Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is finanacial accouting. Please complete fully the 2 requirements and send me the answers asap. Thank you so much! HITH Plex Corp started its

This is finanacial accouting. Please complete fully the 2 requirements and send me the answers asap. Thank you so much!

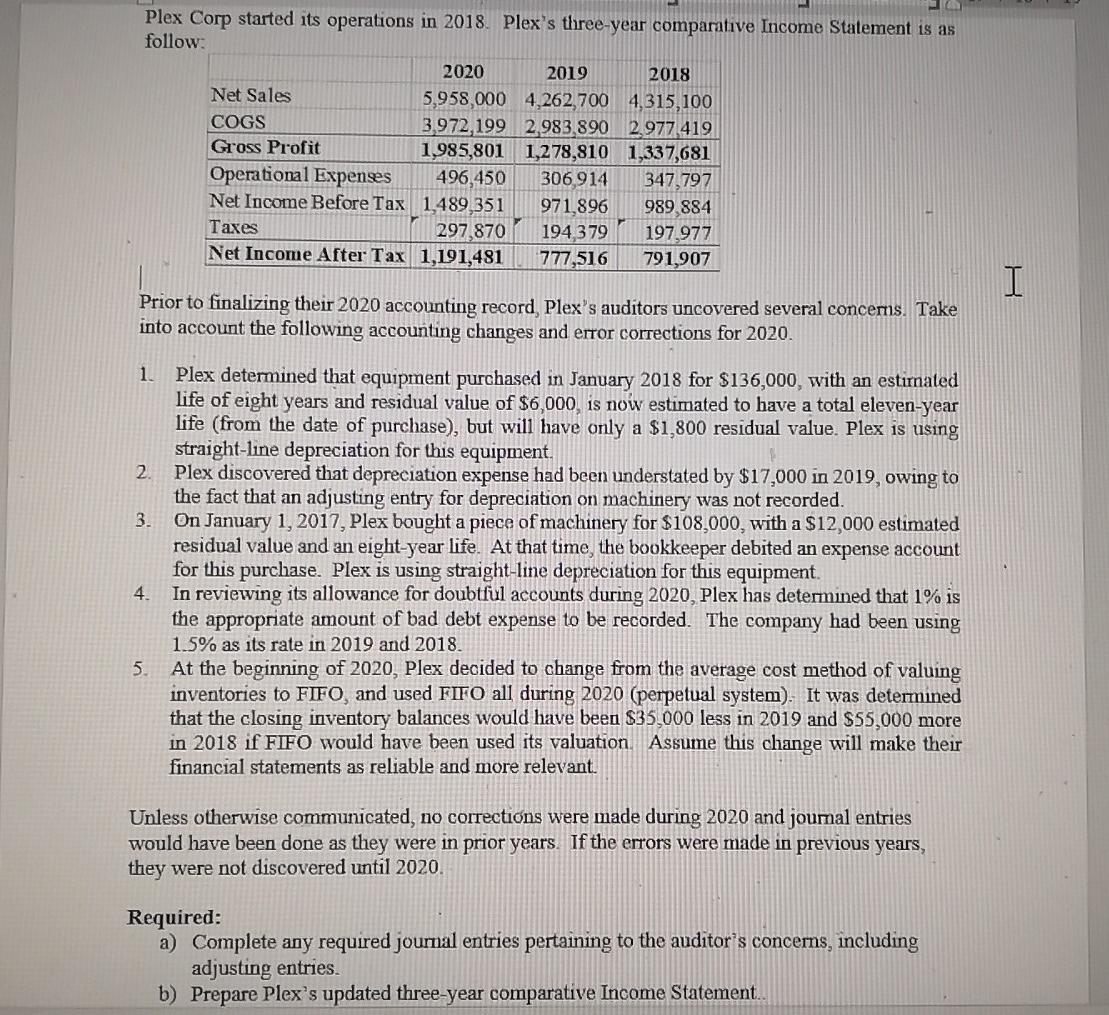

HITH Plex Corp started its operations in 2018 Plex's three-year comparative Income Statement is as follow: 2020 2019 2018 Net Sales 5,958,000 4,262,700 4,315,100 COGS 3,972,199 2.983,890 2.977 419 Gross Profit 1,985,801 1,278,810 1,337,681 Operational Expenses 496,450 306, 914 347.797 Net Income Before Tax 1,489,351 971.896 989 884 Taxes 297 870 194,379 197,977 Net Income After Tax 1,191,481 777,516 791,907 I Prior to finalizing their 2020 accounting record Plex's auditors uncovered several concerns. Take into account the following accounting changes and error corrections for 2020. 1 Plex determined that equipment purchased in January 2018 for $136,000, with an estimated life of eight years and residual value of $6,000, is now estimated to have a total eleven-year life (from the date of purchase), but will have only a $1,800 residual value. Plex is using straight-line depreciation for this equipment. 2. Plex discovered that depreciation expense had been understated by $17,000 in 2019, owing to the fact that an adjusting entry for depreciation on machinery was not recorded. 3. On January 1, 2017, Plex bought a piece of machinery for $108,000, with a $12,000 estimated residual value and an eight-year life. At that time, the bookkeeper debited an expense account for this purchase. Plex is using straight-line depreciation for this equipment. In reviewing its allowance for doubtful accounts during 2020, Plex has determined that 1% is the appropriate amount of bad debt expense to be recorded. The company had been using 1.5% as its rate in 2019 and 2018. 5. At the beginning of 2020, Plex decided to change from the average cost method of valuing inventories to FIFO, and used FIFO all during 2020 (perpetual system). It was determined that the closing inventory balances would have been $35.000 less in 2019 and $55,000 more in 2018 if FIFO would have been used its valuation. Assume this change will make their financial statements as reliable and more relevant. 4. Unless otherwise communicated, no corrections were made during 2020 and joumal entries would have been done as they were in prior years. If the errors were made in previous years, they were not discovered until 2020. Required: a) Complete any required journal entries pertaining to the auditor's concerns, including adjusting entries. b) Prepare Plex's updated three-year comparative Income StatementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started