Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is for a short paper. I know the answer to the first part. I think I have the right idea for the other 3

This is for a short paper. I know the answer to the first part. I think I have the right idea for the other 3 but I am not 100% sure so I just wanted to get some feedback for what the right answer would be for the last 3 parts.

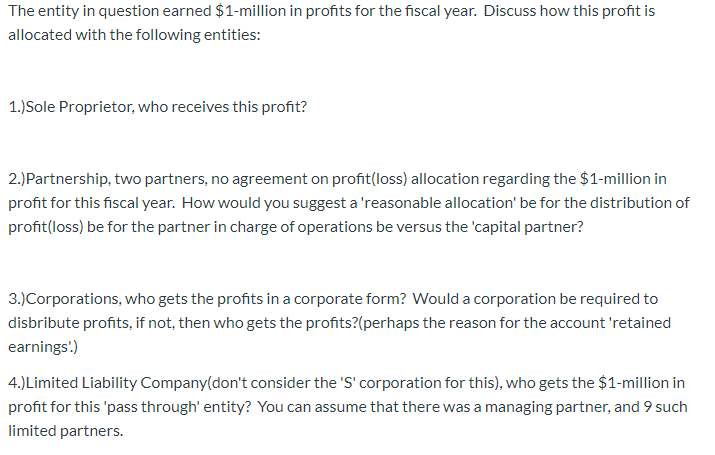

The entity in question earned $1-million in profits for the fiscal year. Discuss how this profit is allocated with the following entities: 1.)Sole Proprietor, who receives this profit? 2.)Partnership, two partners, no agreement on profit(loss) allocation regarding the $1-million in profit for this fiscal year. How would you suggest a 'reasonable allocation' be for the distribution of profit(loss) be for the partner in charge of operations be versus the 'capital partner? 3.)Corporations, who gets the profits in a corporate form? Would a corporation be required to disbribute profits, if not, then who gets the profits?(perhaps the reason for the account 'retained earnings) 4.)Limited Liability Company(don't consider the 'S' corporation for this), who gets the $1-million in profit for this 'pass through' entity? You can assume that there was a managing partner, and 9 such limited partnersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started