Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is Auditing. Please complete fully all requirements below, and explain detail. Also provide me the answers ASAP. Thank you very much!!! 12 points Save

This is Auditing. Please complete fully all requirements below, and explain detail. Also provide me the answers ASAP. Thank you very much!!!

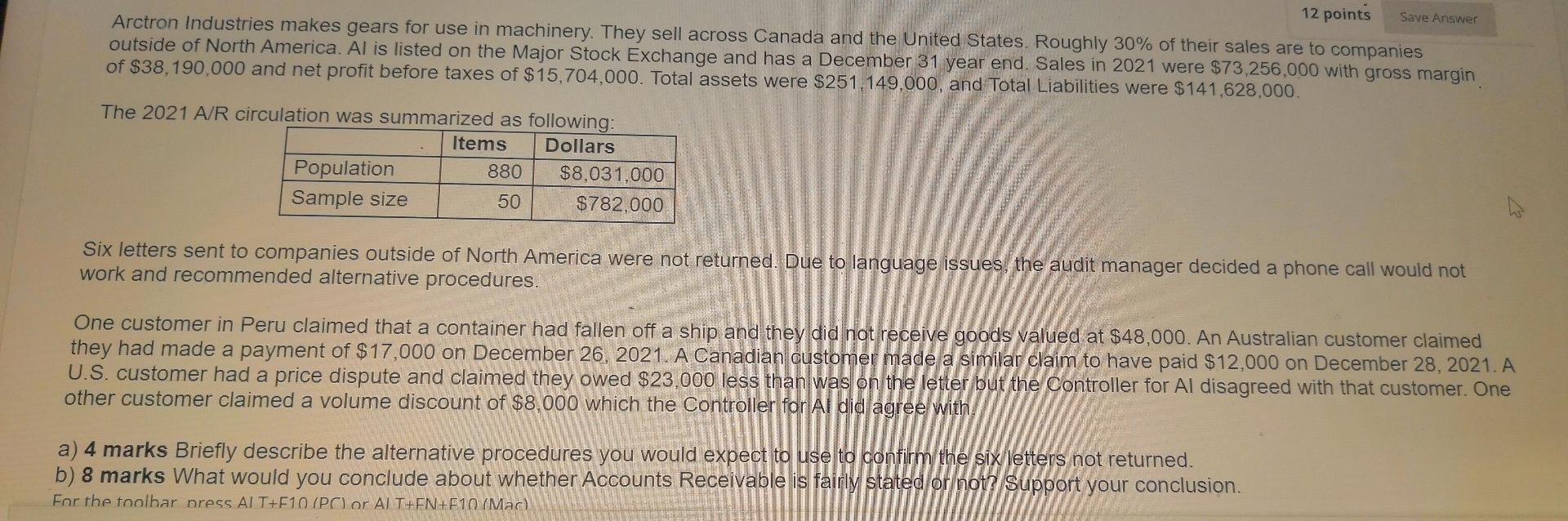

12 points Save Answer Arctron Industries makes gears for use in machinery. They sell across Canada and the United States. Roughly 30% of their sales are to companies outside of North America. Al is listed on the Major Stock Exchange and has a December 31 year end. Sales in 2021 were $73,256,000 with gross margin of $38,190,000 and net profit before taxes of $15,704,000. Total assets were $251,149,000, and Total Liabilities were $141,628,000. The 2021 A/R circulation was summarized as following: Items Dollars Population 880 $8,031,000 Sample size 50 $782,000 Six letters sent to companies outside of North America were not returned. Due to language issues, the audit manager decided a phone call would not work and recommended alternative procedures. One customer in Peru claimed that a container had fallen off a ship and they did not receive goods valued at $48,000. An Australian customer claimed they had made a payment of $17,000 on December 26, 2021. A Canadian customer made a similar claim to have paid $12,000 on December 28, 2021. A U.S. customer had a price dispute and claimed they owed $23,000 less than was on the letter but the Controller for Al disagreed with that customer. One other customer claimed a volume discount of $8,000 which the Controller for Al did agree with a) 4 marks Briefly describe the alternative procedures you would expect to use to confirm the six letters not returned. b) 8 marks What would you conclude about whether Accounts Receivable is fairly stated or not? Support your conclusion. For the toolbar press ALT+F10/PC or ALT+EN+F10 (Mac) 12 points Save Answer Arctron Industries makes gears for use in machinery. They sell across Canada and the United States. Roughly 30% of their sales are to companies outside of North America. Al is listed on the Major Stock Exchange and has a December 31 year end. Sales in 2021 were $73,256,000 with gross margin of $38,190,000 and net profit before taxes of $15,704,000. Total assets were $251,149,000, and Total Liabilities were $141,628,000. The 2021 A/R circulation was summarized as following: Items Dollars Population 880 $8,031,000 Sample size 50 $782,000 Six letters sent to companies outside of North America were not returned. Due to language issues, the audit manager decided a phone call would not work and recommended alternative procedures. One customer in Peru claimed that a container had fallen off a ship and they did not receive goods valued at $48,000. An Australian customer claimed they had made a payment of $17,000 on December 26, 2021. A Canadian customer made a similar claim to have paid $12,000 on December 28, 2021. A U.S. customer had a price dispute and claimed they owed $23,000 less than was on the letter but the Controller for Al disagreed with that customer. One other customer claimed a volume discount of $8,000 which the Controller for Al did agree with a) 4 marks Briefly describe the alternative procedures you would expect to use to confirm the six letters not returned. b) 8 marks What would you conclude about whether Accounts Receivable is fairly stated or not? Support your conclusion. For the toolbar press ALT+F10/PC or ALT+EN+F10 (Mac)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started