THIS IS ONE QUESTION WITH MULTIPLE PARTS. PLEASE MAKE SURE TO ANSWER ALL PARTS OR I WILL DOWNVOTE YOUR ANSWER.

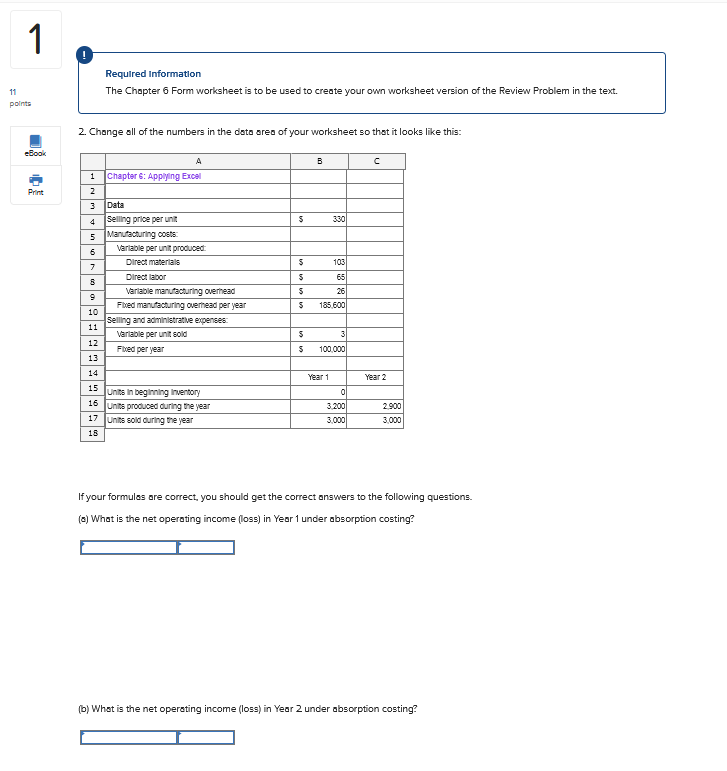

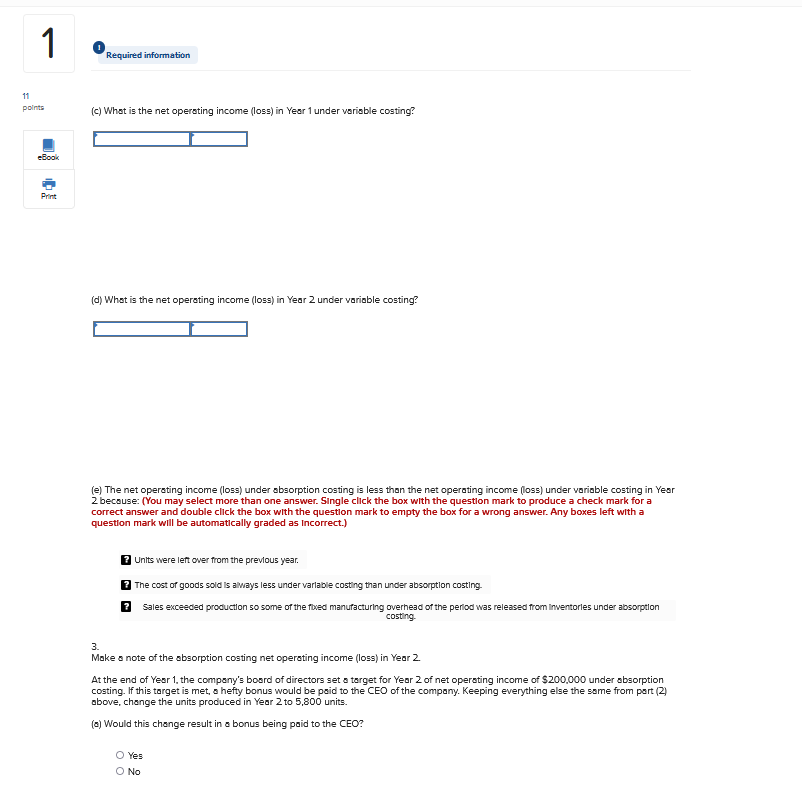

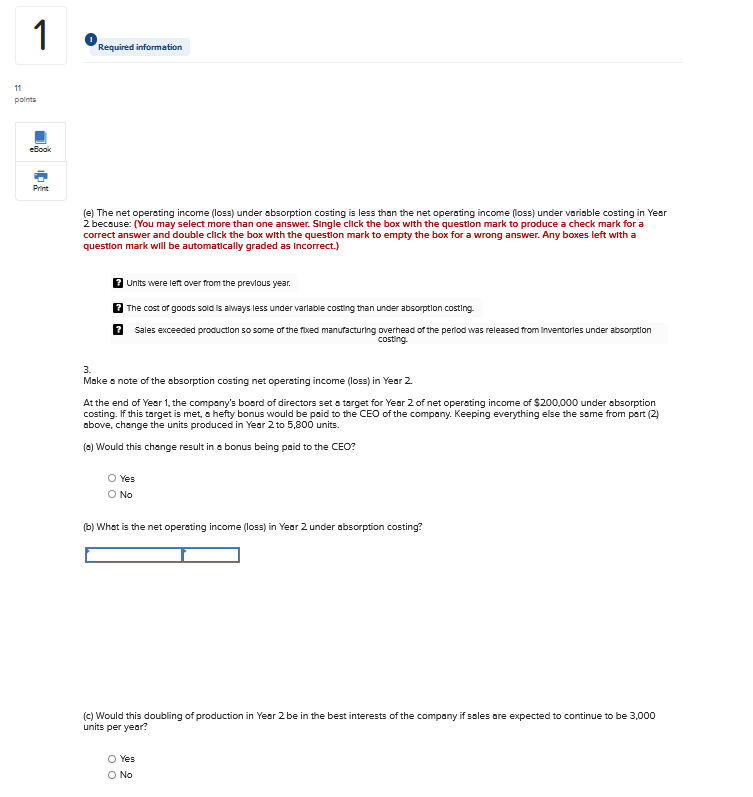

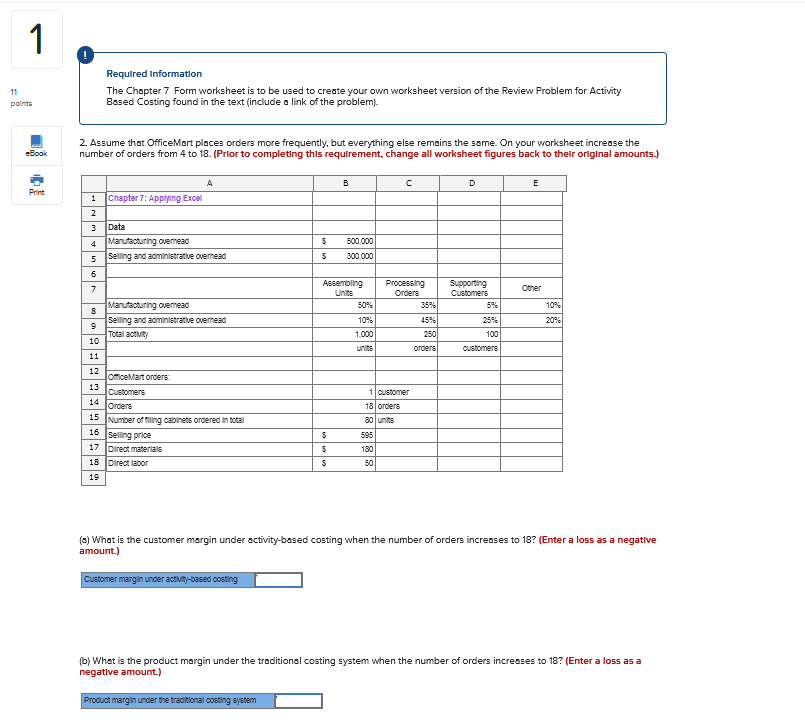

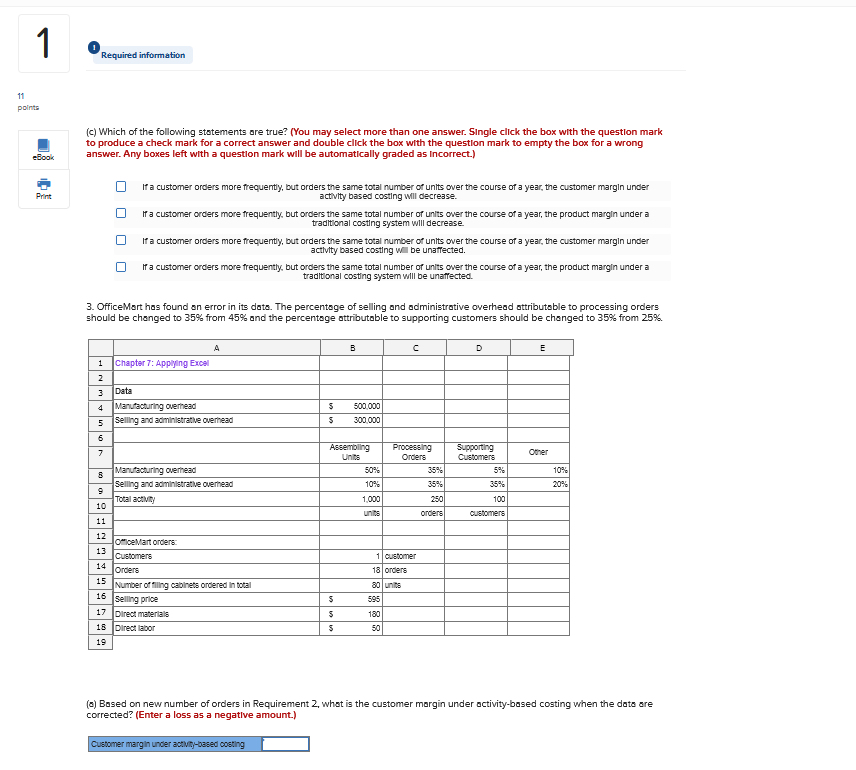

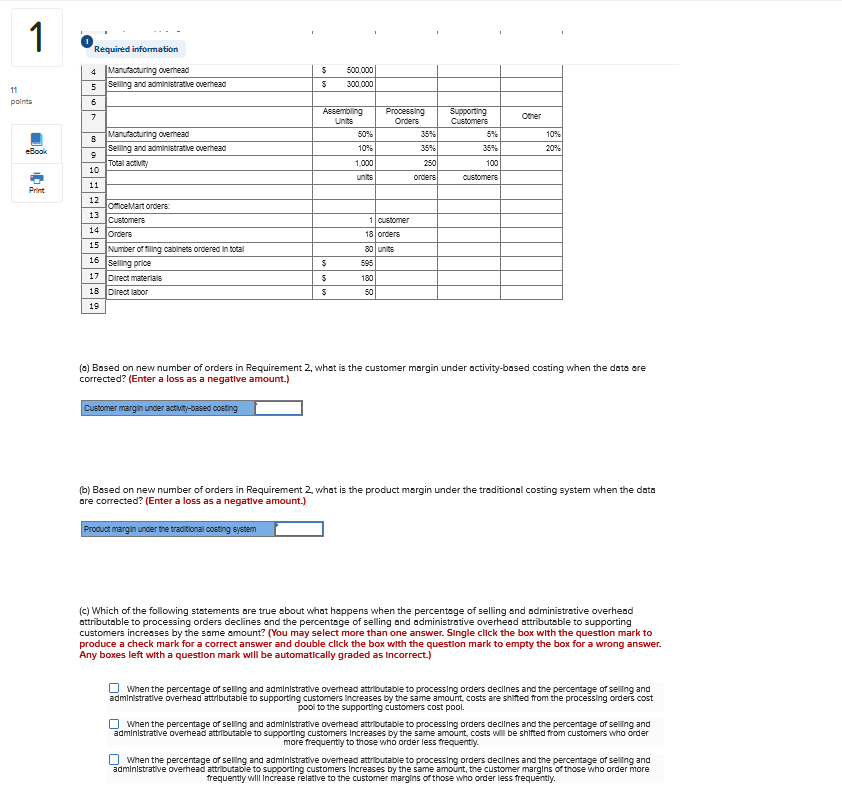

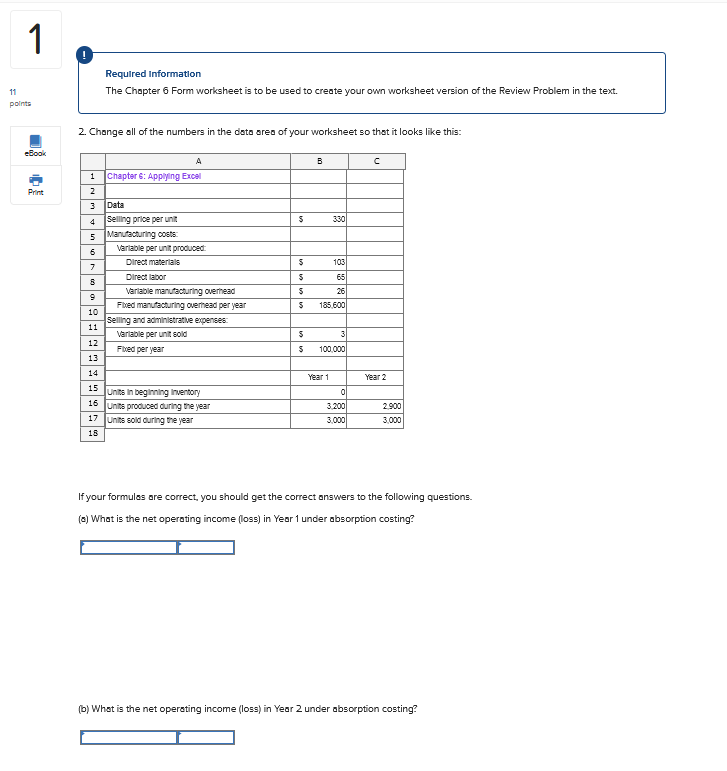

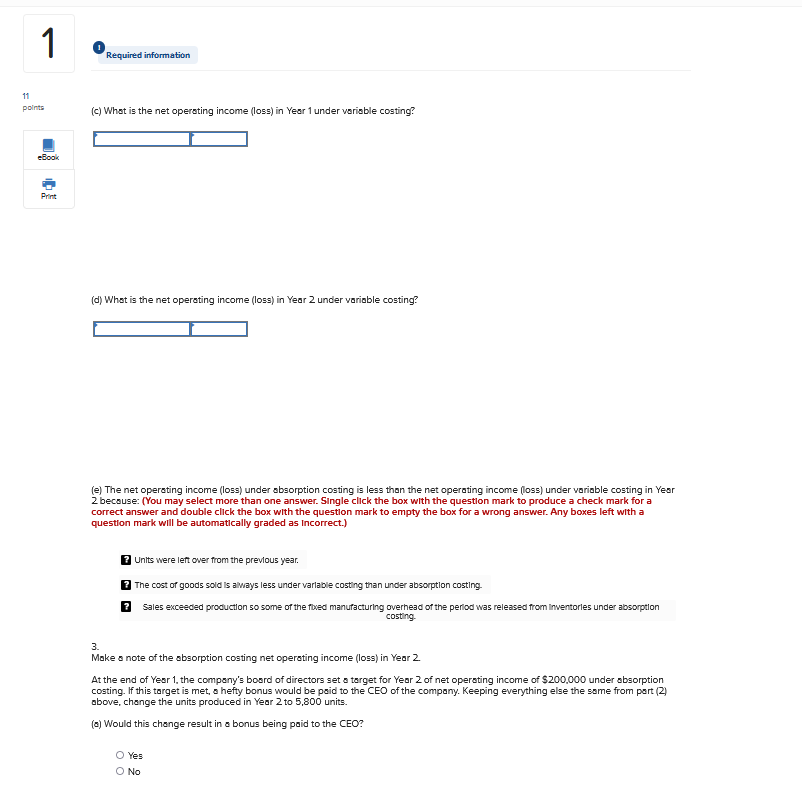

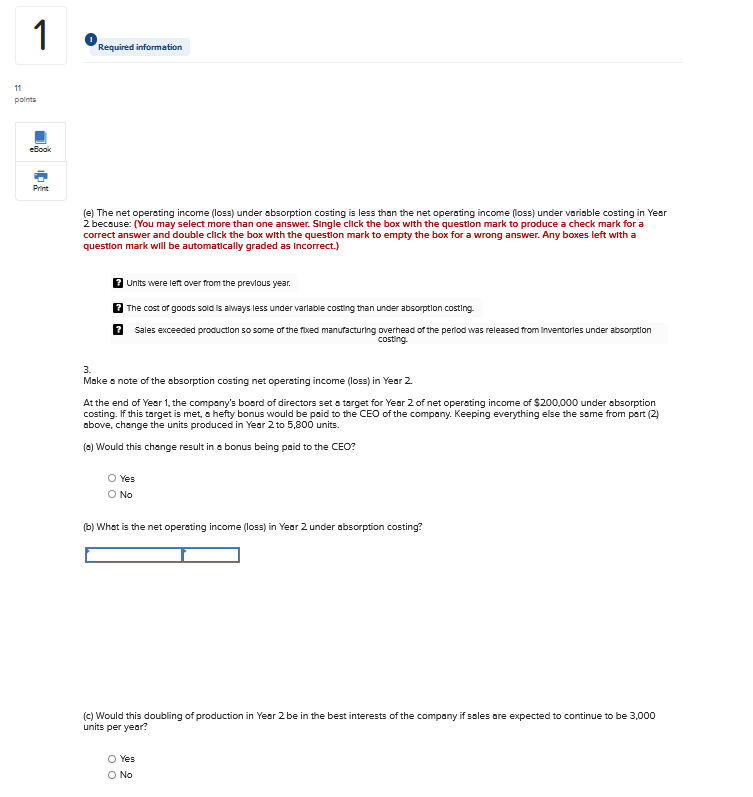

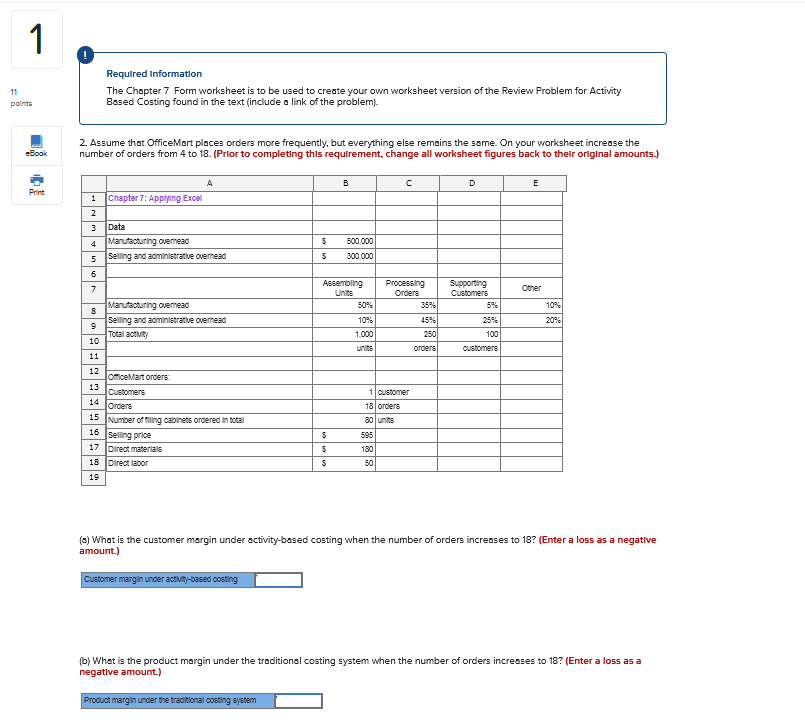

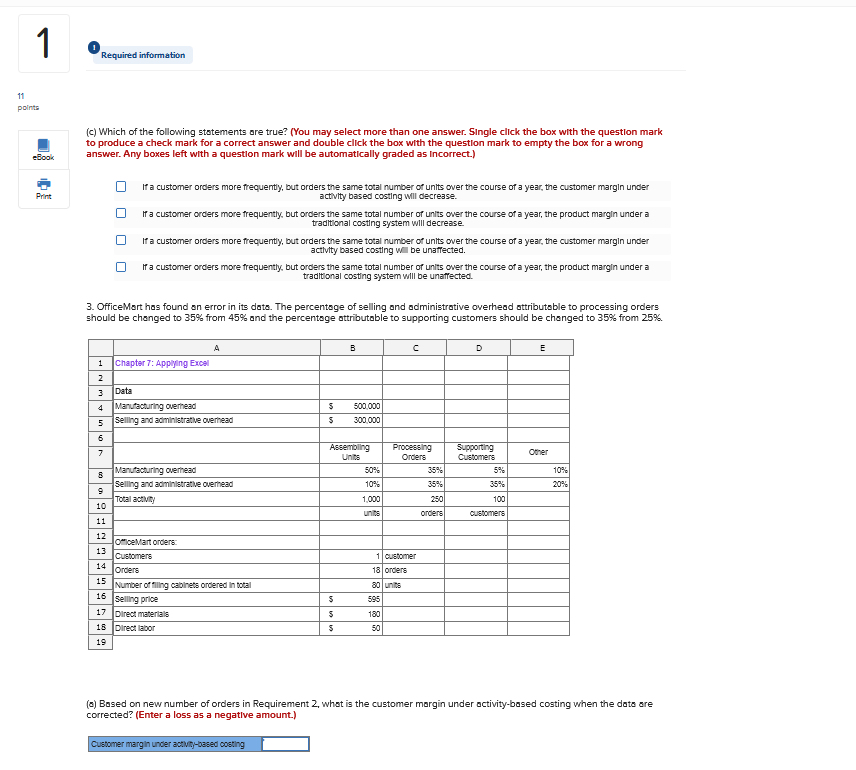

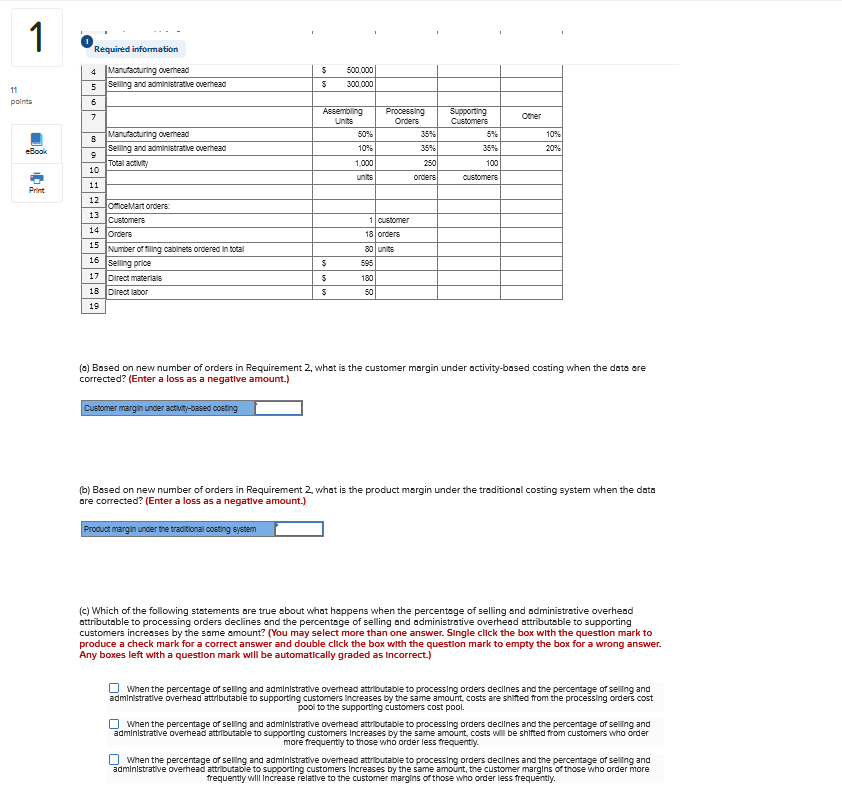

Required Informatlon The Chopter 6 Form worksheet is to be used to create your own worksheet version of the Review Problem in the text. 2. Change sll of the numbers in the dato srev of your worksheet so thet it looks like this: If your formulas are correct, you should get the correct answers to the following queations. (d) What is the net operating income (loss) in Year 1 under absorption costing? (b) What is the net operating income (loss) in Year 2 under absorption costing? (c) What is the net operating income (loss) in Year 1 under veriable coating? (d) What is the net operating income (loss) in Year 2 under variable costing? (e) The net operating income (loss) under sbsorption costing is less than the net operating income (loss) under variable costing in Yes 2 becouse: (You may select more than one answer. Single click the box with the questlon mark to produce a check mark for a correct answer and double click the box with the questlon mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as Incorrect.) Units were left over from the prevous year. The cost of goods sold is always less under varlable costing than under absorption costing. Sales exceeded production so some of the flued manufacturing overhead of the period was released from inventorles under absorption costing. 3. Make a note of the absorption costing net operating income (loss) in Year 2 At the end of Yes 1, the company's bosrd of directors set a target for Year 2 of net operating income of $200,000 under absorption costing. If this target is met, s hefty bonus would be psid to the CEO of the company. Keeping everything else the same from part (2) above, change the units produced in Year 2 to 5,800 units. (a) Would this change result in a bonus being paid to the CEO? Yes No (e) The net operating income (loss) under absorption costing is less than the net operating income (loss) under variable costing in Yes 2 because: (You may select more than one answer. Single click the box with the questlon mark to produce a check mark for a correct answer and double click the box with the questlon mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as Incorrect.) ? Units were left over from the previous year. The cost of goods sold is aways less under varlable costing than under absorption costing. Sales exceeded production so some of the flyed manacturlng overhezd of the period was released from inventorles under absorption costing. 3. Make s note of the sbsorption costing net operating income (loss) in Year 2. At the end of Year 1, the company's bosrd of directors set a target for Year 2 of net operating income of $200,000 under absorption costing. If this target is met, hefty bonus would be paid to the CEO of the company. Keeping everything else the same from part (2) obove, change the units produced in Year 2 to 5,800 units. (a) Would this change result in a bonus being paid to the CEO? Yes No (b) What is the net operating income (loss) in Year 2 under absorption costing? (c) Would this doubling of production in Year 2 be in the best interests of the company if sales are expected to continue to be 3,000 units per year? Yes No Required Information The Chapter 7 Form worksheet is to be used to create your own worksheet version of the Review Problem for Activity Based Costing found in the text (include a link of the problem). 2. Assume that OfficeMart places orders more frequently, but everything else remains the same. On your worksheet increase the number of orders from 4 to 18. (Prior to completing this requirement, change all worksheet figures back to their orlginal amounts.) (a) What is the customer margin under activity-bssed costing when the number of orders increases to 18 ? (Enter a loss as a negative amount.) (b) What is the product margin under the traditional costing system when the number of orders incresses to 18 ? (Enter a loss as a negative amount.) (c) Which of the following statements are true? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a questlon mark will be automatically graded as Incorrect.) If a customer orders more frequently, but orders the same total number of units over the course of a year, the customer margin under activity based costing will decrease. If a customer orders more frequently, but orders the same total number of units over the course of a year, the product margin under a traditional costlng system will decrease If a customer orders more frequentyy, but orders the same total number of units over the course of a year, the customer margin under actlvity based costing wir be unatrected. If a customer orders more frequently, but orders the same total number of units over the course of a year, the product margin under a tradtional costing system will be unaffected. 3. OfficeMart has found an error in its date. The percentsge of selling and administrative overhead attributable to processing orders should be changed to 35% from 45% and the percentage attributable to supporting customers should be changed to 35% from 25%. (a) Based on new number of orders in Requirement 2, what is the customer margin under activity-based coating when the date are corrected? (Enter a loss as a negative amount.) (a) Based on new number of orders in Requirement 2, what is the customer margin under activity-based costing when the dato are corrected? (Enter a loss as a negative amount.) (b) Based on new number of orders in Requirement 2, what is the product margin under the traditional costing system when the data are corrected? (Enter a loss as a negatlve amount.) (c) Which of the following statements are true sbout what happens when the percentage of selling and administrative overhead attributable to processing orders declines and the percentsge of selling and administrative overhead attributable to supporting customers incresses by the same amount? (You may select more than one answer. Single click the box with the questlon mark to produce a check mark for a correct answer and double click the box with the questlon mark to empty the box for a wrong answer. Any boxes left with a questlon mark will be automatically graded as Incorrect.) When the percentage of seling and administrative overhead attroutable to processing orders declines and the percentage of seiling and acministrative overhead attibutable to supporting customers increases by the same amount, costs are shifted from the processing orders cost pool to the supporting customers cost pool. When the percentage of seling and administrative overhead attroutable to processing orders decllnes and the percentage of seiling and duministrative overhead attrlbutable to supporting customers increases by the same amount, costs will be shifted from customers who order more frequently to those who order less frequently. When the percentage of seling and administrative overhead attroutable to processing orders declines and the percentage of seiling and duministrative overhead attroutable to supporting customers increases by the same amount, the customer margins of those who order more frequently will Increase relatlve to the customer margins of those who order less frequently