Answered step by step

Verified Expert Solution

Question

1 Approved Answer

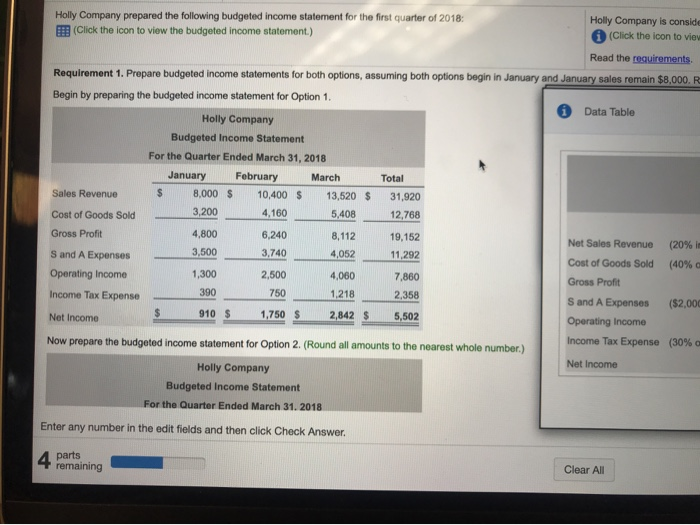

complete option 2 just like option 1 Holly Company prepared the following budgeted income statement for the first quarter of 2018: Holly Company is conside

complete option 2 just like option 1

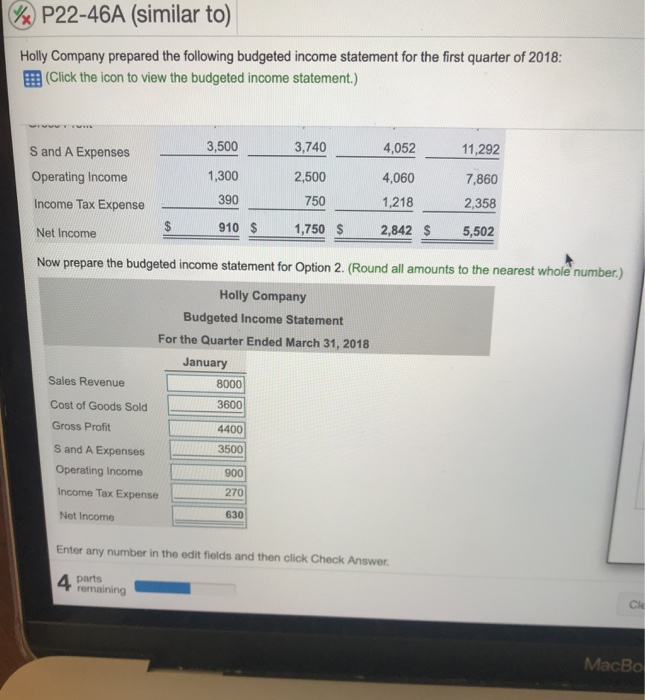

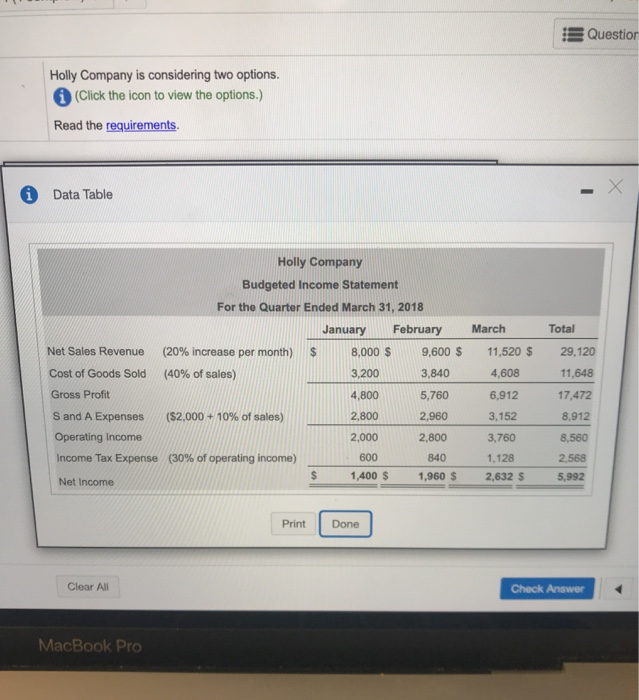

Holly Company prepared the following budgeted income statement for the first quarter of 2018: Holly Company is conside E (Click the icon to view the budgeted income statement.) (Click the icon to viev Read the requirements. Requirement 1. Prepare budgeted income statements for both options, assuming both options begin in January and January sales remain $8,000. R Begin by preparing the budgeted income statement for Option 1 Data Table Holly Company Budgeted Income Statement For the Quarter Ended March 31, 2018 January February March Total Sales Revenue 8,000 S 10,400 S 13,520 $ 31,920 3,200 4,160 Cost of Goods Sold 5,408 12,768 Gross Profit 4,800 6,240 8,112 19,152 Net Sales Revenue (20% in 3,500 3,740 4,052 S and A Expenses 11,292 Cost of Goods Sold (40 % a Operating Income 1,300 2,500 4,060 7,860 Gross Profit 390 750 1,218 Income Tax Expense 2,358 S and A Expenses ($2,000 910 S 1,750 $ 2,842 $ 5,502 Net Income Operating Income Income Tax Expense (30 % a Now prepare the budgeted income statement for Option 2. (Round all amounts to the nearest whole number.) Net Income Holly Company Budgeted Income Statement For the Quarter Ended March 31. 2018 Enter any number in the edit fields and then click Check Answer. 4 parts remaining Clear All P22-46A (similar to) Holly Company prepared the following budgeted income statement for the first quarter of 2018: |(Click the icon to view the budgeted income statement.) 3,740 4,052 11,292 3,500 S and A Expenses 2,500 4,060 7,860 1,300 Operating Income 750 1,218 2,358 390 Income Tax Expense 910 $ 5,502 $ 1,750 $ 2,842 $ Net Income Now prepare the budgeted income statement for Option 2. (Round all amounts to the nearest whole number.) Holly Company Budgeted Income Statement For the Quarter Ended March 31, 2018 January Sales Revenue 8000 3600 Cost of Goods Sold Gross Profit 4400 S and A Expenses 3500 Operating Income 900 270 Income Tax Expense 630 Net Income Enter any number in the edit fields and then click Check Answer. 4 parts remaining Cle MacBo Question Holly Company is considering two options. i (Click the icon to view the options.) Read the requirements X i Data Table Holly Company Budgeted Income Statement For the Quarter Ended March 31, 2018 February March Total January (20% increase per month) Net Sales Revenue 8,000 $ 9,600 $ 11,520 $ 29,120 Cost of Goods Sold (40% of sales) 3.200 3,840 4,608 11,648 Gross Profit 4,800 5,760 6,912 17,472 S and A Expenses ($2,000 + 10% of sales) 2,800 2,960 3,152 8,912 Operating Income 0 800 3,760 8,560 600 Income Tax Expense (30 % of operating income) 840 1,128 2,568 S 1,400 $ 1,960 $ 2,632 $ 5,992 Net Income Print Done Clear All Check Answer MacBook Pro Holly Company prepared the following budgeted income statement for the first quarter of 2018: Holly Company is conside E (Click the icon to view the budgeted income statement.) (Click the icon to viev Read the requirements. Requirement 1. Prepare budgeted income statements for both options, assuming both options begin in January and January sales remain $8,000. R Begin by preparing the budgeted income statement for Option 1 Data Table Holly Company Budgeted Income Statement For the Quarter Ended March 31, 2018 January February March Total Sales Revenue 8,000 S 10,400 S 13,520 $ 31,920 3,200 4,160 Cost of Goods Sold 5,408 12,768 Gross Profit 4,800 6,240 8,112 19,152 Net Sales Revenue (20% in 3,500 3,740 4,052 S and A Expenses 11,292 Cost of Goods Sold (40 % a Operating Income 1,300 2,500 4,060 7,860 Gross Profit 390 750 1,218 Income Tax Expense 2,358 S and A Expenses ($2,000 910 S 1,750 $ 2,842 $ 5,502 Net Income Operating Income Income Tax Expense (30 % a Now prepare the budgeted income statement for Option 2. (Round all amounts to the nearest whole number.) Net Income Holly Company Budgeted Income Statement For the Quarter Ended March 31. 2018 Enter any number in the edit fields and then click Check Answer. 4 parts remaining Clear All P22-46A (similar to) Holly Company prepared the following budgeted income statement for the first quarter of 2018: |(Click the icon to view the budgeted income statement.) 3,740 4,052 11,292 3,500 S and A Expenses 2,500 4,060 7,860 1,300 Operating Income 750 1,218 2,358 390 Income Tax Expense 910 $ 5,502 $ 1,750 $ 2,842 $ Net Income Now prepare the budgeted income statement for Option 2. (Round all amounts to the nearest whole number.) Holly Company Budgeted Income Statement For the Quarter Ended March 31, 2018 January Sales Revenue 8000 3600 Cost of Goods Sold Gross Profit 4400 S and A Expenses 3500 Operating Income 900 270 Income Tax Expense 630 Net Income Enter any number in the edit fields and then click Check Answer. 4 parts remaining Cle MacBo Question Holly Company is considering two options. i (Click the icon to view the options.) Read the requirements X i Data Table Holly Company Budgeted Income Statement For the Quarter Ended March 31, 2018 February March Total January (20% increase per month) Net Sales Revenue 8,000 $ 9,600 $ 11,520 $ 29,120 Cost of Goods Sold (40% of sales) 3.200 3,840 4,608 11,648 Gross Profit 4,800 5,760 6,912 17,472 S and A Expenses ($2,000 + 10% of sales) 2,800 2,960 3,152 8,912 Operating Income 0 800 3,760 8,560 600 Income Tax Expense (30 % of operating income) 840 1,128 2,568 S 1,400 $ 1,960 $ 2,632 $ 5,992 Net Income Print Done Clear All Check Answer MacBook Pro Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started