This is one question, please answer the whole question, thanks very much and I will give kudos!

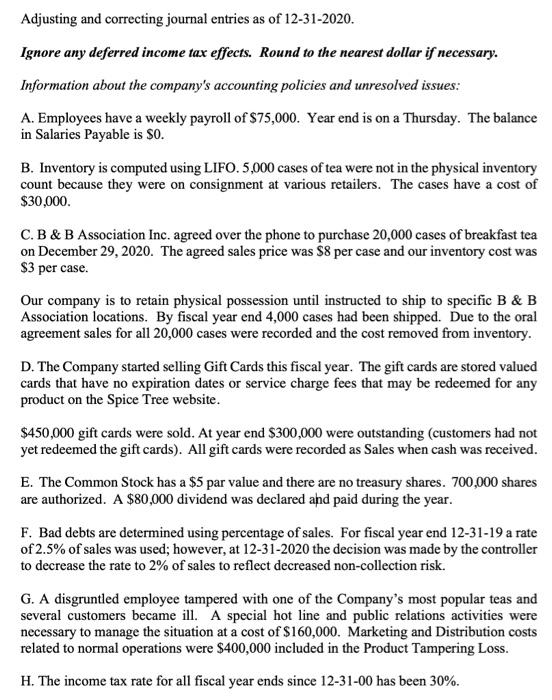

Adjusting and correcting journal entries as of 12-31-2020. Ignore any deferred income tax effects. Round to the nearest dollar if necessary. Information about the company's accounting policies and unresolved issues: A. Employees have a weekly payroll of $75,000. Year end is on a Thursday. The balance in Salaries Payable is $0. B. Inventory is computed using LIFO.5,000 cases of tea were not in the physical inventory count because they were on consignment at various retailers. The cases have a cost of $30,000. C. B & B Association Inc. agreed over the phone to purchase 20,000 cases of breakfast tea on December 29, 2020. The agreed sales price was $8 per case and our inventory cost was $3 per case. Our company is to retain physical possession until instructed to ship to specific B & B Association locations. By fiscal year end 4,000 cases had been shipped. Due to the oral agreement sales for all 20,000 cases were recorded and the cost removed from inventory. D. The Company started selling Gift Cards this fiscal year. The gift cards are stored valued cards that have no expiration dates or service charge fees that may be redeemed for any product on the Spice Tree website. $450,000 gift cards were sold. At year end $300,000 were outstanding (customers had not yet redeemed the gift cards). All gift cards were recorded as Sales when cash was received. E. The Common Stock has a $5 par value and there are no treasury shares. 700,000 shares are authorized. A $80,000 dividend was declared and paid during the year. F. Bad debts are determined using percentage of sales. For fiscal year end 12-31-19 a rate of 2.5% of sales was used; however, at 12-31-2020 the decision was made by the controller to decrease the rate to 2% of sales to reflect decreased non-collection risk. G. A disgruntled employee tampered with one of the Company's most popular teas and several customers became ill. A special hot line and public relations activities were necessary to manage the situation at a cost of $160,000. Marketing and Distribution costs related to normal operations were $400,000 included in the Product Tampering Loss. H. The income tax rate for all fiscal year ends since 12-31-00 has been 30%