Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is Financial Accounting. Please complete fully all requirements above. Thank you very much! 4) AT-AT Inc's first ever Loss was recorded in 2020 due

This is Financial Accounting. Please complete fully all requirements above. Thank you very much!

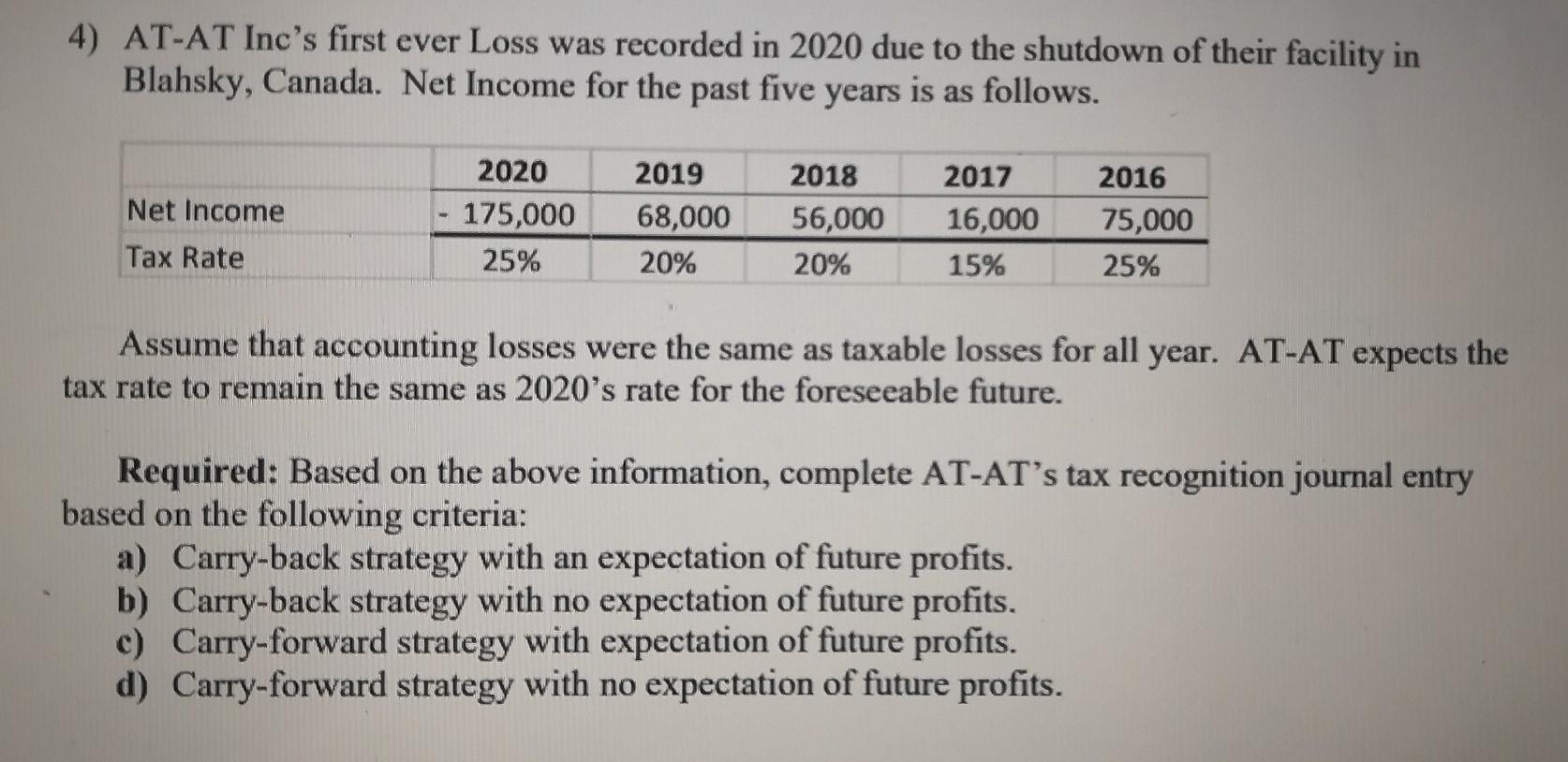

4) AT-AT Inc's first ever Loss was recorded in 2020 due to the shutdown of their facility in Blahsky, Canada. Net Income for the past five years is as follows. Net Income Tax Rate 2020 175,000 25% 2019 68,000 20% 2018 56,000 20% 2017 16,000 15% 2016 75,000 25% Assume that accounting losses were the same as taxable losses for all year. AT-AT expects the tax rate to remain the same as 2020's rate for the foreseeable future. Required: Based on the above information, complete AT-AT's tax recognition journal entry based on the following criteria: a) Carry-back strategy with an expectation of future profits. b) Carry-back strategy with no expectation of future profits. c) Carry-forward strategy with expectation of future profits. d) Carry-forward strategy with no expectation of future profitsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started