this is already completed but i would appreciate if someone could check my work

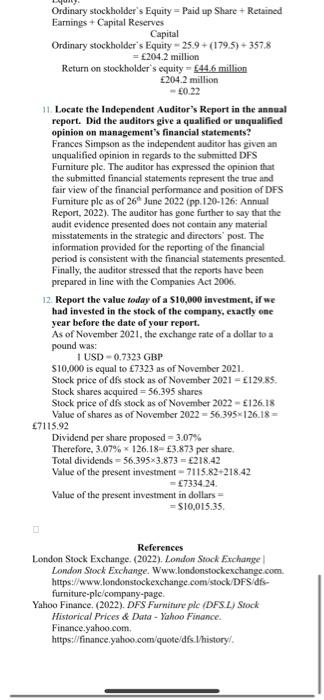

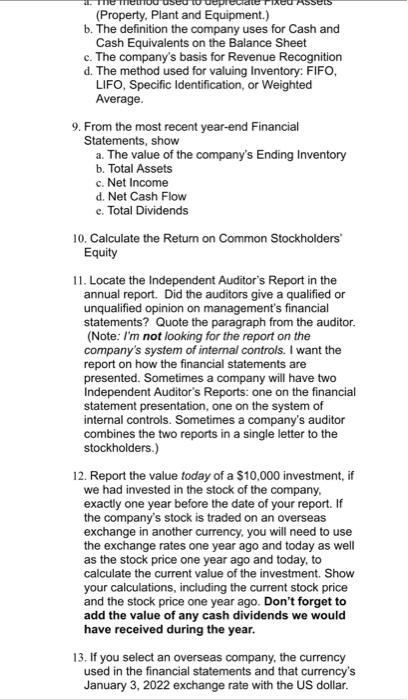

Part 1. Company selection: Select a publicly traded company that has an inventory account on its balance sheet. This means that you cannot pick a financial institution or a company that is exclusively in a service business. It must be a merchandising or manufacturing business. Look at the company's balance sheet to check before submitting your selection. A 25\% bonus will be added to your project score if you select a company headquartered outside the United States that prepares its financial statements using another set of financial standards, not U.S. GAAP. The company must prepare its statements in a foreign currency, not USS, and its shares must be traded on an overseas stock exchange. Do not choose a company listed in the current U.S. Fortune 500 or the Fortune Global 500. (Google the Fortune 500 and Fortune Global 500 listings before submitting.) I will not grade your project if it is a Fortune Global 500 company. You will need access to the full audited annual report issued by the company itself and you will need to tell me the URL where I can see it also. The URL must be on a website administered by the company itself. It will probably have companyname.com as part of the address. Make sure you have access to the full report, complete with the Independent Auditor's Report, the Management Discussion and Analysis, and all the Notes to the Financial Statements. Don't use quarterly reports; they aren't audited.) You are responsible for checking that your company meets these requirements If the company you want to select does not meet all the above requirements, choose another company. At the end of Q1 2022, the total number of publicly listed companies worldwide stood at 58,200. I will not check that the company meets the requirements until I grade the project after the due date You should not limit your selection to larger companies. Smaller companies are often extremely interesting. Upload in Canvas an MS Word file no later than November 18, 2022, containing the following information: 1. Company name and the type of business or industrv. 7. Identify the accounting standards used for the company's annual report. Quote the sentence(s) in the annual report you used to determine this and give the page number in the report. (Hint: Look for something like "These financial statements were prepared according to accounting principles generally accepted in ..." or a similar statement. You will probably find it in the Report of the Independent Auditor.) 8. From reading the Notes to the Financial Statements, identify the following and cite the page number in the report: a. The method used to depreciate Fixed Assets (Property, Plant and Equipment.) b. The definition the company uses for Cash and Cash Equivalents on the Balance Sheet c. The company's basis for Revenue Recognition d. The method used for valuing Inventory: FIFO, LIFO, Specific Identification, or Weighted Average. 9. From the most recent year-end Financial Statements, show a. The value of the company's Ending Inventory b. Total Assets c. Net Income d. Net Cash Flow e. Total Dividends 10. Calculate the Return on Common Stockholders' Equity 11. Locate the Independent Auditor's Report in the annual report. Did the auditors give a qualified or unqualified opinion on management's financial statements? Quote the paragraph from the auditor. (Note: I'm not looking for the report on the (Property, Plant and Equipment.) b. The definition the company uses for Cash and Cash Equivalents on the Balance Sheet c. The company's basis for Revenue Recognition d. The method used for valuing Inventory: FIFO, LIFO, Specific Identification, or Weighted Average. 9. From the most recent year-end Financial Statements, show a. The value of the company's Ending Inventory b. Total Assets c. Net Income d. Net Cash Flow e. Total Dividends 10. Calculate the Retum on Common Stockholders' Equity 11. Locate the Independent Auditor's Report in the annual report. Did the auditors give a qualified or unqualified opinion on management's financial statements? Quote the paragraph from the auditor. (Note: I'm not looking for the report on the company's system of intemal controls. I want the report on how the financial statements are presented. Sometimes a company will have two Independent Auditor's Reports: one on the financial statement presentation, one on the system of internal controls. Sometimes a company's auditor combines the two reports in a single letter to the stockholders.) 12. Report the value today of a $10,000 investment, if we had invested in the stock of the company. exactly one year before the date of your report. If the company's stock is traded on an overseas exchange in another currency, you will need to use the exchange rates one year ago and today as well as the stock price one year ago and today, to calculate the current value of the investment. Show your calculations, including the current stock price and the stock price one year ago. Don't forget to add the value of any cash dividends we would have received during the year. 13. If you select an overseas company, the currency used in the financial statements and that currency's January 3, 2022 exchange rate with the US dollar. 1. Company name and the type of business or industry. The company name for analysis is DFS Furniture ple and which is a merchandize business. The company is the biggest retailer of sofas in the UK and recently the company is venturing into mattresses and beds market. 2. The name of the Stock Exchange on which its shares are traded. DFS Fumiture ple is a publicly traded company listed in the London stock exchange. The company has an average share price of 126.18 as shown by Yahoo Finance. The 2022 annual report has not listed the market capitalization of DFS Furniture. However, London stock exchange, 2022 reveals that the company had a market capitalization of 301 million as of November 2022. 3. The company's Ticker symbol on that exchange. DFS Fumiture ticker symbol is stylized as "dfs" as traded in the London stock exchange. Investors and traders identify DFS Furniture's shares using this symbol when placing orders. 4. Location of company headquarters and the name of the CEO. According to the DFS Furniture Annual Report, 2022 DFS Fumiture plc is a company which was incorporated and located in the United Kingdom under the company number-07236769. The registered head office is stationed in Rockingham Way, Redhouse Interchange, Adwick-LeStreet, Doncaster, South Yorkshire. The company was founded in 1969, as a sofa specialist and soft furnishings. Up to date the company is the largest retailer if sofa in the UK with 118 showrooms in the UK and the Republic of Ireland as highlighted on page 5 of the annual report, 2021. Tim Stacey took over as the CEO of DFS Furniture ple from 2018. The CEO has briefly outlined the outlined the strategies of the company to lead in the retailing of furniture in digital age and continued investment in DFS and Sofology retail pillars and the company's new expansion into Home retail pillar, a focus on mattresses and beds market. 5. The date of the company's most recent published annual report. DFS Fumiture ple most recent published annual report contains information about 2022 financial year which is divided into 3 reports namely; the strategic report, governance report and financial statements. The strategic report highlights the company's focus to lead in the retailing of sofa in the digital age (pp.19-75) The governance report provides a detailed introduction of the company's directors, the activities of the Board and committees of the board (pp 76-127: Annual report, 2022). ple details and financial performance and position as at 275 June 2022 (pp.128-165; Annual report, 2022). 6. The URL on the company's own website. DFS Furniture Ple Annual Report can be viewed or downloaded from the following URL. 7. Identify the accounting standards used for the company's annual report. The independent auditor of the company is Frances Simpson who acts for and on behalf of KPMG LLP. On the auditor's report, paragraph 1 (pp, 120-126: Annual report, 2022) the auditor has expressed opinion on the standards used by DFS Furniture ple in preparing financial statements whereby; The financial statements have been prepared in accordance with UK-LAS. Furthermore, the Grosep financial statements have also been prepared in accordance with accounting standards in the UK, in inclusion to FRS 101 Reduced Disclosure Framework. In addition, the financial statements have been prepared in line to the Companies' Act of 2006 requirements. 8. From readiag the Notes to the Financial Statements, identify the following and cite the page number in the report: a The method used to depreciate Fixed Assets (Property, Plant and Equipment.) On page 135 of DFS Furniture ple 2022 annual teport, the depreciation charged on the income statement is calculated using the straight line basis in estimation of the useful life of parts of plant, property and equipment. Buildings, plant and equipment and motot vehicles have useful lives of 50 years, 3 - 10 years and 4 years respectively. Rights of use of assets are measured at primary carrying value less depreciation calculated on straight-line basis from the beginning to the end of the lease term. The definition the company uses for Cash and Cash Equivalents on the Balance Sheet. On page 136 of the company's 2022 annual report cash and cash equivalents are defined to comprise call deposits and eash balances. Furthermore, it is worth noting that bank overdrafts have been included 25 part of cash and eash equivalents when preparing the consolidated cash flow statement for the financial year cnding on June 262022. The company's basis for Revenue Recognition. Revenue is calculated at its fair value of the receivable consideration after provision of goods to the company's customers. Consideration in the hereby case is the total monies payable by customers less value added tax and tax on sales, cost of interest free credit and the amounts payable to third-parties in relation to products where the group has acted as an agent. Revenues gained when the group acts as an agent are recognized as net free by the group. consolidated cash flow statement for the financial year ending on June 262022 The company's basis for Revenue Recognition. Revenue is calculated at its fair value of the receivable consideration after provision of goods to the company's customers. Consideration in the hereby case is the total monies payable by customers less value added tax and tax on sales, cost of interest free credit and the amounts payable to third-parties in relation to products where the group has acted as an agent. Revenues gained when the group acts as an agent are recognized as net free by the group. Revenues and gross sales are only recognized when the goods are delivered to the intended customer and the costs and revenues relating to that particular transactions are measured reliably and the collectability of the so funds is assured (pp.133-134: Annual Rejort, 2022). 1 The method used for valuing Inventory: FIFO, LIFO, Specific Identification, or Weighted Average. The company's inventory is stated at the lower of cost and net realizable value. Direct materials, appropriate expenditures in overheads and direct labor comprise of the cost of manufactured finished goods. Net realizable value of inventory us made in reference to the similar items sold in the past taking into account the expected opportunities from sale. 9. From the most recent year-end Financial Statements, show The value of the company's Ending Inventory 64,400,000 Total Assets 1,119,900,000 Net Income 44,600,000 1. Net Cash Flow 5,000,000 Total Dividends 53,800,0000 10. Calculate the Return on Common Stockholders" Equity. Retum on stockholder's equity = Net nrofit after tax0 and Preference dividends Equity. Ordinary stockholder's Equity = Paid up Share + Retained Earnings + Capital Reserves Capital Ordinary stockholder' $ Equity =25.9+(179.5)+357.8 =E204.2 million Return on stockholder's equity =44.6million 204.2million 204.2 million 50.22 11. Locate the Independent Auditor's Report in the annual report. Did the auditors give a qualified or unqualified opinion on management's financial statements? Ordinary stockholder's Equity = Paid up Share + Retained Earnings + Capital Reserves Capital Ordinary stockholder's Equity =25.9+(179.5)+357.8 =204.2 million Retum on stockholder's equity = 44.6 million 204.2 million =5022 11. Locate the Independent Auditor's Report in the anneal report. Did the auditors give a qualified or unqualified opinion on management's financial statements? Frances Simpson as the independent auditor has given an unqualified opinion in regards to the submitted DFS Furniture ple. The auditor has expressed the opinion that the submitted financial statements represent the true and fair view of the financial performance and position of DFS Furniture ple as of 26 June 2022(pp.120126 : Annual Report, 2022). The auditor has gone further to say that the audit evidence presented does not contain any material misstatements in the strategic and directors" post. The information provided for the reporting of the financial period is consistent with the financial statements presented. Finally, the auditor stressed that the reports have been prepared in line with the Companies Act 2006. 12. Report the value today of a $10,000 investment, if we had invested in the stock of the company, esactly one year before the date of your repert. As of November 2021, the exchange rate of a dollar to a pound was: I USD =0.7323GBP $10,000 is cqual to 7323 as of November 2021 . Stock price of dfs stock as of November 2021=129.85. Stock shares acquired =56.395 shares Stock price of dfs stock as of November 2022=126.18 Value of shares as of November 2022=56.395126.18= {7115.92 Dividend per share proposed =3.07% Therefore, 3.07% * 126,18=3.873 per share. Total dividends =56.3953.873=218.42 Value of the present investment =7115.82+218.42 =7334.24. Value of the present investment in dollars = =$10.015.35. References London Stock Exchange. (2022), London Stock Exchange London Stock Exchange. Www.londonstockexchange.com. https:// www.londonstockexchange.com/stock/DFS/dfsfurniture-plcicompany-page. Yahoo Finance. (2022). DFS Furniture ple (DFS. L.) Stock Historical Prices \& Data - Yahoo Finance. Finance.yahoo.com. https://finance. yahoo.com/quote/dfs//history/. Part 1. Company selection: Select a publicly traded company that has an inventory account on its balance sheet. This means that you cannot pick a financial institution or a company that is exclusively in a service business. It must be a merchandising or manufacturing business. Look at the company's balance sheet to check before submitting your selection. A 25\% bonus will be added to your project score if you select a company headquartered outside the United States that prepares its financial statements using another set of financial standards, not U.S. GAAP. The company must prepare its statements in a foreign currency, not USS, and its shares must be traded on an overseas stock exchange. Do not choose a company listed in the current U.S. Fortune 500 or the Fortune Global 500. (Google the Fortune 500 and Fortune Global 500 listings before submitting.) I will not grade your project if it is a Fortune Global 500 company. You will need access to the full audited annual report issued by the company itself and you will need to tell me the URL where I can see it also. The URL must be on a website administered by the company itself. It will probably have companyname.com as part of the address. Make sure you have access to the full report, complete with the Independent Auditor's Report, the Management Discussion and Analysis, and all the Notes to the Financial Statements. Don't use quarterly reports; they aren't audited.) You are responsible for checking that your company meets these requirements If the company you want to select does not meet all the above requirements, choose another company. At the end of Q1 2022, the total number of publicly listed companies worldwide stood at 58,200. I will not check that the company meets the requirements until I grade the project after the due date You should not limit your selection to larger companies. Smaller companies are often extremely interesting. Upload in Canvas an MS Word file no later than November 18, 2022, containing the following information: 1. Company name and the type of business or industrv. 7. Identify the accounting standards used for the company's annual report. Quote the sentence(s) in the annual report you used to determine this and give the page number in the report. (Hint: Look for something like "These financial statements were prepared according to accounting principles generally accepted in ..." or a similar statement. You will probably find it in the Report of the Independent Auditor.) 8. From reading the Notes to the Financial Statements, identify the following and cite the page number in the report: a. The method used to depreciate Fixed Assets (Property, Plant and Equipment.) b. The definition the company uses for Cash and Cash Equivalents on the Balance Sheet c. The company's basis for Revenue Recognition d. The method used for valuing Inventory: FIFO, LIFO, Specific Identification, or Weighted Average. 9. From the most recent year-end Financial Statements, show a. The value of the company's Ending Inventory b. Total Assets c. Net Income d. Net Cash Flow e. Total Dividends 10. Calculate the Return on Common Stockholders' Equity 11. Locate the Independent Auditor's Report in the annual report. Did the auditors give a qualified or unqualified opinion on management's financial statements? Quote the paragraph from the auditor. (Note: I'm not looking for the report on the (Property, Plant and Equipment.) b. The definition the company uses for Cash and Cash Equivalents on the Balance Sheet c. The company's basis for Revenue Recognition d. The method used for valuing Inventory: FIFO, LIFO, Specific Identification, or Weighted Average. 9. From the most recent year-end Financial Statements, show a. The value of the company's Ending Inventory b. Total Assets c. Net Income d. Net Cash Flow e. Total Dividends 10. Calculate the Retum on Common Stockholders' Equity 11. Locate the Independent Auditor's Report in the annual report. Did the auditors give a qualified or unqualified opinion on management's financial statements? Quote the paragraph from the auditor. (Note: I'm not looking for the report on the company's system of intemal controls. I want the report on how the financial statements are presented. Sometimes a company will have two Independent Auditor's Reports: one on the financial statement presentation, one on the system of internal controls. Sometimes a company's auditor combines the two reports in a single letter to the stockholders.) 12. Report the value today of a $10,000 investment, if we had invested in the stock of the company. exactly one year before the date of your report. If the company's stock is traded on an overseas exchange in another currency, you will need to use the exchange rates one year ago and today as well as the stock price one year ago and today, to calculate the current value of the investment. Show your calculations, including the current stock price and the stock price one year ago. Don't forget to add the value of any cash dividends we would have received during the year. 13. If you select an overseas company, the currency used in the financial statements and that currency's January 3, 2022 exchange rate with the US dollar. 1. Company name and the type of business or industry. The company name for analysis is DFS Furniture ple and which is a merchandize business. The company is the biggest retailer of sofas in the UK and recently the company is venturing into mattresses and beds market. 2. The name of the Stock Exchange on which its shares are traded. DFS Fumiture ple is a publicly traded company listed in the London stock exchange. The company has an average share price of 126.18 as shown by Yahoo Finance. The 2022 annual report has not listed the market capitalization of DFS Furniture. However, London stock exchange, 2022 reveals that the company had a market capitalization of 301 million as of November 2022. 3. The company's Ticker symbol on that exchange. DFS Fumiture ticker symbol is stylized as "dfs" as traded in the London stock exchange. Investors and traders identify DFS Furniture's shares using this symbol when placing orders. 4. Location of company headquarters and the name of the CEO. According to the DFS Furniture Annual Report, 2022 DFS Fumiture plc is a company which was incorporated and located in the United Kingdom under the company number-07236769. The registered head office is stationed in Rockingham Way, Redhouse Interchange, Adwick-LeStreet, Doncaster, South Yorkshire. The company was founded in 1969, as a sofa specialist and soft furnishings. Up to date the company is the largest retailer if sofa in the UK with 118 showrooms in the UK and the Republic of Ireland as highlighted on page 5 of the annual report, 2021. Tim Stacey took over as the CEO of DFS Furniture ple from 2018. The CEO has briefly outlined the outlined the strategies of the company to lead in the retailing of furniture in digital age and continued investment in DFS and Sofology retail pillars and the company's new expansion into Home retail pillar, a focus on mattresses and beds market. 5. The date of the company's most recent published annual report. DFS Fumiture ple most recent published annual report contains information about 2022 financial year which is divided into 3 reports namely; the strategic report, governance report and financial statements. The strategic report highlights the company's focus to lead in the retailing of sofa in the digital age (pp.19-75) The governance report provides a detailed introduction of the company's directors, the activities of the Board and committees of the board (pp 76-127: Annual report, 2022). ple details and financial performance and position as at 275 June 2022 (pp.128-165; Annual report, 2022). 6. The URL on the company's own website. DFS Furniture Ple Annual Report can be viewed or downloaded from the following URL. 7. Identify the accounting standards used for the company's annual report. The independent auditor of the company is Frances Simpson who acts for and on behalf of KPMG LLP. On the auditor's report, paragraph 1 (pp, 120-126: Annual report, 2022) the auditor has expressed opinion on the standards used by DFS Furniture ple in preparing financial statements whereby; The financial statements have been prepared in accordance with UK-LAS. Furthermore, the Grosep financial statements have also been prepared in accordance with accounting standards in the UK, in inclusion to FRS 101 Reduced Disclosure Framework. In addition, the financial statements have been prepared in line to the Companies' Act of 2006 requirements. 8. From readiag the Notes to the Financial Statements, identify the following and cite the page number in the report: a The method used to depreciate Fixed Assets (Property, Plant and Equipment.) On page 135 of DFS Furniture ple 2022 annual teport, the depreciation charged on the income statement is calculated using the straight line basis in estimation of the useful life of parts of plant, property and equipment. Buildings, plant and equipment and motot vehicles have useful lives of 50 years, 3 - 10 years and 4 years respectively. Rights of use of assets are measured at primary carrying value less depreciation calculated on straight-line basis from the beginning to the end of the lease term. The definition the company uses for Cash and Cash Equivalents on the Balance Sheet. On page 136 of the company's 2022 annual report cash and cash equivalents are defined to comprise call deposits and eash balances. Furthermore, it is worth noting that bank overdrafts have been included 25 part of cash and eash equivalents when preparing the consolidated cash flow statement for the financial year cnding on June 262022. The company's basis for Revenue Recognition. Revenue is calculated at its fair value of the receivable consideration after provision of goods to the company's customers. Consideration in the hereby case is the total monies payable by customers less value added tax and tax on sales, cost of interest free credit and the amounts payable to third-parties in relation to products where the group has acted as an agent. Revenues gained when the group acts as an agent are recognized as net free by the group. consolidated cash flow statement for the financial year ending on June 262022 The company's basis for Revenue Recognition. Revenue is calculated at its fair value of the receivable consideration after provision of goods to the company's customers. Consideration in the hereby case is the total monies payable by customers less value added tax and tax on sales, cost of interest free credit and the amounts payable to third-parties in relation to products where the group has acted as an agent. Revenues gained when the group acts as an agent are recognized as net free by the group. Revenues and gross sales are only recognized when the goods are delivered to the intended customer and the costs and revenues relating to that particular transactions are measured reliably and the collectability of the so funds is assured (pp.133-134: Annual Rejort, 2022). 1 The method used for valuing Inventory: FIFO, LIFO, Specific Identification, or Weighted Average. The company's inventory is stated at the lower of cost and net realizable value. Direct materials, appropriate expenditures in overheads and direct labor comprise of the cost of manufactured finished goods. Net realizable value of inventory us made in reference to the similar items sold in the past taking into account the expected opportunities from sale. 9. From the most recent year-end Financial Statements, show The value of the company's Ending Inventory 64,400,000 Total Assets 1,119,900,000 Net Income 44,600,000 1. Net Cash Flow 5,000,000 Total Dividends 53,800,0000 10. Calculate the Return on Common Stockholders" Equity. Retum on stockholder's equity = Net nrofit after tax0 and Preference dividends Equity. Ordinary stockholder's Equity = Paid up Share + Retained Earnings + Capital Reserves Capital Ordinary stockholder' $ Equity =25.9+(179.5)+357.8 =E204.2 million Return on stockholder's equity =44.6million 204.2million 204.2 million 50.22 11. Locate the Independent Auditor's Report in the annual report. Did the auditors give a qualified or unqualified opinion on management's financial statements? Ordinary stockholder's Equity = Paid up Share + Retained Earnings + Capital Reserves Capital Ordinary stockholder's Equity =25.9+(179.5)+357.8 =204.2 million Retum on stockholder's equity = 44.6 million 204.2 million =5022 11. Locate the Independent Auditor's Report in the anneal report. Did the auditors give a qualified or unqualified opinion on management's financial statements? Frances Simpson as the independent auditor has given an unqualified opinion in regards to the submitted DFS Furniture ple. The auditor has expressed the opinion that the submitted financial statements represent the true and fair view of the financial performance and position of DFS Furniture ple as of 26 June 2022(pp.120126 : Annual Report, 2022). The auditor has gone further to say that the audit evidence presented does not contain any material misstatements in the strategic and directors" post. The information provided for the reporting of the financial period is consistent with the financial statements presented. Finally, the auditor stressed that the reports have been prepared in line with the Companies Act 2006. 12. Report the value today of a $10,000 investment, if we had invested in the stock of the company, esactly one year before the date of your repert. As of November 2021, the exchange rate of a dollar to a pound was: I USD =0.7323GBP $10,000 is cqual to 7323 as of November 2021 . Stock price of dfs stock as of November 2021=129.85. Stock shares acquired =56.395 shares Stock price of dfs stock as of November 2022=126.18 Value of shares as of November 2022=56.395126.18= {7115.92 Dividend per share proposed =3.07% Therefore, 3.07% * 126,18=3.873 per share. Total dividends =56.3953.873=218.42 Value of the present investment =7115.82+218.42 =7334.24. Value of the present investment in dollars = =$10.015.35. References London Stock Exchange. (2022), London Stock Exchange London Stock Exchange. Www.londonstockexchange.com. https:// www.londonstockexchange.com/stock/DFS/dfsfurniture-plcicompany-page. Yahoo Finance. (2022). DFS Furniture ple (DFS. L.) Stock Historical Prices \& Data - Yahoo Finance. Finance.yahoo.com. https://finance. yahoo.com/quote/dfs//history/

this is already completed but i would appreciate if someone could check my work

this is already completed but i would appreciate if someone could check my work