Answered step by step

Verified Expert Solution

Question

1 Approved Answer

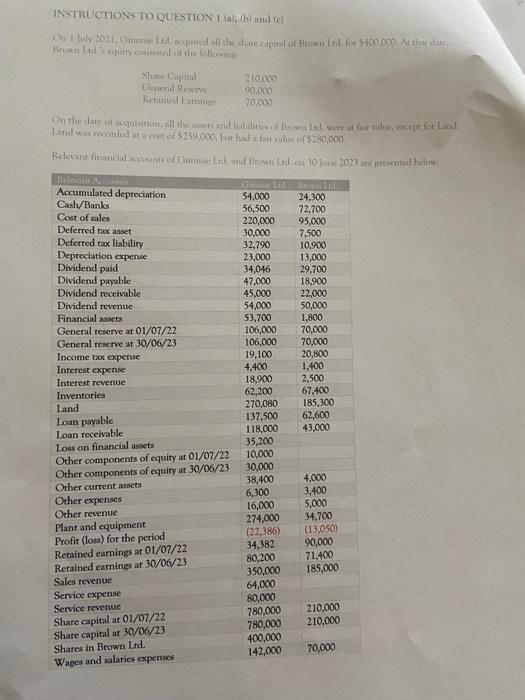

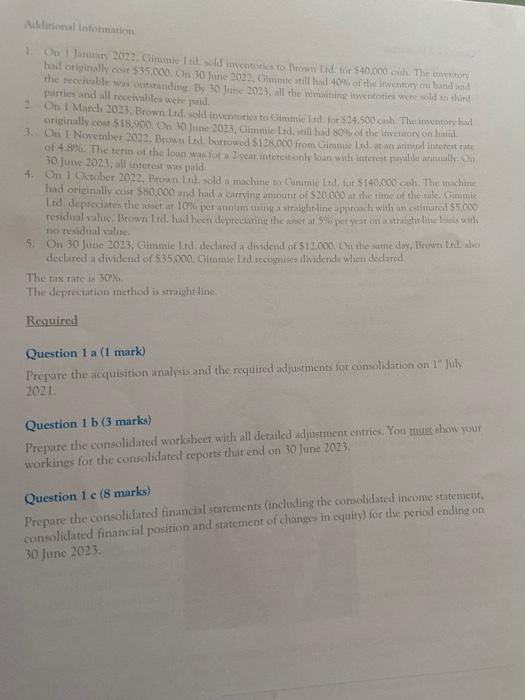

this is full question/ you can zoom it. INSTRUCTIONS TO QUESITON 1(a),(b) and (c) Iromp lad sequity coquited or the followais Adelirional information the recoivable

this is full question/

you can zoom it.

INSTRUCTIONS TO QUESITON 1(a),(b) and (c) Iromp lad sequity coquited or the followais Adelirional information the recoivable was oilituanding. Hy 2. On I Mareli 2023, Brown L tat, wold inventoiesera Gimatie litd for 324,500 ewh The mwecuroty had originally cont $18,900, On 30 Juhe 2023 , Gimmie lrd, atili had 80% of the irwentory on hathid. 30 June 2023, ill interest whe pidid had originally cost $40.000 and had a campanng amount of $20,000 at the time of the alle. Gramnic no-residuid salue 5. On 30 June 2023, Crtamie. Lrd. dedured adividend of $13,000. On the satne day, Brion Lal. aloo declared a dividend of $35,000. Gimmie lrd recognise divdend when doclared. The tis tate is 30% The deprectation method in-strighthine. Required Question 1 a (1 mark) Prepare the acquisition anilysisand the required adjustments for consolidation on 1 J Julv 2021. Question 1 b ( 3 marks) Prepure the cansolidated worksheet with all detailed adjustmententries. You must show wour workings for the consolidated reports that end on 30 lune 2023. Question 1 c ( 8 marks). Prepare the consolidated financial staremenrs Sincluding the consolidated incume statement. 30 June 2023. INSTRUCTIONS TO QUESITON 1(a),(b) and (c) Iromp lad sequity coquited or the followais Adelirional information the recoivable was oilituanding. Hy 2. On I Mareli 2023, Brown L tat, wold inventoiesera Gimatie litd for 324,500 ewh The mwecuroty had originally cont $18,900, On 30 Juhe 2023 , Gimmie lrd, atili had 80% of the irwentory on hathid. 30 June 2023, ill interest whe pidid had originally cost $40.000 and had a campanng amount of $20,000 at the time of the alle. Gramnic no-residuid salue 5. On 30 June 2023, Crtamie. Lrd. dedured adividend of $13,000. On the satne day, Brion Lal. aloo declared a dividend of $35,000. Gimmie lrd recognise divdend when doclared. The tis tate is 30% The deprectation method in-strighthine. Required Question 1 a (1 mark) Prepare the acquisition anilysisand the required adjustments for consolidation on 1 J Julv 2021. Question 1 b ( 3 marks) Prepure the cansolidated worksheet with all detailed adjustmententries. You must show wour workings for the consolidated reports that end on 30 lune 2023. Question 1 c ( 8 marks). Prepare the consolidated financial staremenrs Sincluding the consolidated incume statement. 30 June 2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started