Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is an URGENT matter. I wanna know the answer as soon as possible. TRUE or FALSE True/False Indicate whether the statement is true or

This is an URGENT matter.

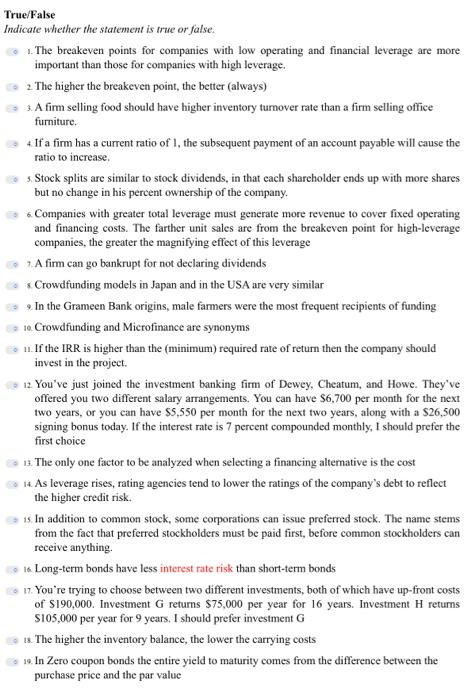

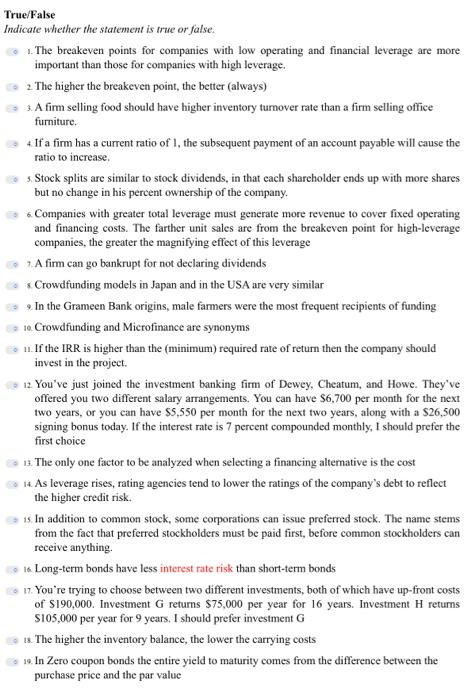

True/False Indicate whether the statement is true or false. 1. The breakeven points for companies with low operating and financial leverage are more important than those for companies with high leverage. 2 The higher the breakeven point, the better (always) 3. A firm selling food should have higher inventory turnover rate than a firm selling office furniture. 4. If a firm has a current ratio of 1 , the subsequent payment of an account payable will cause the ratio to increase. 5. Stock splits are similar to stock dividends, in that each shareholder ends up with more shares but no change in his percent ownership of the company. 6. Companies with greater total leverage must generate more revenue to cover fixed operating and financing costs. The farther unit sales are from the breakeven point for high-leverage companies, the greater the magnifying effect of this leverage 7. A firm can go bankrupt for not declaring dividends s. Crowdfunding models in Japan and in the USA are very similar 9. In the Grameen Bank origins, male farmers were the most frequent recipients of funding 10. Crowdfunding and Microfinance are synonyms i. If the IRR is higher than the (minimum) required rate of return then the company should invest in the project. 12. You've just joined the investment banking firm of Dewey, Cheatum, and Howe. They've offered you two different salary arrangements. You can have $6,700 per month for the next two years, or you can have $5,550 per month for the next two years, along with a $26,500 signing bonus today. If the interest rate is 7 percent compounded monthly, I should prefer the first choice 13. The only one factor to be analyzed when selecting a financing alternative is the cost 14. As leverage rises, rating agencies tend to lower the ratings of the company's debt to reflect the higher credit risk. 15. In addition to common stock, some corporations can issue preferred stock. The name stems from the fact that preferred stockholders must be paid first, before common stockholders can receive anything. 16. Long-term bonds have less interest rate risk than short-term bonds 17. You're trying to choose between two different investments, both of which have up-front costs of $190,000. Investment G returns $75,000 per year for 16 years. Investment H returns S105,000 per year for 9 years. I should prefer investment G is. The higher the inventory balance, the lower the carrying costs 10. In Zero coupon bonds the entire yield to maturity comes from the difference between the purchase price and the par value I wanna know the answer as soon as possible.

TRUE or FALSE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started