Answered step by step

Verified Expert Solution

Question

1 Approved Answer

***This is from Investment and Financial Mathematics (IFM) course for Actuaries. Please give handwritten solution with ALL steps shown plus with description because I need

***This is from Investment and Financial Mathematics (IFM) course for Actuaries. Please give handwritten solution with ALL steps shown plus with description because I need to understand the process. I will give "thumbs-up" for clear and correct solution. Thanks in advance!***

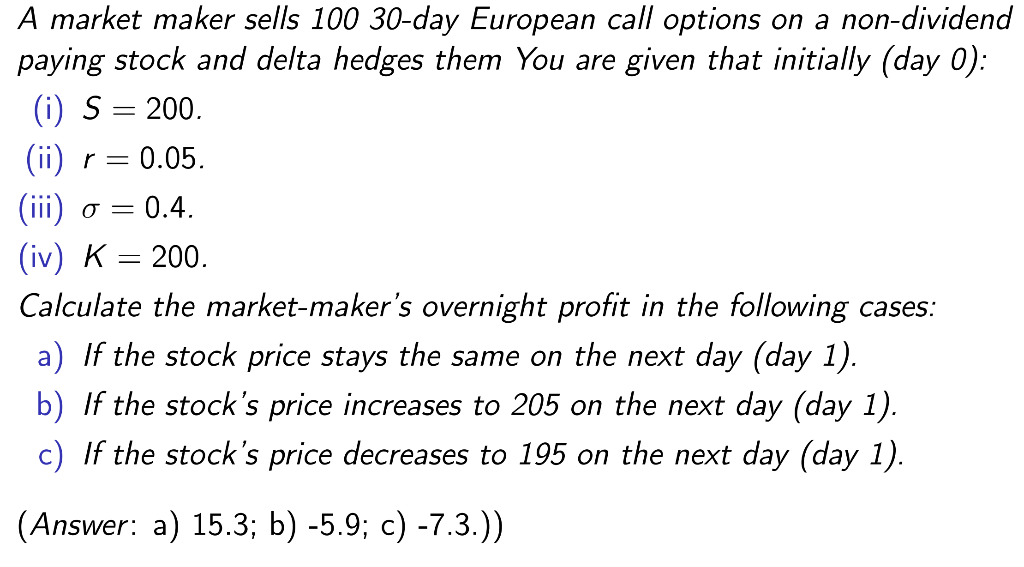

A market maker sells 100 30-day European call options on a non-dividend paying stock and delta hedges them You are given that initially (day 0): (i) S = 200. (ii) r= = 0.05. (iii) or 0.4. (iv) K 200. Calculate the market-maker's overnight profit in the following cases: a) If the stock price stays the same on the next day (day 1). b) If the stock's price increases to 205 on the next day (day 1). c) If the stock's price decreases to 195 on the next day (day 1). (Answer: a) 15.3; b) -5.9; c) -7.3.)) A market maker sells 100 30-day European call options on a non-dividend paying stock and delta hedges them You are given that initially (day 0): (i) S = 200. (ii) r= = 0.05. (iii) or 0.4. (iv) K 200. Calculate the market-maker's overnight profit in the following cases: a) If the stock price stays the same on the next day (day 1). b) If the stock's price increases to 205 on the next day (day 1). c) If the stock's price decreases to 195 on the next day (day 1). (Answer: a) 15.3; b) -5.9; c) -7.3.))

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started