groups

- Identify additional key financial line items related to triple bottom line that are required needed to measure cost.

Supporting Material

Financial records of the health and beauty company you work at

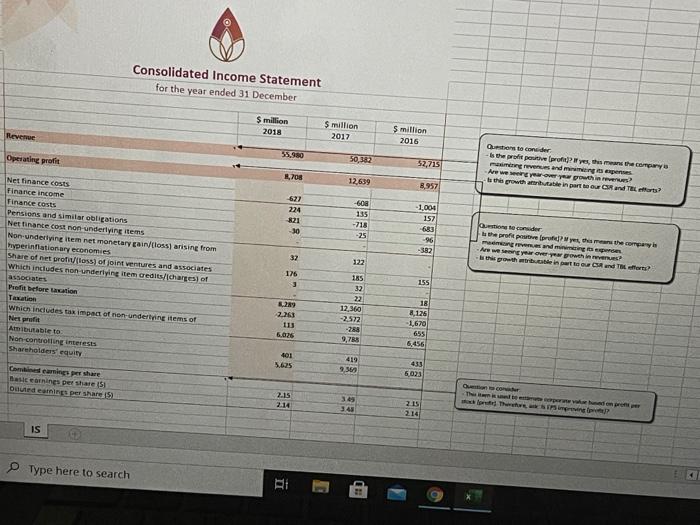

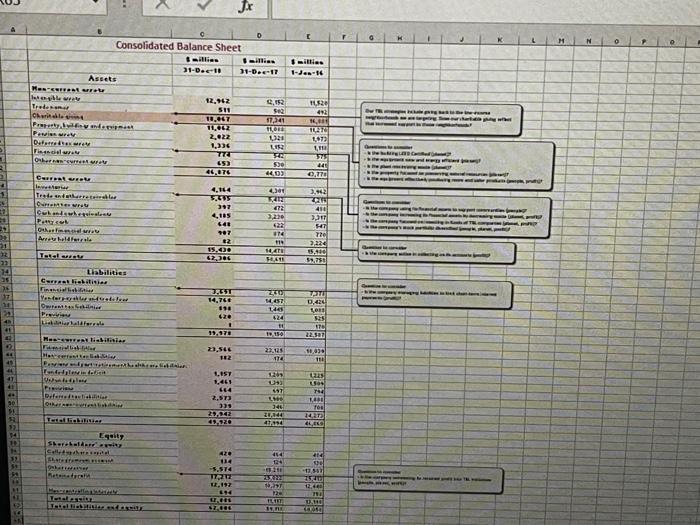

- Consolidated balance sheet

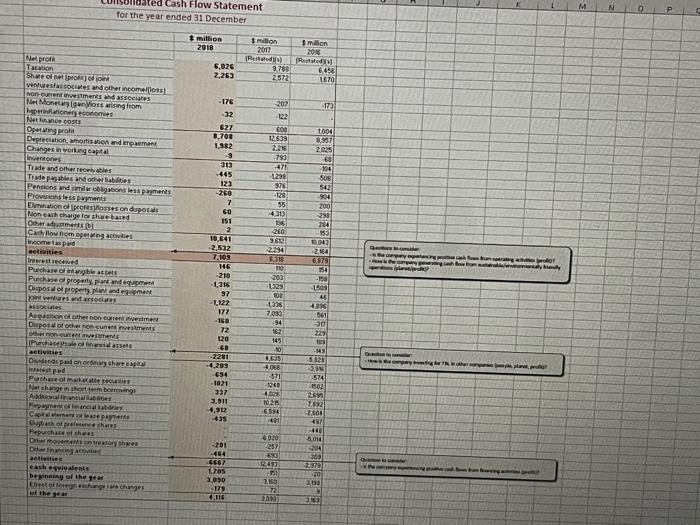

- Consolidated cash flow statement

- Consolidated income statement

Financial records of Amazon

- Balance sheet of your chosen company

- Cash flow statement of your chosen company

- Income statement of your chosen company

Consolidated Income Statement for the year ended 31 December $ million 2018 Revenue $ million 2017 Smillion 2016 55380 Operating profit 50,32 52,715 Questions to consider - Is the properly, this means the companys ming and engages Are we gry gothin to the growth in turn forts? 1,708 12,639 8.957 -1.004 Net finance costs Finance income Finance costs Pensions and similar obligations Net finance Cost non underliners Non-underlying item ne monetary in loss) arising from hyperinflationary economies Share of net profess) of joint ventures and associates Which includes non underlying item credits charge of associates Profit before action -60 135 -718 -25 -30 157 600 -96 -382 the properthim the company memang Are we were gowth in - this growth and for 37 122 176 3 155 which includes tax impact of underlying items of Net Aibutable to Non controlling interests Shareholders' equity R289 2.63 113 5.016 185 32 22 12,360 -2.522 -258 9,785 16 4,126 1,670 655 6,456 419 56.25 433 6,023 | Camise pershare has earnings per Share 15 Outdeines persha 2.15 2.14 349 345 215 214 IS Type here to search Rt Cash Flow Statement for the year ended 31 December M N o million 2018 Na po million milion 2017 203 Rested Rated 9783 6456 2572 1670 6,025 2,269 -176 -32 -172 207 -122 600 12.639 Tantion Shwe oletproofint venues associes and other income foss Don Guestments and associates Net Moneglunyosing from prilonymes Netfance costs Opeting profit Depreciation on and man Changes in working capital Inventories Trade and other recebe Tuwde pagables and other abilities Pensions and milions les parts Provision less payments Ellion a profession disposal Non cash change for share based Other sments Cash flow from opening actitles Income aspad activities 790 471 1238 376 -128 55 4013 1004 8957 2025 60 2104 508 542 904 2001 288 260 9.612 627 0.700 1.982 -9 313 445 123 -260 7 CO 151 2 107641 -2.522 7.103 146 -210 -1,316 97 -1122 177 -160 72 120 -CO -2281 .4.203 634 -1021 337 32.911 Purchase intangible assets Purchase of groot plant and Dupondo properts pluiment eta do 10 2 1004) 2164 5,879 154 -150 -150 45 123 102 13:38 7,090 -94 Aegaon other non esimest Doposcoother non cunet investments che non curants M . 05 055 activities Dwindspadowy share ped Pushereket ble et Netshange in the term bening Atrionalne Pepayment finances Cuplement base para Dyback opereshe Fechat shes Dovore sve Oct 20 4.02 10.216 6554 40 561 17 25 180 -143 SU -2.50 -574 2502 20590 72 2800 *92 448 3010 204 303 2979 70 200 35 6020 690 1242 eash eulalents Deginning of the sea Change change -201 -464 .6667 1205 3,070 179 4.116 2.83 Jx D H N O sillies 1-Jee 16 Consolidated Balance Sheet willies 31-0. 10 31-Dec-17 Assets Mes sur law 12,762 2,152 treden Icharit 10.17 17241 11.062 TOT 2.022 20 1,036 1152 Financier 777 65) 46,076 440) 16520 421 16.01 TUTO 14 11 as 44 0.770 3.12 Trade antrelas 4.30 TAR 072 410 TEE Cuku 4,114 5.95 397 4105 600 707 2 15.00 42.286 Ohner Arather 31 14 119 NA HAT HT The 2.226 15.400 53.750 34 Tatar Liabilities Curatebitisies Tinnit Yondertiteur Dw 26 17 LU P 14,760 16 1445 . 17,970 125 170 22.327 Net 162 22.125 174 10,3 111 41 ( en LES Us 184 657 Diferentiat 1. SY 44 2,973 29.24 E PPLE PREF Tee 14,23 G' 1 PR 5.574 11,551 7702 RREST 12.192 194 10. 12. 11 1211 Consolidated Income Statement for the year ended 31 December $ million 2018 Revenue $ million 2017 Smillion 2016 55380 Operating profit 50,32 52,715 Questions to consider - Is the properly, this means the companys ming and engages Are we gry gothin to the growth in turn forts? 1,708 12,639 8.957 -1.004 Net finance costs Finance income Finance costs Pensions and similar obligations Net finance Cost non underliners Non-underlying item ne monetary in loss) arising from hyperinflationary economies Share of net profess) of joint ventures and associates Which includes non underlying item credits charge of associates Profit before action -60 135 -718 -25 -30 157 600 -96 -382 the properthim the company memang Are we were gowth in - this growth and for 37 122 176 3 155 which includes tax impact of underlying items of Net Aibutable to Non controlling interests Shareholders' equity R289 2.63 113 5.016 185 32 22 12,360 -2.522 -258 9,785 16 4,126 1,670 655 6,456 419 56.25 433 6,023 | Camise pershare has earnings per Share 15 Outdeines persha 2.15 2.14 349 345 215 214 IS Type here to search Rt Cash Flow Statement for the year ended 31 December M N o million 2018 Na po million milion 2017 203 Rested Rated 9783 6456 2572 1670 6,025 2,269 -176 -32 -172 207 -122 600 12.639 Tantion Shwe oletproofint venues associes and other income foss Don Guestments and associates Net Moneglunyosing from prilonymes Netfance costs Opeting profit Depreciation on and man Changes in working capital Inventories Trade and other recebe Tuwde pagables and other abilities Pensions and milions les parts Provision less payments Ellion a profession disposal Non cash change for share based Other sments Cash flow from opening actitles Income aspad activities 790 471 1238 376 -128 55 4013 1004 8957 2025 60 2104 508 542 904 2001 288 260 9.612 627 0.700 1.982 -9 313 445 123 -260 7 CO 151 2 107641 -2.522 7.103 146 -210 -1,316 97 -1122 177 -160 72 120 -CO -2281 .4.203 634 -1021 337 32.911 Purchase intangible assets Purchase of groot plant and Dupondo properts pluiment eta do 10 2 1004) 2164 5,879 154 -150 -150 45 123 102 13:38 7,090 -94 Aegaon other non esimest Doposcoother non cunet investments che non curants M . 05 055 activities Dwindspadowy share ped Pushereket ble et Netshange in the term bening Atrionalne Pepayment finances Cuplement base para Dyback opereshe Fechat shes Dovore sve Oct 20 4.02 10.216 6554 40 561 17 25 180 -143 SU -2.50 -574 2502 20590 72 2800 *92 448 3010 204 303 2979 70 200 35 6020 690 1242 eash eulalents Deginning of the sea Change change -201 -464 .6667 1205 3,070 179 4.116 2.83 Jx D H N O sillies 1-Jee 16 Consolidated Balance Sheet willies 31-0. 10 31-Dec-17 Assets Mes sur law 12,762 2,152 treden Icharit 10.17 17241 11.062 TOT 2.022 20 1,036 1152 Financier 777 65) 46,076 440) 16520 421 16.01 TUTO 14 11 as 44 0.770 3.12 Trade antrelas 4.30 TAR 072 410 TEE Cuku 4,114 5.95 397 4105 600 707 2 15.00 42.286 Ohner Arather 31 14 119 NA HAT HT The 2.226 15.400 53.750 34 Tatar Liabilities Curatebitisies Tinnit Yondertiteur Dw 26 17 LU P 14,760 16 1445 . 17,970 125 170 22.327 Net 162 22.125 174 10,3 111 41 ( en LES Us 184 657 Diferentiat 1. SY 44 2,973 29.24 E PPLE PREF Tee 14,23 G' 1 PR 5.574 11,551 7702 RREST 12.192 194 10. 12. 11 1211