Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is chapter 16 E-11 of Intermediate Accounting 2 by the authors Spiceland, Nelson, and Thomas. If deferred asset is normally a credit balance when

This is chapter 16 E-11 of Intermediate Accounting 2 by the authors Spiceland, Nelson, and Thomas.

If deferred asset is normally a credit balance when it is decreased from 30,000,000 to 28,000,000 wouldn't it be debited in the above journal entry instead of credited?

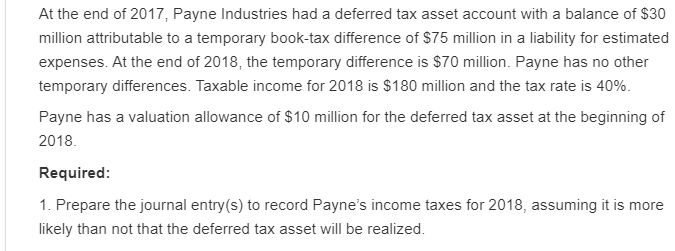

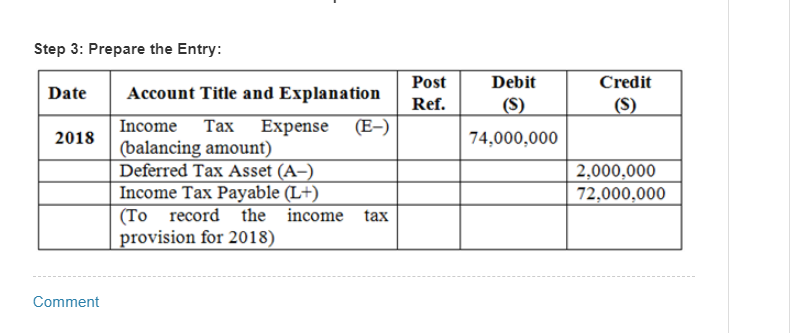

At the end of 2017, Payne Industries had a deferred tax asset account with a balance of $30 million attributable to a temporary book-tax difference of $75 million in a liability for estimated expenses. At the end of 2018, the temporary difference is $70 million. Payne has no other temporary differences. Taxable income for 2018 is $180 million and the tax rate is 40%. Payne has a valuation allowance of $10 million for the deferred tax asset at the beginning of 2018. Required: 1. Prepare the journal entry(s) to record Payne's income taxes for 2018, assuming it is more likely than not that the deferred tax asset will be realized. Step 3: Prepare the Entry: Debit Date Post Ref. Credit (S) (S) 2018 74,000,000 Account Title and Explanation Income Tax Expense (E-) (balancing amount) Deferred Tax Asset (A-) Income Tax Payable (L+) (To record the income tax provision for 2018) 2.000.000 72,000,000 CommentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started