THIS IS ALL WHAT I NEED, YOU CAN JUST DO IT.

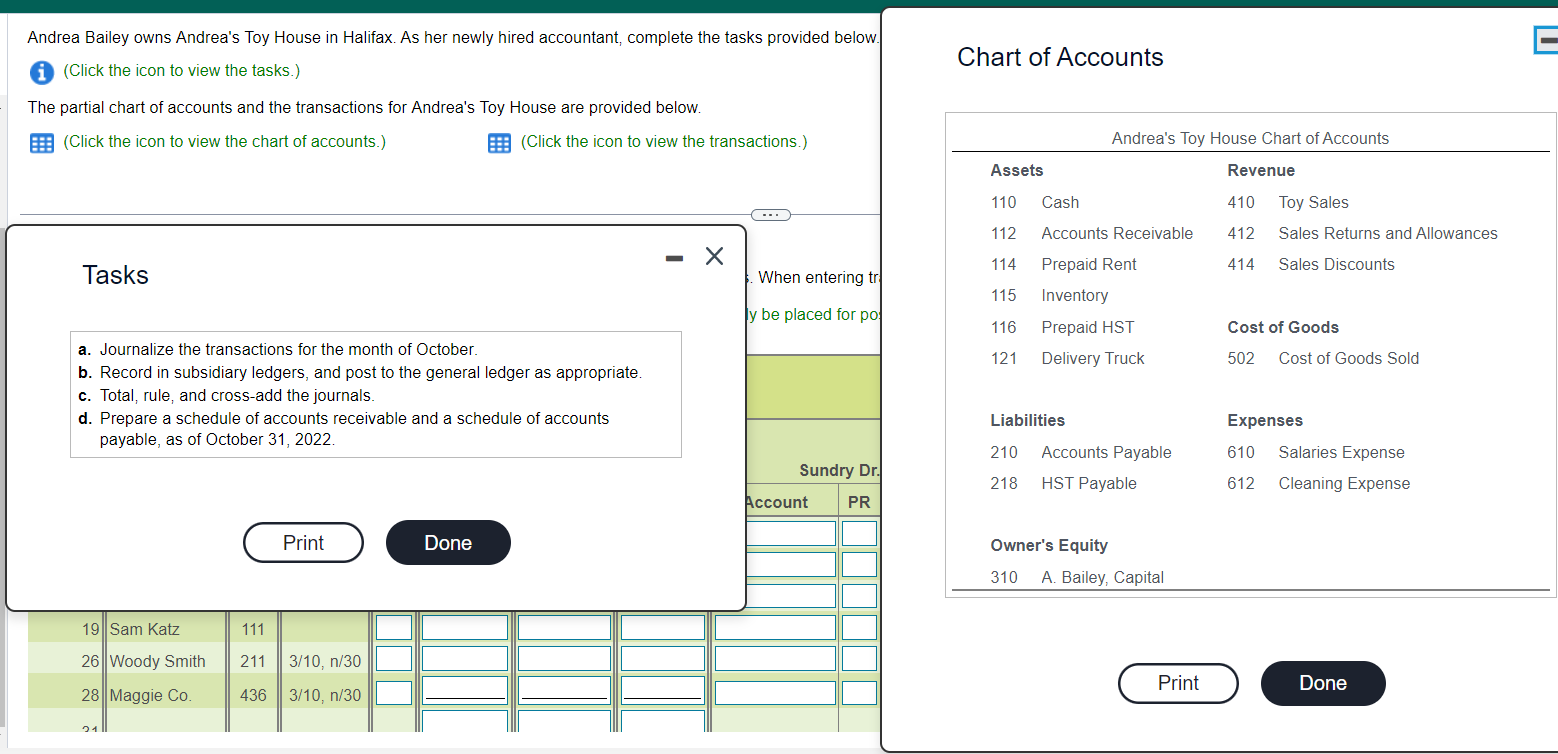

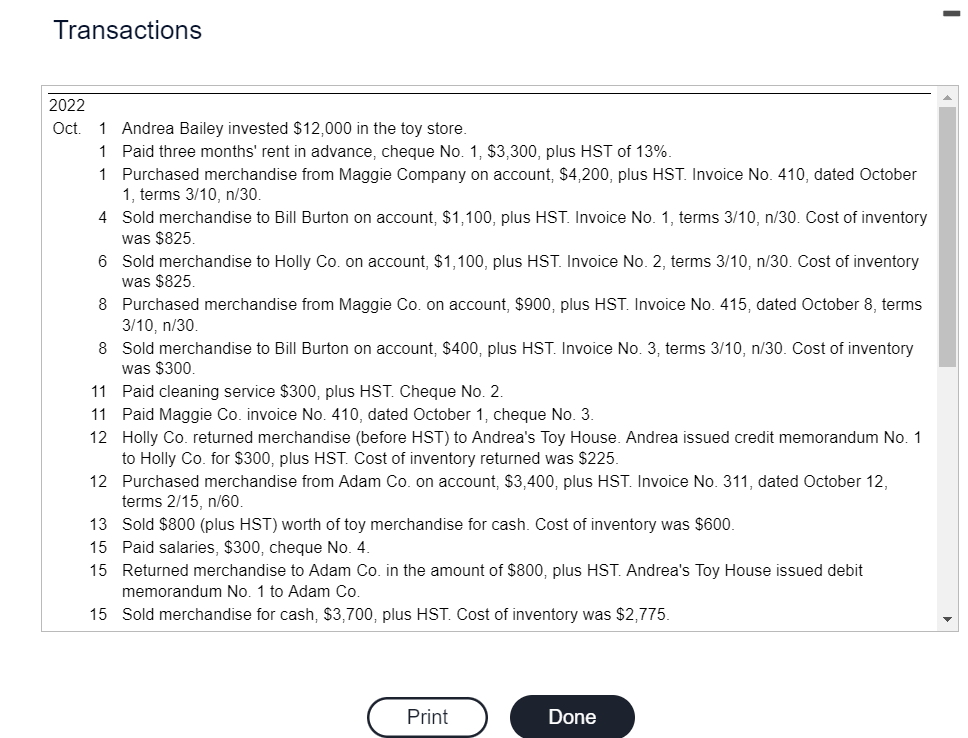

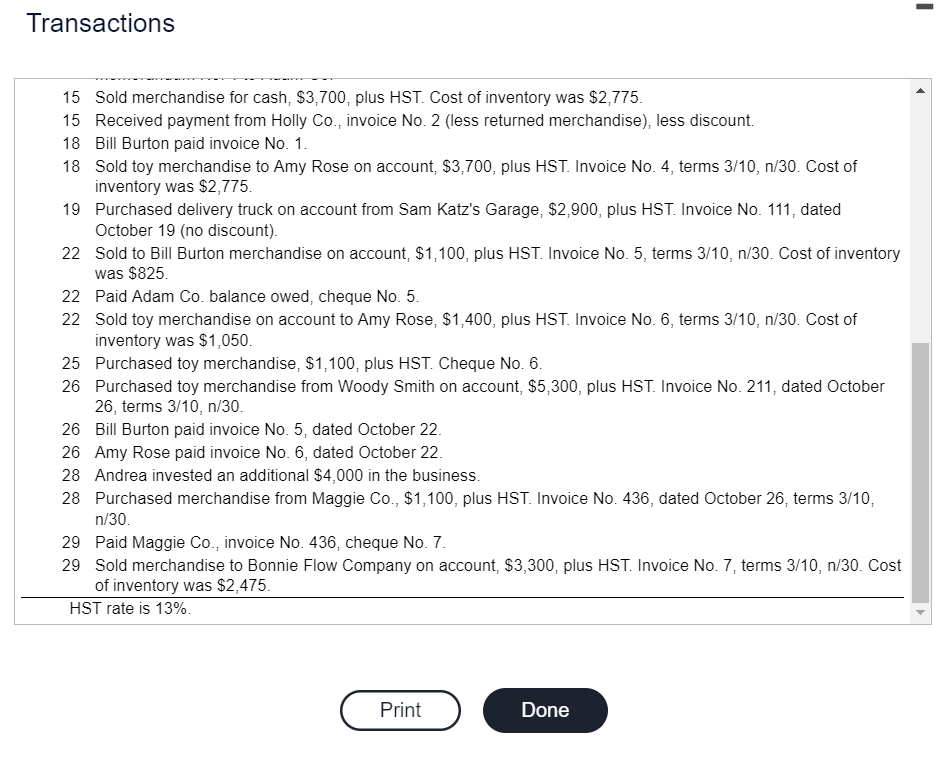

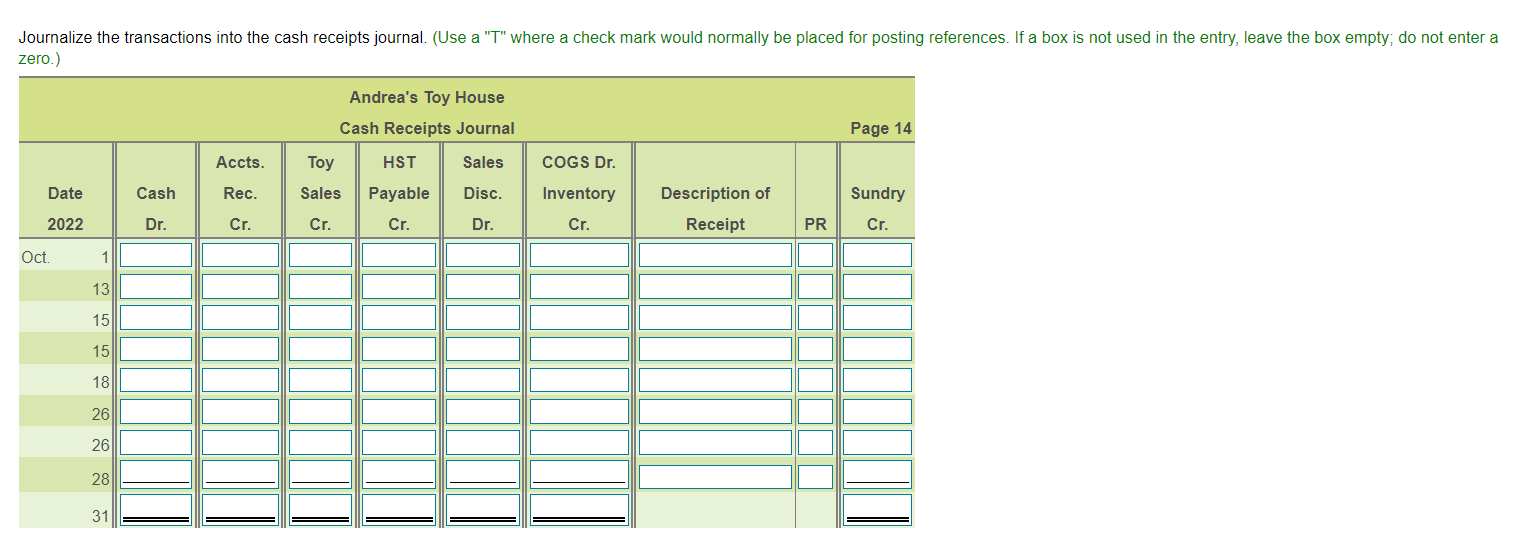

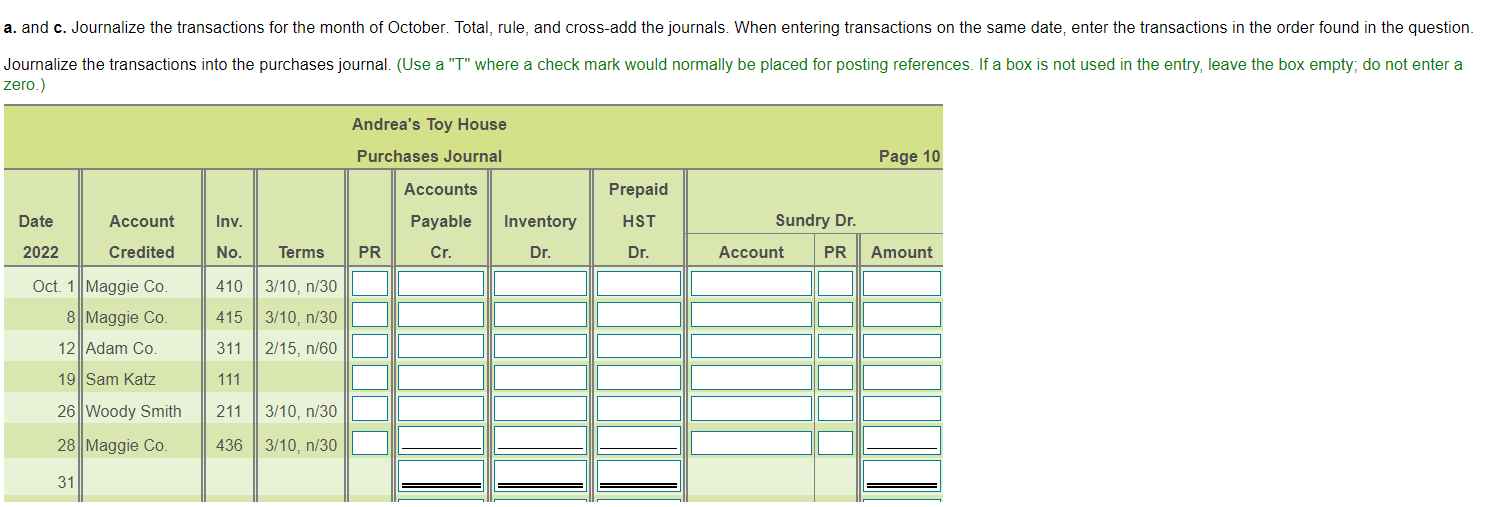

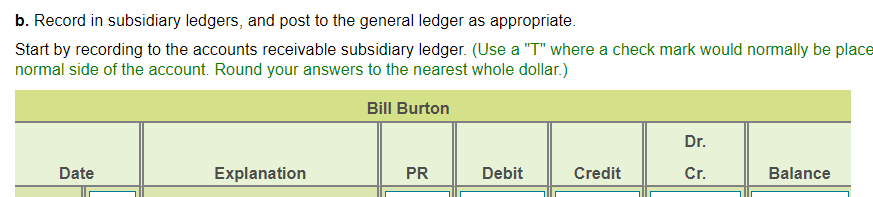

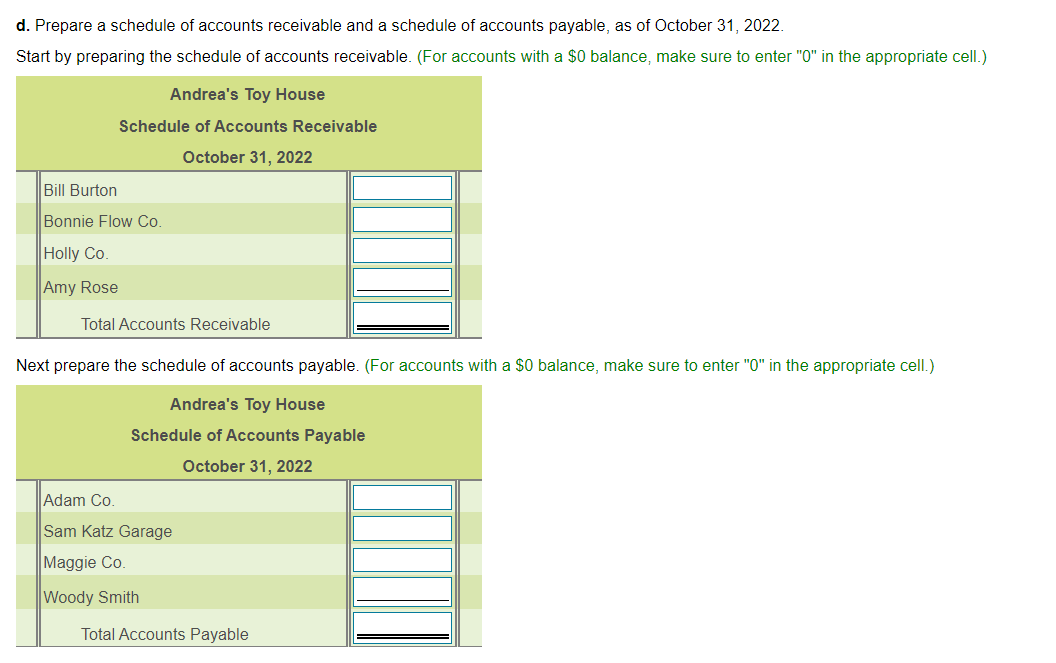

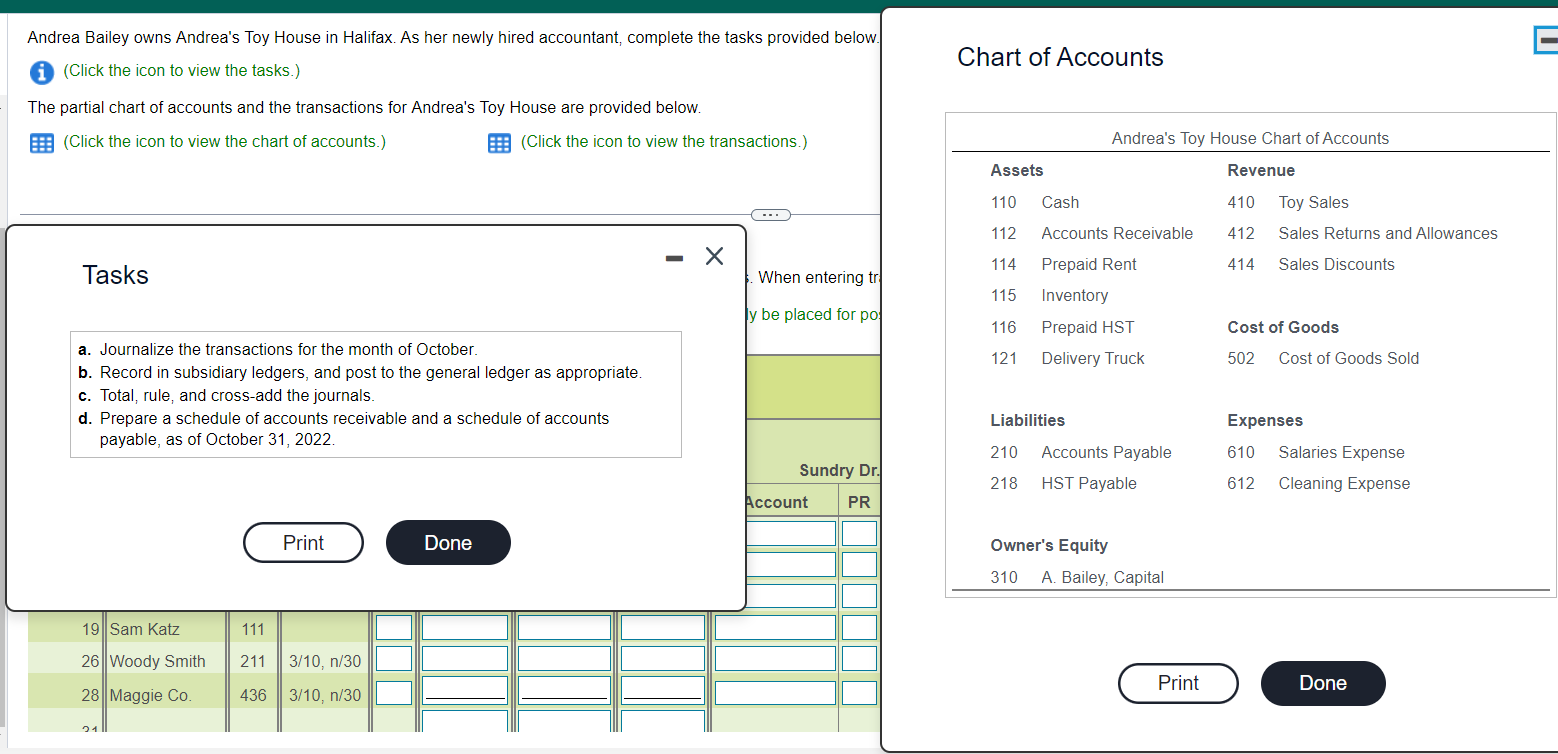

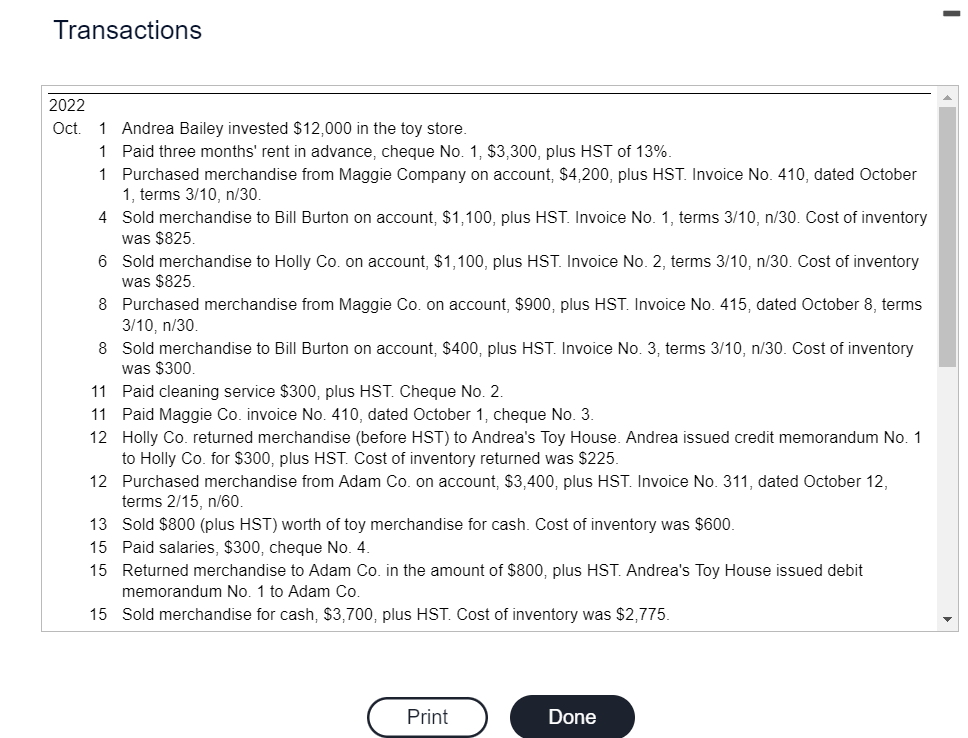

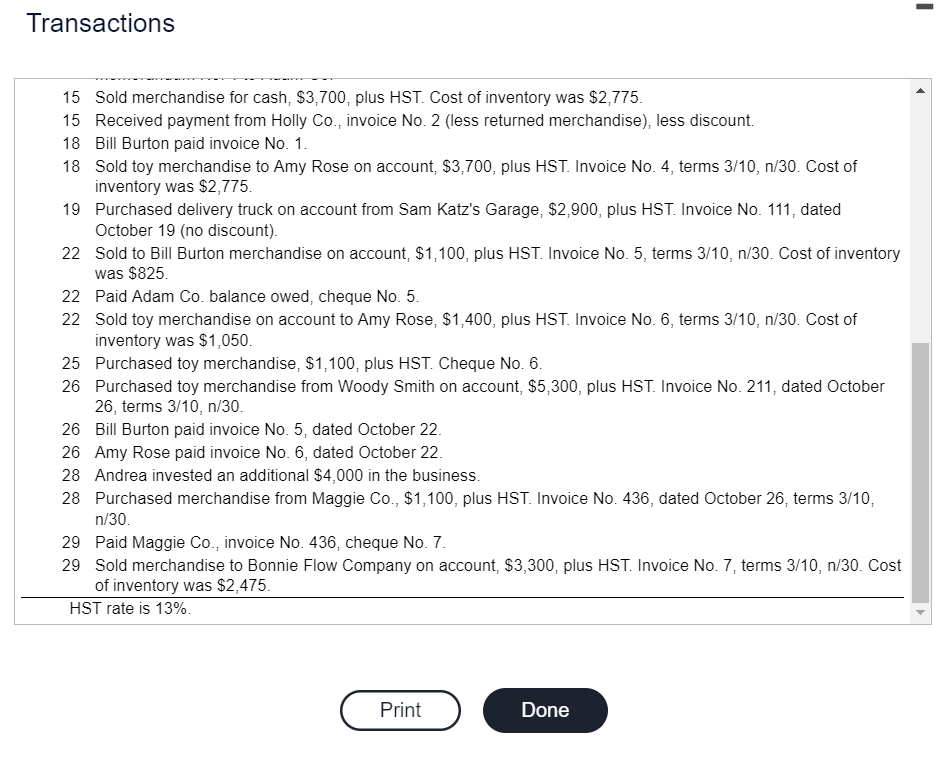

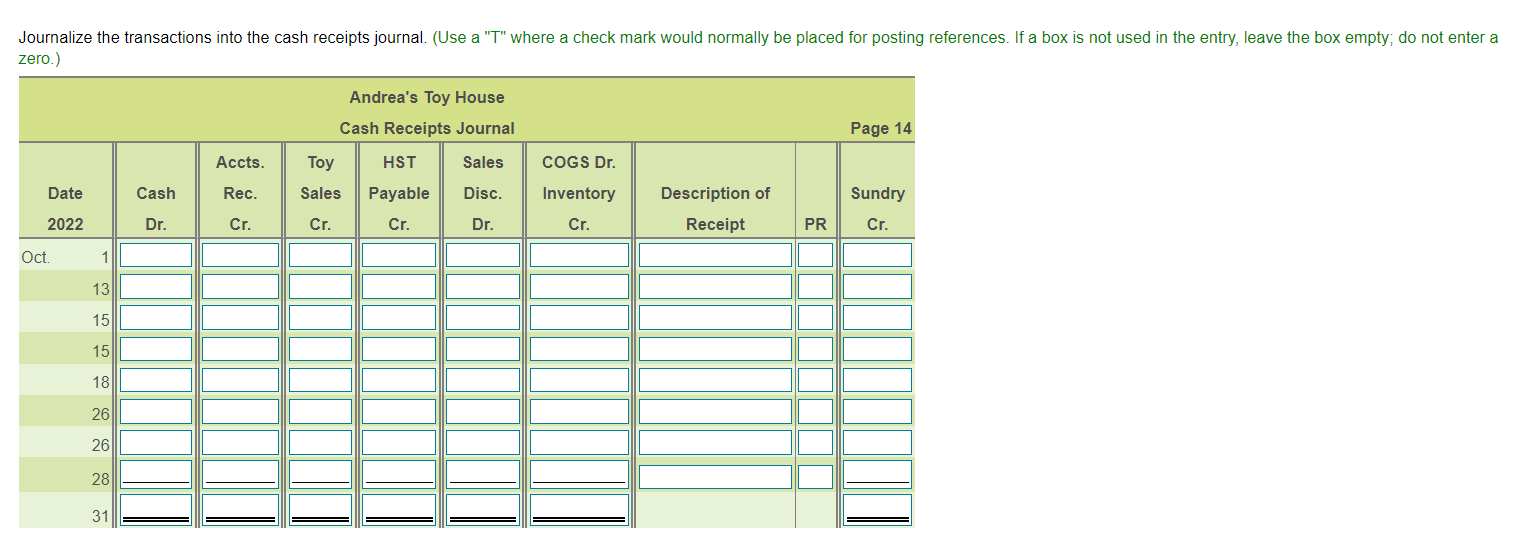

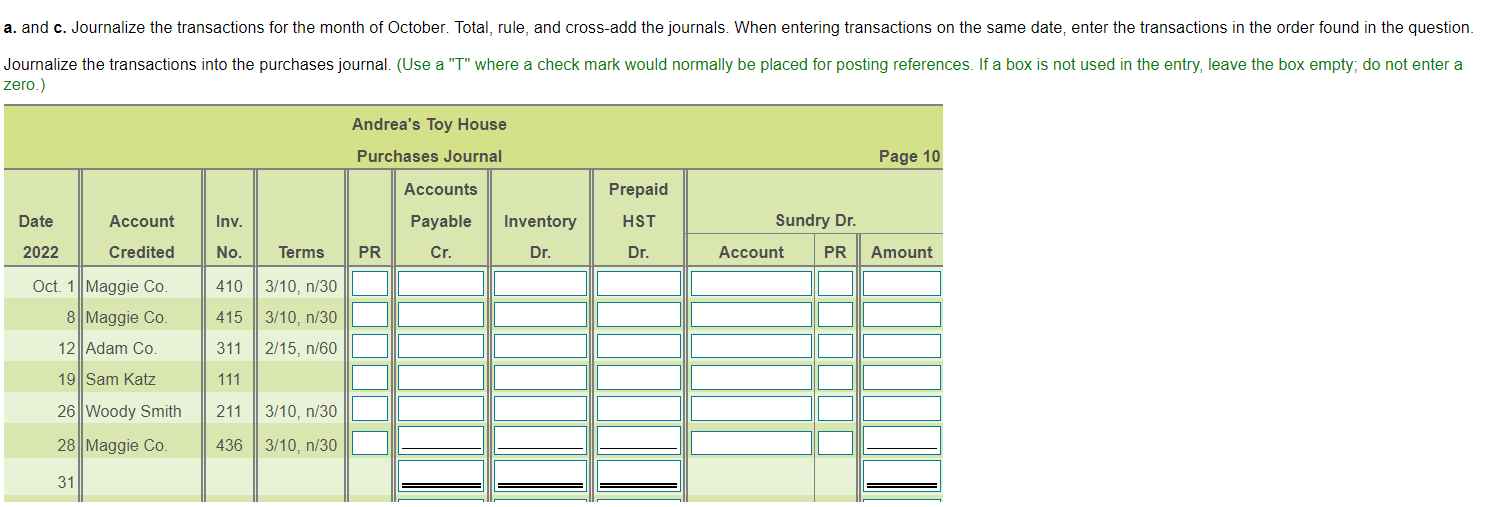

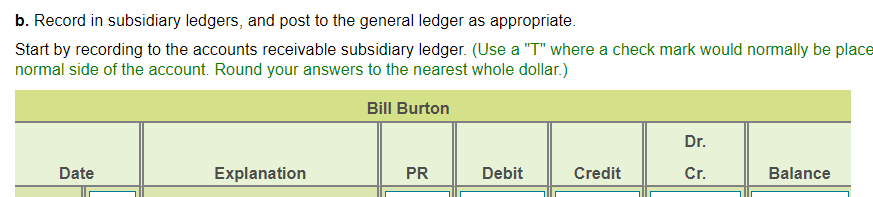

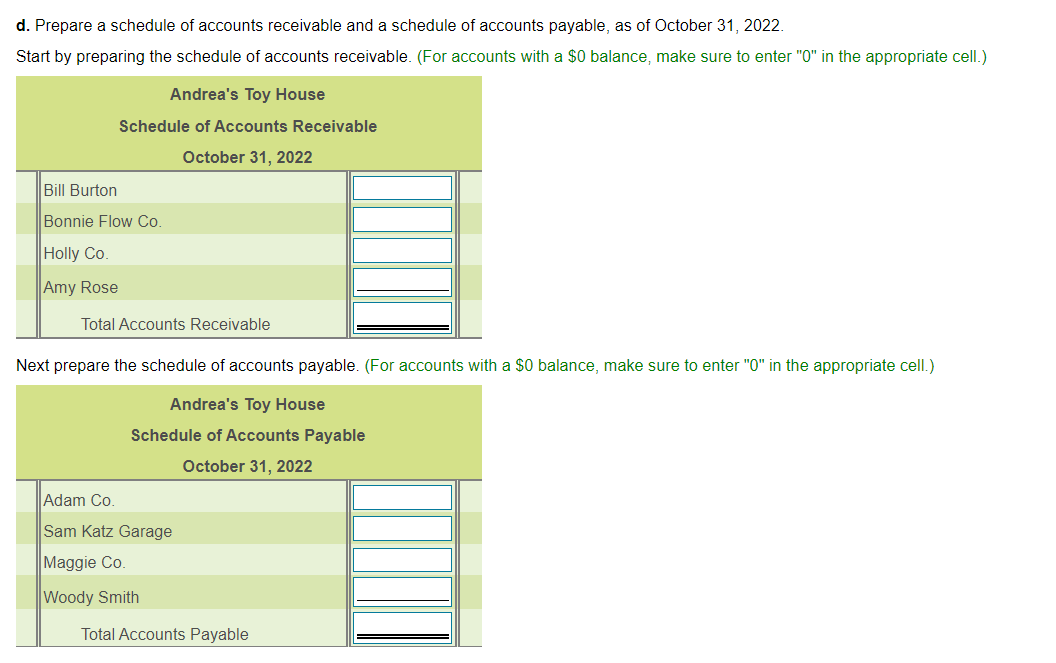

Andrea Bailey owns Andrea's Toy House in Halifax. As her newly hired accountant, complete the tasks provided below. Chart of Accounts (Click the icon to view the tasks.) The partial chart of accounts and the transactions for Andrea's Toy House are provided below. (Click the icon to view the chart of accounts.) (Click the icon to view the transactions.) Tasks a. Journalize the transactions for the month of October. b. Record in subsidiary ledgers, and post to the general ledger as appropriate. c. Total, rule, and cross-add the journals. d. Prepare a schedule of accounts receivable and a schedule of accounts payable, as of October 31, 2022. Transactions 2022 Oct. 1 Andrea Bailey invested $12,000 in the toy store. 1 Paid three months' rent in advance, cheque No. 1,$3,300, plus HST of 13%. 1 Purchased merchandise from Maggie Company on account, $4,200, plus HST. Invoice No. 410, dated October 1 , terms 3/10,n/30. 4 Sold merchandise to Bill Burton on account, $1,100, plus HST. Invoice No. 1 , terms 3/10,n/30. Cost of inventory was $825. 6 Sold merchandise to Holly Co. on account, $1,100, plus HST. Invoice No. 2, terms 3/10,n/30. Cost of inventory was $825. 8 Purchased merchandise from Maggie Co. on account, $900, plus HST. Invoice No. 415, dated October 8 , terms 3/10,n/30. 8 Sold merchandise to Bill Burton on account, $400, plus HST. Invoice No. 3 , terms 3/10,n/30. Cost of inventory was $300. 11 Paid cleaning service $300, plus HST. Cheque No. 2. 11 Paid Maggie Co. invoice No. 410, dated October 1, cheque No. 3. 12 Holly Co. returned merchandise (before HST) to Andrea's Toy House. Andrea issued credit memorandum No. 1 to Holly Co. for $300, plus HST. Cost of inventory returned was $225. 12 Purchased merchandise from Adam Co. on account, \$3,400, plus HST. Invoice No. 311, dated October 12, terms 2/15,n/60. 13 Sold $800 (plus HST) worth of toy merchandise for cash. Cost of inventory was $600. 15 Paid salaries, $300, cheque No. 4. 15 Returned merchandise to Adam C. in the amount of $800, plus HST. Andrea's Toy House issued debit memorandum No. 1 to Adam Co. 15 Sold merchandise for cash, $3,700, plus HST. Cost of inventory was $2,775. Transactions 15 Sold merchandise for cash, $3,700, plus HST. Cost of inventory was $2,775. 15 Received payment from Holly Co., invoice No. 2 (less returned merchandise), less discount. 18 Bill Burton paid invoice No. 1. 18 Sold toy merchandise to Amy Rose on account, \$3,700, plus HST. Invoice No. 4, terms 3/10, n/30. Cost of inventory was $2,775. 19 Purchased delivery truck on account from Sam Katz's Garage, \$2,900, plus HST. Invoice No. 111, dated October 19 (no discount). 22 Sold to Bill Burton merchandise on account, $1,100, plus HST. Invoice No. 5, terms 3/10,n/30. Cost of inventory was $825. 22 Paid Adam Co. balance owed, cheque No. 5. 22 Sold toy merchandise on account to Amy Rose, $1,400, plus HST. Invoice No. 6, terms 3/10, n/30. Cost of inventory was $1,050. 25 Purchased toy merchandise, $1,100, plus HST. Cheque No. 6. 26 Purchased toy merchandise from Woody Smith on account, \$5,300, plus HST. Invoice No. 211, dated October 26, terms 3/10,n/30 26 Bill Burton paid invoice No. 5, dated October 22. 26 Amy Rose paid invoice No. 6, dated October 22. 28 Andrea invested an additional $4,000 in the business. 28 Purchased merchandise from Maggie Co., $1,100, plus HST. Invoice No. 436, dated October 26 , terms 3/10, n/30 29 Paid Maggie Co., invoice No. 436, cheque No. 7. 29 Sold merchandise to Bonnie Flow Company on account, $3,300, plus HST. Invoice No. 7 , terms 3/10, n/30. Cost of inventory was $2,475. HST rate is 13%. zero.) Andrea's Toy House Cash Receipts Journal Page 14 Date a. and c. Journalize the transactions for the month of October. Total, rule, and cross-add the journals. When entering transactions on the same date, enter the transactions in the order found in the question. Journalize the transactions into the purchases journal. (Use a "T" where a check mark would normally be placed for posting references. If a box is not used in the entry, leave the box empty; do not enter a zero.) b. Record in subsidiary ledgers, and post to the general ledger as appropriate. Start by recording to the accounts receivable subsidiary ledger. (Use a "T" where a check mark would normally be place normal side of the account. Round your answers to the nearest whole dollar.) d. Prepare a schedule of accounts receivable and a schedule of accounts payable, as of October 31, 2022. Start by preparing the schedule of accounts receivable. (For accounts with a $0 balance, make sure to enter "0" in the appropriate cell.) Next prepare the schedule of accounts payable. (For accounts with a $0 balance, make sure to enter "0" in the appropriate cell.) Andrea Bailey owns Andrea's Toy House in Halifax. As her newly hired accountant, complete the tasks provided below. Chart of Accounts (Click the icon to view the tasks.) The partial chart of accounts and the transactions for Andrea's Toy House are provided below. (Click the icon to view the chart of accounts.) (Click the icon to view the transactions.) Tasks a. Journalize the transactions for the month of October. b. Record in subsidiary ledgers, and post to the general ledger as appropriate. c. Total, rule, and cross-add the journals. d. Prepare a schedule of accounts receivable and a schedule of accounts payable, as of October 31, 2022. Transactions 2022 Oct. 1 Andrea Bailey invested $12,000 in the toy store. 1 Paid three months' rent in advance, cheque No. 1,$3,300, plus HST of 13%. 1 Purchased merchandise from Maggie Company on account, $4,200, plus HST. Invoice No. 410, dated October 1 , terms 3/10,n/30. 4 Sold merchandise to Bill Burton on account, $1,100, plus HST. Invoice No. 1 , terms 3/10,n/30. Cost of inventory was $825. 6 Sold merchandise to Holly Co. on account, $1,100, plus HST. Invoice No. 2, terms 3/10,n/30. Cost of inventory was $825. 8 Purchased merchandise from Maggie Co. on account, $900, plus HST. Invoice No. 415, dated October 8 , terms 3/10,n/30. 8 Sold merchandise to Bill Burton on account, $400, plus HST. Invoice No. 3 , terms 3/10,n/30. Cost of inventory was $300. 11 Paid cleaning service $300, plus HST. Cheque No. 2. 11 Paid Maggie Co. invoice No. 410, dated October 1, cheque No. 3. 12 Holly Co. returned merchandise (before HST) to Andrea's Toy House. Andrea issued credit memorandum No. 1 to Holly Co. for $300, plus HST. Cost of inventory returned was $225. 12 Purchased merchandise from Adam Co. on account, \$3,400, plus HST. Invoice No. 311, dated October 12, terms 2/15,n/60. 13 Sold $800 (plus HST) worth of toy merchandise for cash. Cost of inventory was $600. 15 Paid salaries, $300, cheque No. 4. 15 Returned merchandise to Adam C. in the amount of $800, plus HST. Andrea's Toy House issued debit memorandum No. 1 to Adam Co. 15 Sold merchandise for cash, $3,700, plus HST. Cost of inventory was $2,775. Transactions 15 Sold merchandise for cash, $3,700, plus HST. Cost of inventory was $2,775. 15 Received payment from Holly Co., invoice No. 2 (less returned merchandise), less discount. 18 Bill Burton paid invoice No. 1. 18 Sold toy merchandise to Amy Rose on account, \$3,700, plus HST. Invoice No. 4, terms 3/10, n/30. Cost of inventory was $2,775. 19 Purchased delivery truck on account from Sam Katz's Garage, \$2,900, plus HST. Invoice No. 111, dated October 19 (no discount). 22 Sold to Bill Burton merchandise on account, $1,100, plus HST. Invoice No. 5, terms 3/10,n/30. Cost of inventory was $825. 22 Paid Adam Co. balance owed, cheque No. 5. 22 Sold toy merchandise on account to Amy Rose, $1,400, plus HST. Invoice No. 6, terms 3/10, n/30. Cost of inventory was $1,050. 25 Purchased toy merchandise, $1,100, plus HST. Cheque No. 6. 26 Purchased toy merchandise from Woody Smith on account, \$5,300, plus HST. Invoice No. 211, dated October 26, terms 3/10,n/30 26 Bill Burton paid invoice No. 5, dated October 22. 26 Amy Rose paid invoice No. 6, dated October 22. 28 Andrea invested an additional $4,000 in the business. 28 Purchased merchandise from Maggie Co., $1,100, plus HST. Invoice No. 436, dated October 26 , terms 3/10, n/30 29 Paid Maggie Co., invoice No. 436, cheque No. 7. 29 Sold merchandise to Bonnie Flow Company on account, $3,300, plus HST. Invoice No. 7 , terms 3/10, n/30. Cost of inventory was $2,475. HST rate is 13%. zero.) Andrea's Toy House Cash Receipts Journal Page 14 Date a. and c. Journalize the transactions for the month of October. Total, rule, and cross-add the journals. When entering transactions on the same date, enter the transactions in the order found in the question. Journalize the transactions into the purchases journal. (Use a "T" where a check mark would normally be placed for posting references. If a box is not used in the entry, leave the box empty; do not enter a zero.) b. Record in subsidiary ledgers, and post to the general ledger as appropriate. Start by recording to the accounts receivable subsidiary ledger. (Use a "T" where a check mark would normally be place normal side of the account. Round your answers to the nearest whole dollar.) d. Prepare a schedule of accounts receivable and a schedule of accounts payable, as of October 31, 2022. Start by preparing the schedule of accounts receivable. (For accounts with a $0 balance, make sure to enter "0" in the appropriate cell.) Next prepare the schedule of accounts payable. (For accounts with a $0 balance, make sure to enter "0" in the appropriate cell.)