Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is my work and it is incorrect. Please answer all parts. Thank you! Consider the following two mutually exclusive projects: 00 Year 0 3.75/30

This is my work and it is incorrect.

Please answer all parts. Thank you!

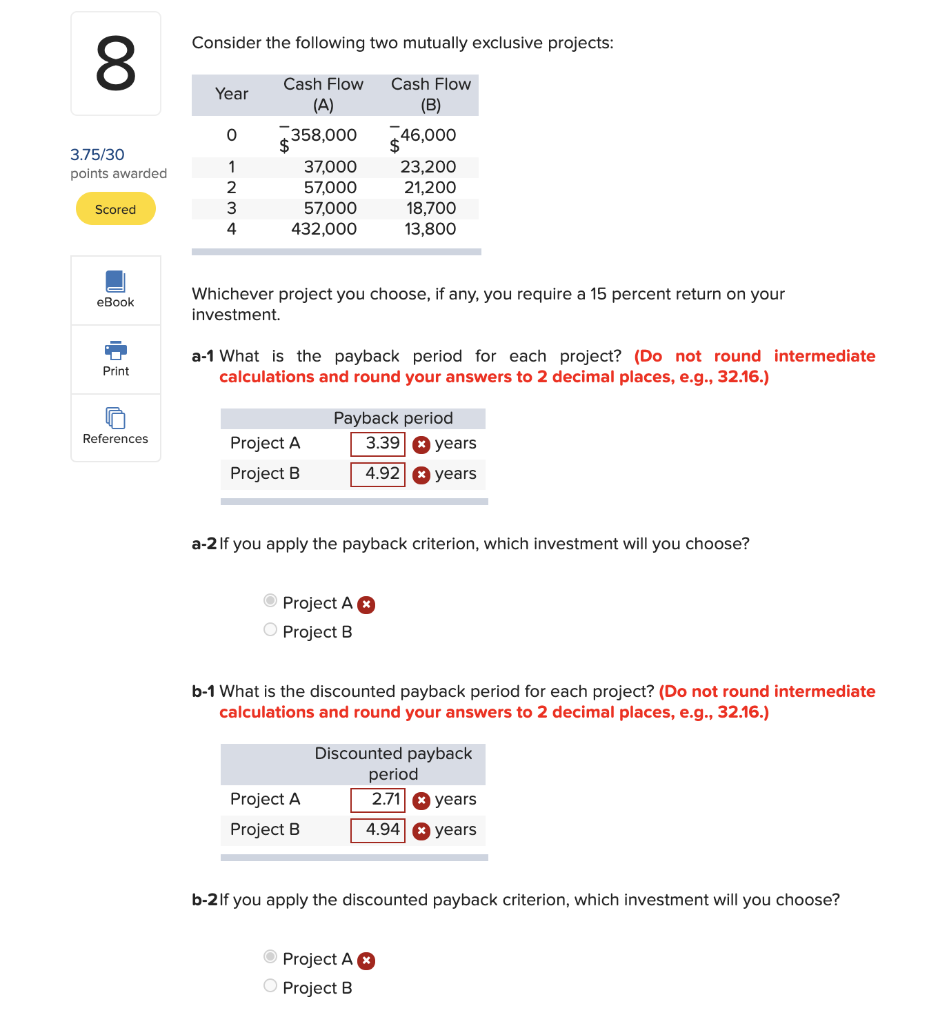

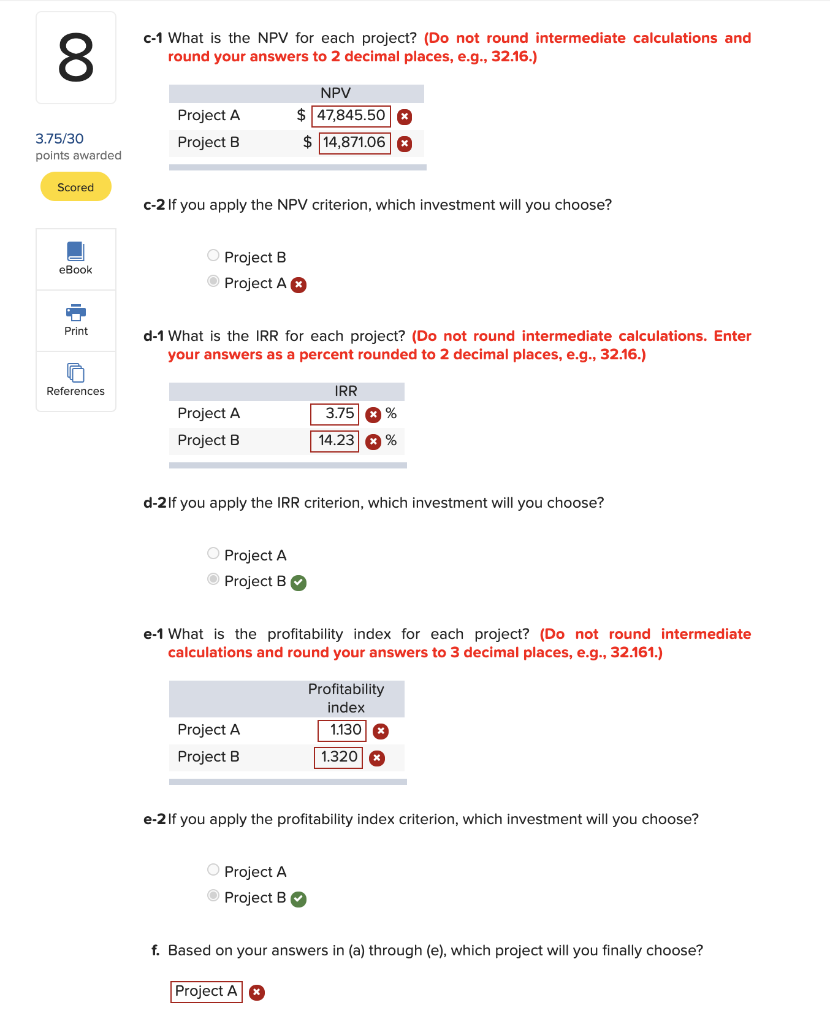

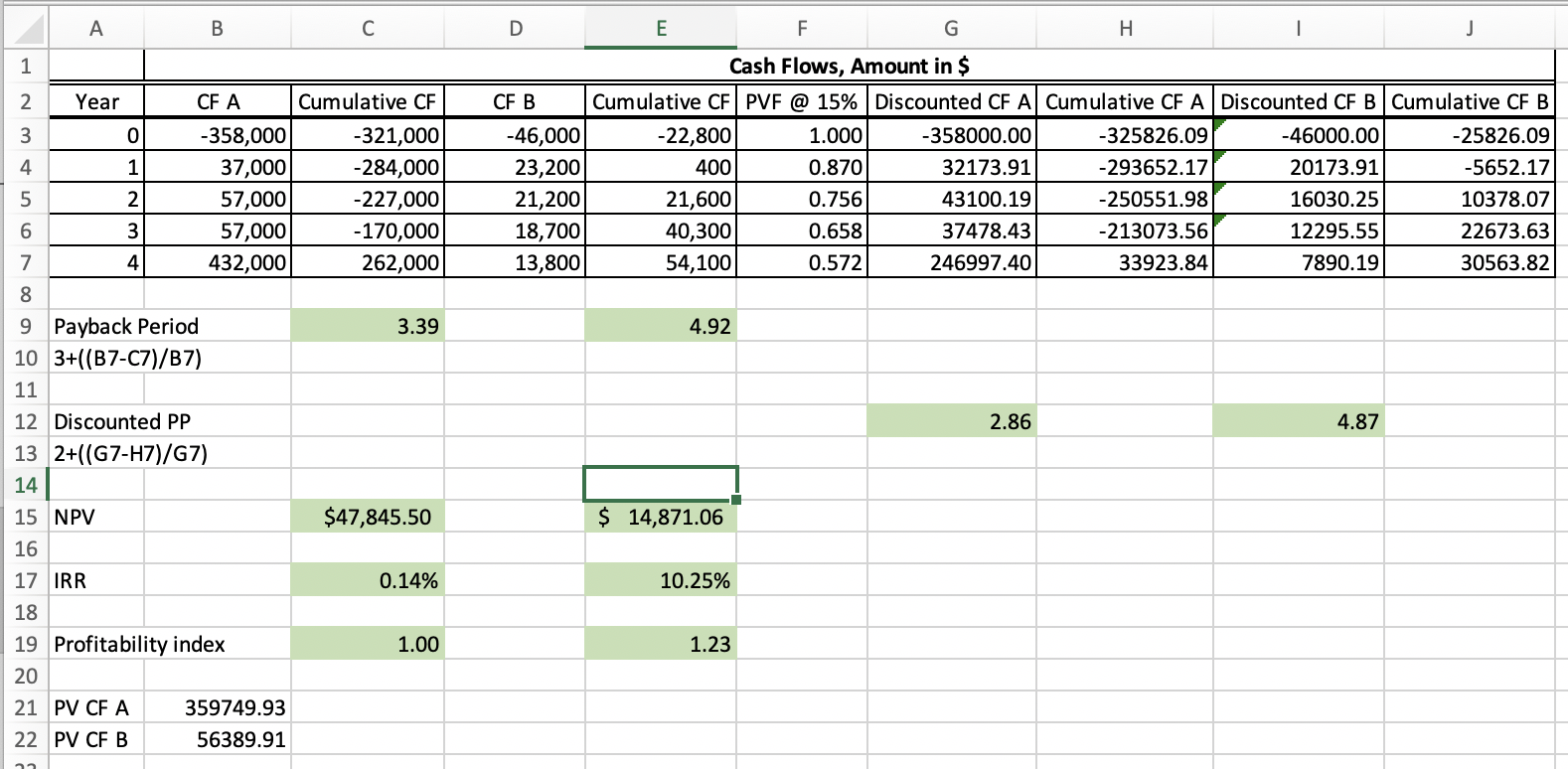

Consider the following two mutually exclusive projects: 00 Year 0 3.75/30 points awarded Cash Flow (A) 358,000 $ 37,000 57,000 57,000 432,000 Cash Flow (B) 46,000 $ 23,200 21,200 18,700 13,800 1 2 3 4 Scored eBook Whichever project you choose, if any, you require a 15 percent return on your investment. Print a-1 What is the payback period for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Payback period 3.39 years References Project A Project B 4.92 x years a-2 If you apply the payback criterion, which investment will you choose? Project A Project B b-1 What is the discounted payback period for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Discounted payback period 2.71 x years Project A Project B 4.94 years b-2 If you apply the discounted payback criterion, which investment will you choose? Project A Project B 8 C-1 What is the NPV for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Project A Project B NPV $ 47,845.50 x $ 14,871.06 x 3.75/30 points awarded Scored c-2 If you apply the NPV criterion, which investment will you choose? eBook Project B Project A Print d-1 What is the IRR for each project? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) fo References IRR 3.75 % Project A Project B 14.23 % d-2 If you apply the IRR criterion, which investment will you choose? Project A Project B e-1 What is the profitability index for each project? (Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.) Project A Project B Profitability index 1.130 > 1.320 e-2 If you apply the profitability index criterion, which investment will you choose? Project A Project B f. Based on your answers in (a) through (e), which project will you finally choose? Project A A B D E F. G H J 1 Cash Flows, Amount in $ CF B Cumulative CF PVF @ 15% Discounted CF A Cumulative CF A Discounted CF B Cumulative CF B -46,000 -22,800 1.000 -358000.00 -325826.09 -46000.00 -25826.09 23,200 400 0.870 32173.91 -293652.17 20173.91 -5652.17 21,200 21,600 0.756 43100.19 -250551.98 16030.25 10378.07 18,700 40,300 0.658 37478.43 -213073.56 12295.55 22673.63 13,800 54,100 0.572 246997.40 33923.84 7890.19 30563.82 4.92 2 Year CF A Cumulative CF 3 0 -358,000 -321,000 4 1 37,000 -284,000 5 2 57,000 -227,000 6 3 57,000 -170,000 7 4 432,000 262,000 8 9 Payback Period 3.39 10 3+((B7-C7)/B7) 11 12 Discounted PP 13 2+((G7-H7)/G7) 14 15 NPV $47,845.50 16 17 IRR 0.14% 18 19 Profitability index 1.00 20 21 PV CF A 359749.93 22 PV CF B 56389.91 2.86 4.87 $ 14,871.06 10.25% 1.23Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started