Answered step by step

Verified Expert Solution

Question

1 Approved Answer

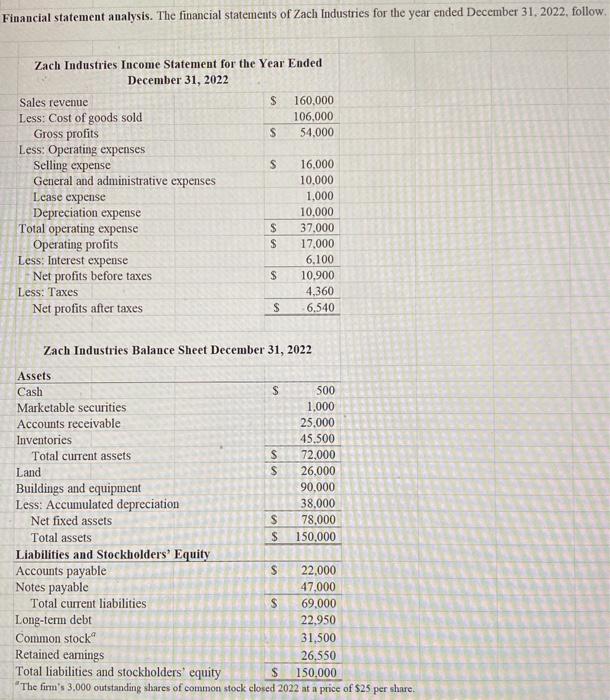

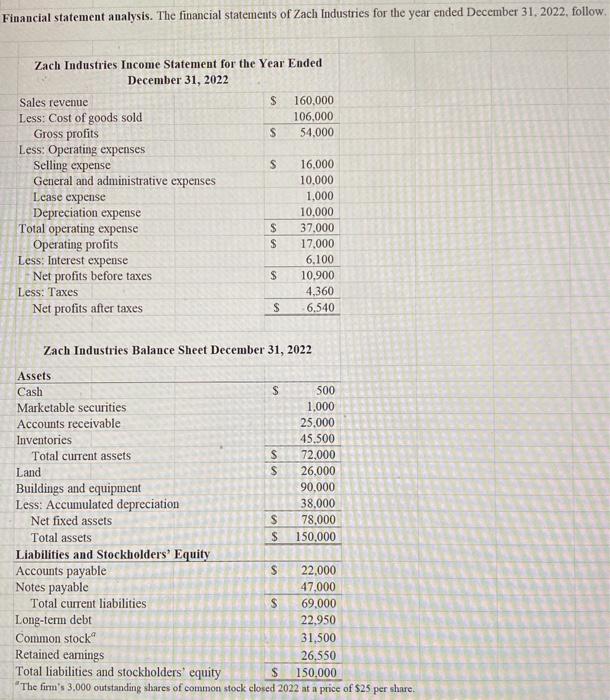

This is for business. Thanks! Financial statement analysis. The financial statements of Zach Industries for the year ended December 31, 2022, follow Zach Industries Balance

This is for business. Thanks!

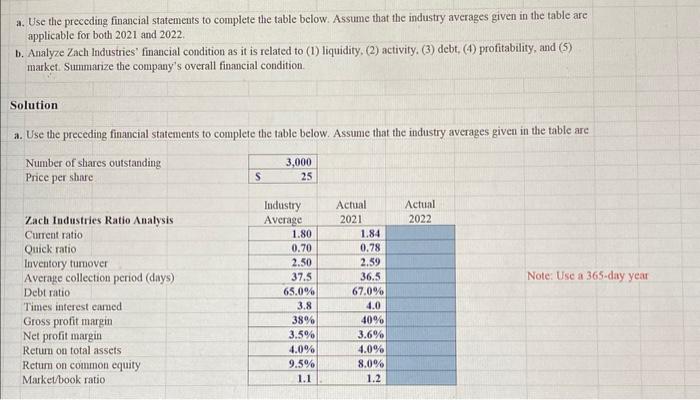

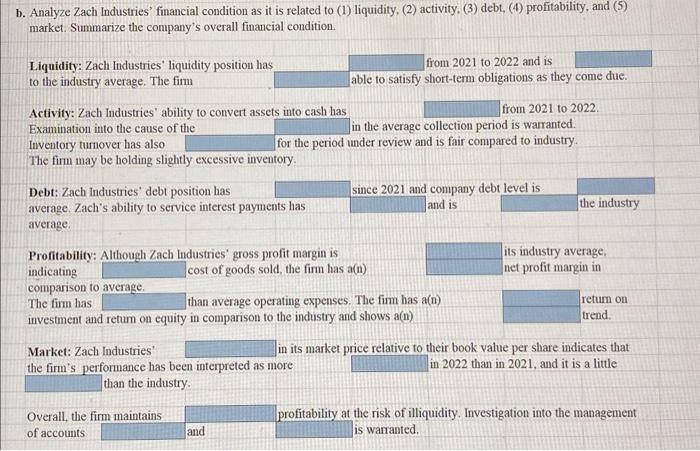

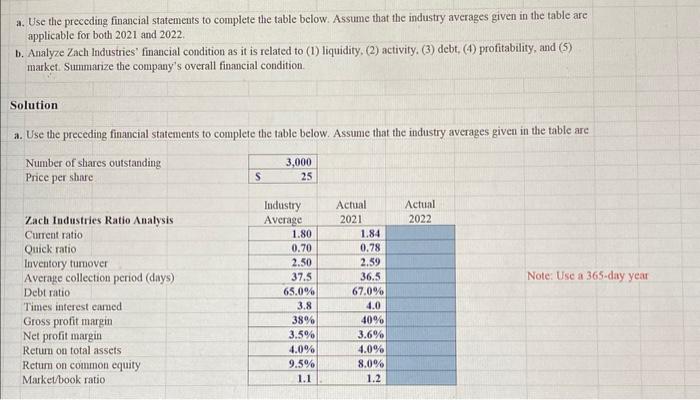

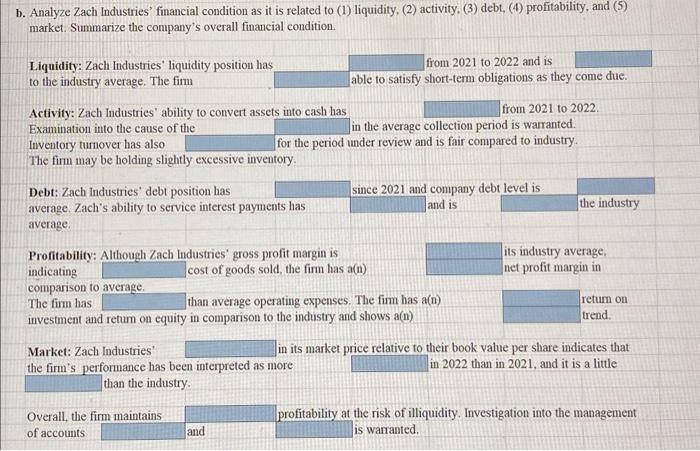

Financial statement analysis. The financial statements of Zach Industries for the year ended December 31, 2022, follow Zach Industries Balance Sheet December 31, 2022 a. Use the preceding financial statements to complete the table below. Assume that the industry averages given in the table are applicable for both 2021 and 2022. b. Analyze Zach Industries' financial condition as it is related to (1) liquidity, (2) activity. (3) debt, (4) profitability, and (5) market. Summarize the company's overall finmcial condition. Solution a. Use the preceding financial statements to complete the table below. Assume that the industry averages given in the table are Note: Use a 365-day yeat b. Analyze Zach Industries' financial condition as it is related to (1) liquidity, (2) activity. (3) debt, (4) profitability, and (5) market. Summarize the company's overall financial condition. Liquidity: Zach Industries' liquidity position has from 2021 to 2022 and is to the industry average. The firm able to satisfy short-tem obligations as they come due. Activity: Zach Industries' ability to convert assets into cash has from 2021 to 2022 . Examination into the cause of thi in the average collection period is warranted. Inventory turnover has also for the period under review and is fair compared to industry. The firm may be holding slightly excessive inventory. Debt: Zach Industries' debt position has since 2021 and company debt level is average. Zach's ability to service interest payments has and is the industry average. Profitability: Although Zach lndustries' gross profit margin is its industry average, indicating cost of goods sold, the firm has a(ii) net profit margin in comparison to average. The firm has than average operating expenses. The firm has a(n) investment and retum on equity in comparison to the industry and shows a(n) retum on Market: Zach Industries' in its market price relative to their book value per share indicates that the firm's performance has been interpreted as more in 2022 than in 2021, and it is a little than the industry. Overall, the firm maintains profitability at the risk of illiquidity. Investigation into the management of accounts and is warranted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started