Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What do you see in these 3 top priority issues below of Ford Motor Company that CEO Jim Hackett and his management team to address?

What do you see in these 3 top priority issues below of Ford Motor Company that CEO Jim Hackett and his management team to address? What recommendations would you make to Fords CEO Jim Hackett? At a minimum, your recommendations must address the 34 priority issues identified. (AT least on paragraph for each issue and one paragraph for each recommendation)

Issue #1: Defects in already produced and sold Ford vehicles that cause delays in production of new models

Issue #2: The risk of the Ford Credit Company

Issue #3: The profitability declines

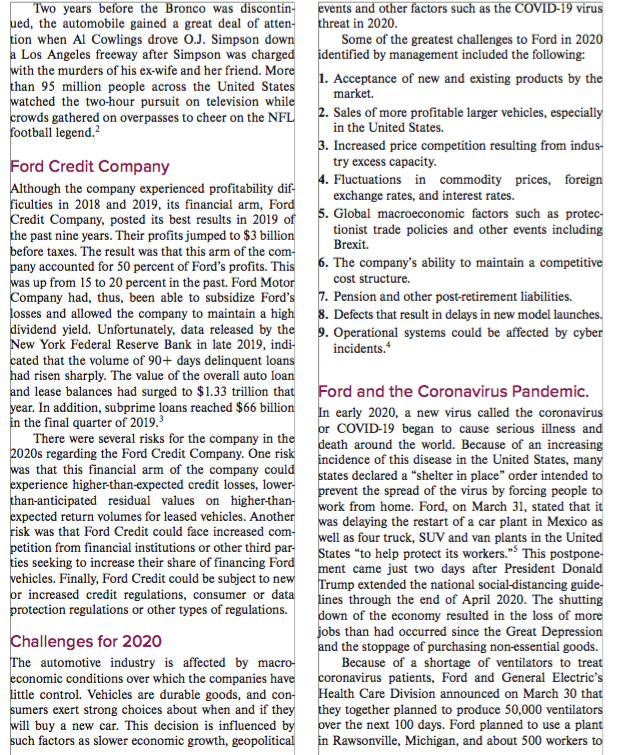

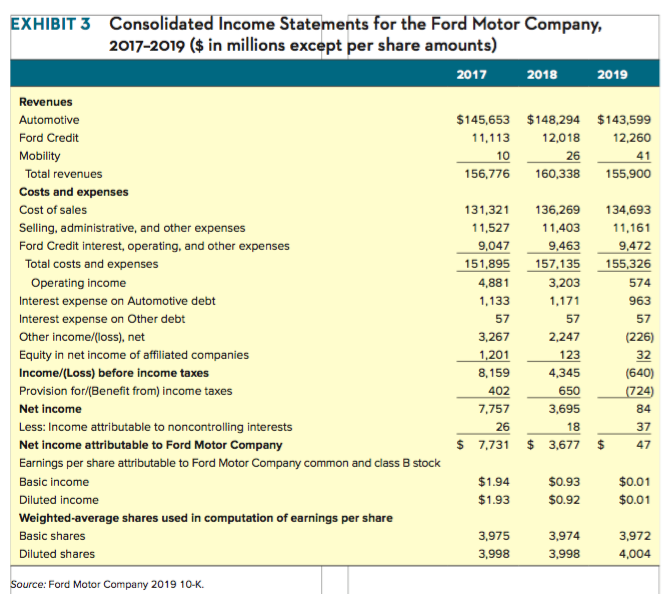

Two years before the Bronco was discontin- events and other factors such as the COVID-19 virus ued, the automobile gained a great deal of atten- threat in 2020. tion when Al Cowlings drove O.J. Simpson down Some of the greatest challenges to Ford in 2020 a Los Angeles freeway after Simpson was charged identified by management included the following: with the murders of his ex-wife and her friend. More than 95 million people across the United States 1. Acceptance of new and existing products by the market watched the two-hour pursuit on television while crowds gathered on overpasses to cheer on the NFL 2. Sales of more profitable larger vehicles, especially football legend.? in the United States. 3. Increased price competition resulting from indus- Ford Credit Company try excess capacity. Although the company experienced profitability dif- 4. Fluctuations in commodity prices, foreign ficulties in 2018 and 2019, its financial arm, Ford exchange rates, and interest rates. Credit Company, posted its best results in 2019 of 5. Global macroeconomic factors such as protec- the past nine years. Their profits jumped to $3 billion tionist trade policies and other events including before taxes. The result was that this arm of the com- Brexit. pany accounted for 50 percent of Ford's profits. This 6. The company's ability to maintain a competitive was up from 15 to 20 percent in the past. Ford Motor cost structure. Company had, thus, been able to subsidize Ford's 7. Pension and other post-retirement liabilities. losses and allowed the company to maintain a high 8. Defects that result in delays in new model launches. dividend yield. Unfortunately, data released by the 9. Operational systems could be affected by cyber New York Federal Reserve Bank in late 2019, indi- incidents. cated that the volume of 90+ days delinquent loans had risen sharply. The value of the overall auto loan and lease balances had surged to $1.33 trillion that Ford and the Coronavirus Pandemic. year. In addition, subprime loans reached $66 billion in early 2020, a new virus called the coronavirus in the final quarter of 2019.3 or COVID-19 began to cause serious illness and There were several risks for the company in the death around the world. Because of an increasing 2020s regarding the Ford Credit Company. One risk was that this financial arm of the company could incidence of this disease in the United States, many experience higher-than-expected credit losses, lower- states declared a "shelter in place order intended to prevent the spread of the virus by forcing people to than-anticipated residual values on higher-than- work from home. Ford, on March 31, stated that it expected return volumes for leased vehicles. Another was delaying the restart of a car plant in Mexico as risk was that Ford Credit could face increased com- well as four truck, SUV and van plants in the United petition from financial institutions or other third par- States to help protect its workers. This postpone- ties seeking to increase their share of financing Ford ment came just two days after President Donald vehicles. Finally, Ford Credit could be subject to new Trump extended the national social distancing guide- or increased credit regulations, consumer or data lines through the end of April 2020. The shutting protection regulations or other types of regulations. down of the economy resulted in the loss of more jobs than had occurred since the Great Depression Challenges for 2020 and the stoppage of purchasing non-essential goods. The automotive industry is affected by macro Because of a shortage of ventilators to treat economic conditions over which the companies have coronavirus patients, Ford and General Electric's little control. Vehicles are durable goods, and con- Health Care Division announced on March 30 that sumers exert strong choices about when and if they they together planned to produce 50,000 ventilators will buy a new car. This decision is influenced by over the next 100 days. Ford planned to use a plant such factors as slower economic growth, geopolitical in Rawsonville, Michigan, and about 500 workers to EXHIBIT 3 Consolidated Income Statements for the Ford Motor Company, 2017-2019 ($ in millions except per share amounts) 2017 2018 2019 Revenues Automotive $145,653 $148,294 $143,599 Ford Credit 11,113 12,018 12,260 Mobility 10 26 41 Total revenues 156,776 160,338 155,900 Costs and expenses Cost of sales 131,321 136,269 134,693 Selling, administrative, and other expenses 11,527 11,403 11,161 Ford Credit interest, operating, and other expenses 9,047 9,463 9,472 Total costs and expenses 151,895 157,135 155,326 Operating income 4,881 3,203 574 Interest expense on Automotive debt 1,133 1,171 963 Interest expense on Other debt 57 57 Other income/(loss), net 3,267 2,247 (226) Equity in net income of affiliated companies 1,201 123 32 Income/(Loss) before income taxes 8,159 4,345 (640) Provision for/Benefit from) income taxes 402 650 (724) Net income 7,757 3.695 84 Less: Income attributable to noncontrolling interests 26 18 37 Net income attributable to Ford Motor Company $ 7,731 $ 3,677 $ 47 Earnings per share attributable to Ford Motor Company common and class B stock Basic income $1.94 $0.93 $0.01 Diluted income $1.93 $0.92 $0.01 Weighted-average shares used in computation of earnings per share Basic shares 3,975 3,974 3,972 Diluted shares 3,998 3,998 4,004 Source: Ford Motor Company 2019 10-K. 57 Two years before the Bronco was discontin- events and other factors such as the COVID-19 virus ued, the automobile gained a great deal of atten- threat in 2020. tion when Al Cowlings drove O.J. Simpson down Some of the greatest challenges to Ford in 2020 a Los Angeles freeway after Simpson was charged identified by management included the following: with the murders of his ex-wife and her friend. More than 95 million people across the United States 1. Acceptance of new and existing products by the market watched the two-hour pursuit on television while crowds gathered on overpasses to cheer on the NFL 2. Sales of more profitable larger vehicles, especially football legend.? in the United States. 3. Increased price competition resulting from indus- Ford Credit Company try excess capacity. Although the company experienced profitability dif- 4. Fluctuations in commodity prices, foreign ficulties in 2018 and 2019, its financial arm, Ford exchange rates, and interest rates. Credit Company, posted its best results in 2019 of 5. Global macroeconomic factors such as protec- the past nine years. Their profits jumped to $3 billion tionist trade policies and other events including before taxes. The result was that this arm of the com- Brexit. pany accounted for 50 percent of Ford's profits. This 6. The company's ability to maintain a competitive was up from 15 to 20 percent in the past. Ford Motor cost structure. Company had, thus, been able to subsidize Ford's 7. Pension and other post-retirement liabilities. losses and allowed the company to maintain a high 8. Defects that result in delays in new model launches. dividend yield. Unfortunately, data released by the 9. Operational systems could be affected by cyber New York Federal Reserve Bank in late 2019, indi- incidents. cated that the volume of 90+ days delinquent loans had risen sharply. The value of the overall auto loan and lease balances had surged to $1.33 trillion that Ford and the Coronavirus Pandemic. year. In addition, subprime loans reached $66 billion in early 2020, a new virus called the coronavirus in the final quarter of 2019.3 or COVID-19 began to cause serious illness and There were several risks for the company in the death around the world. Because of an increasing 2020s regarding the Ford Credit Company. One risk was that this financial arm of the company could incidence of this disease in the United States, many experience higher-than-expected credit losses, lower- states declared a "shelter in place order intended to prevent the spread of the virus by forcing people to than-anticipated residual values on higher-than- work from home. Ford, on March 31, stated that it expected return volumes for leased vehicles. Another was delaying the restart of a car plant in Mexico as risk was that Ford Credit could face increased com- well as four truck, SUV and van plants in the United petition from financial institutions or other third par- States to help protect its workers. This postpone- ties seeking to increase their share of financing Ford ment came just two days after President Donald vehicles. Finally, Ford Credit could be subject to new Trump extended the national social distancing guide- or increased credit regulations, consumer or data lines through the end of April 2020. The shutting protection regulations or other types of regulations. down of the economy resulted in the loss of more jobs than had occurred since the Great Depression Challenges for 2020 and the stoppage of purchasing non-essential goods. The automotive industry is affected by macro Because of a shortage of ventilators to treat economic conditions over which the companies have coronavirus patients, Ford and General Electric's little control. Vehicles are durable goods, and con- Health Care Division announced on March 30 that sumers exert strong choices about when and if they they together planned to produce 50,000 ventilators will buy a new car. This decision is influenced by over the next 100 days. Ford planned to use a plant such factors as slower economic growth, geopolitical in Rawsonville, Michigan, and about 500 workers to EXHIBIT 3 Consolidated Income Statements for the Ford Motor Company, 2017-2019 ($ in millions except per share amounts) 2017 2018 2019 Revenues Automotive $145,653 $148,294 $143,599 Ford Credit 11,113 12,018 12,260 Mobility 10 26 41 Total revenues 156,776 160,338 155,900 Costs and expenses Cost of sales 131,321 136,269 134,693 Selling, administrative, and other expenses 11,527 11,403 11,161 Ford Credit interest, operating, and other expenses 9,047 9,463 9,472 Total costs and expenses 151,895 157,135 155,326 Operating income 4,881 3,203 574 Interest expense on Automotive debt 1,133 1,171 963 Interest expense on Other debt 57 57 Other income/(loss), net 3,267 2,247 (226) Equity in net income of affiliated companies 1,201 123 32 Income/(Loss) before income taxes 8,159 4,345 (640) Provision for/Benefit from) income taxes 402 650 (724) Net income 7,757 3.695 84 Less: Income attributable to noncontrolling interests 26 18 37 Net income attributable to Ford Motor Company $ 7,731 $ 3,677 $ 47 Earnings per share attributable to Ford Motor Company common and class B stock Basic income $1.94 $0.93 $0.01 Diluted income $1.93 $0.92 $0.01 Weighted-average shares used in computation of earnings per share Basic shares 3,975 3,974 3,972 Diluted shares 3,998 3,998 4,004 Source: Ford Motor Company 2019 10-K. 57Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started