Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is one question (Related to Checkpoint 6.2) (Present value of an ordinary annuity) Nicki Johnson, a sophomore mechanical engineering student, receives a call from

This is one question

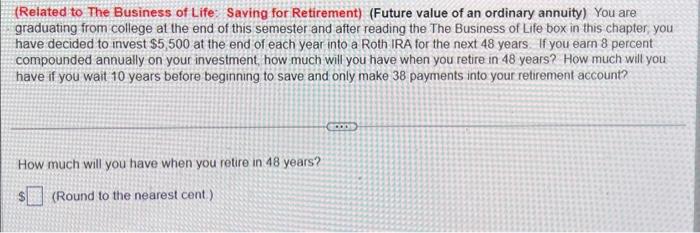

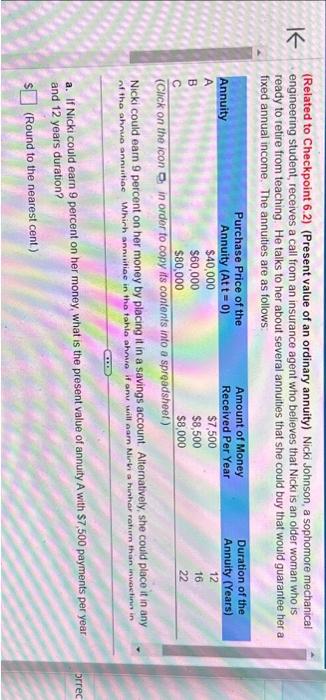

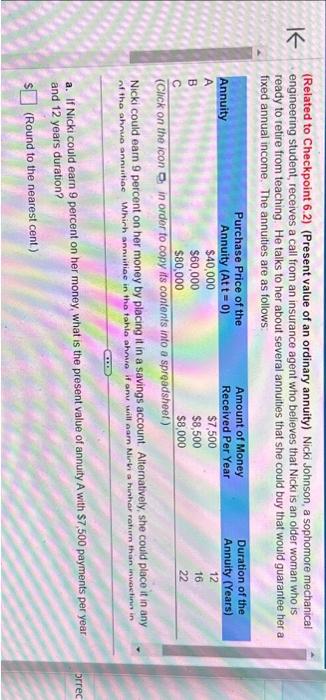

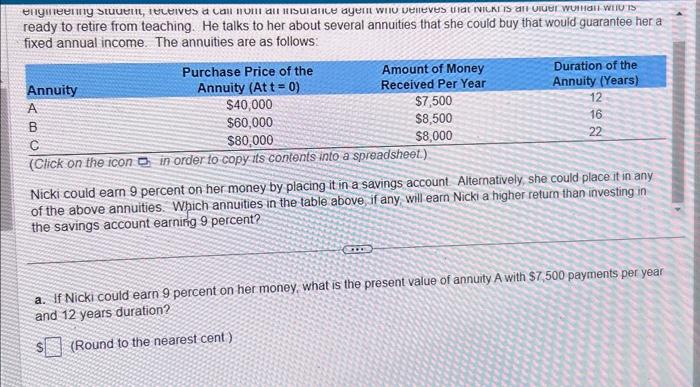

(Related to Checkpoint 6.2) (Present value of an ordinary annuity) Nicki Johnson, a sophomore mechanical engineering student, receives a call from an insurance agent who believes that Nicki is an older woman who is ready to retire from teaching. He talks to her about several annuities that she could buy that would guarantee her a fixed annual income. The annuties are as follows Nicki could earn 9 percent on her money by placing it in a savings account. Alternatively, she could place it in any a. If Nicki could earn 9 percent on her money, what is the present value of annuity A with $7,500 payments per year and 12 years duration? \$ (Round to the nearest cent) ready to retire from teaching. He talks to her about several annuities that she could buy that would guarantee her a fixed annual income. The annuities are as follows: Nicki could earn 9 percent on her money by placing it in a savings account Alternatively, she could place it in any of the above annuities. Which annuities in the table above, if any, will earn Nicki a higher retum than investing in the savings account earnirig 9 percent? a. If Nicki could earn 9 percent on her money, what is the present value of annuity A with $7,500 payments per year and 12 years duration? (Round to the nearest cent) (Related to The Business of Life: Saving for Retirement) (Future value of an ordinary annuity) You are graduating from college at the end of this semester and after reading the The Business of Life box in this chapter, you have decided to invest $5,500 at the end of each year into a Roth IRA for the next 48 years. If you earn 8 percent compounded annually on your investment, how much will you have when you retire in 48 years? How much will you have if you wait 10 years before beginning to save and only make 38 payments into your retirement account? How much will you have when you retire in 48 years? (Round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started