Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is one question which has 2 problems kindly solve both of them otherwise i rate it accordingly thanks QUESTION 5: Problem (a): XYZ Ltd.

this is one question which has 2 problems kindly solve both of them otherwise i rate it accordingly thanks

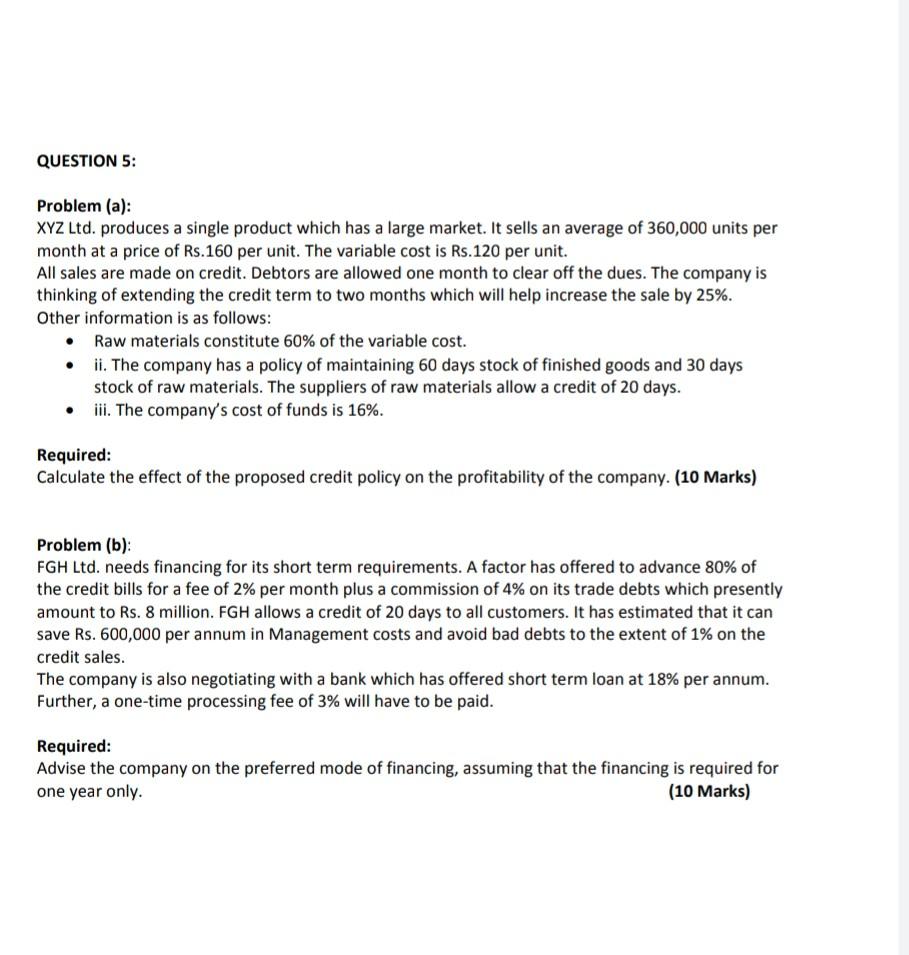

QUESTION 5: Problem (a): XYZ Ltd. produces a single product which has a large market. It sells an average of 360,000 units per month at a price of Rs.160 per unit. The variable cost is Rs. 120 per unit. All sales are made on credit. Debtors are allowed one month to clear off the dues. The company is thinking of extending the credit term to two months which will help increase the sale by 25%. Other information is as follows: Raw materials constitute 60% of the variable cost. ii. The company has a policy of maintaining 60 days stock of finished goods and 30 days stock of raw materials. The suppliers of raw materials allow a credit of 20 days. iii. The company's cost of funds is 16%. Required: Calculate the effect of the proposed credit policy on the profitability of the company. (10 Marks) Problem (b): FGH Ltd. needs financing for its short term requirements. A factor has offered to advance 80% of the credit bills for a fee of 2% per month plus a commission of 4% on its trade debts which presently amount to Rs. 8 million. FGH allows a credit of 20 days to all customers. It has estimated that it can save Rs. 600,000 per annum in Management costs and avoid bad debts to the extent of 1% on the credit sales. The company is also negotiating with a bank which has offered short term loan at 18% per annum. Further, a one-time processing fee of 3% will have to be paid. Required: Advise the company on the preferred mode of financing, assuming that the financing is required for one year only. (10 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started