This is only 2 questions: There is a lot of text - but the question doesn't require too much. Question says it should not take very long

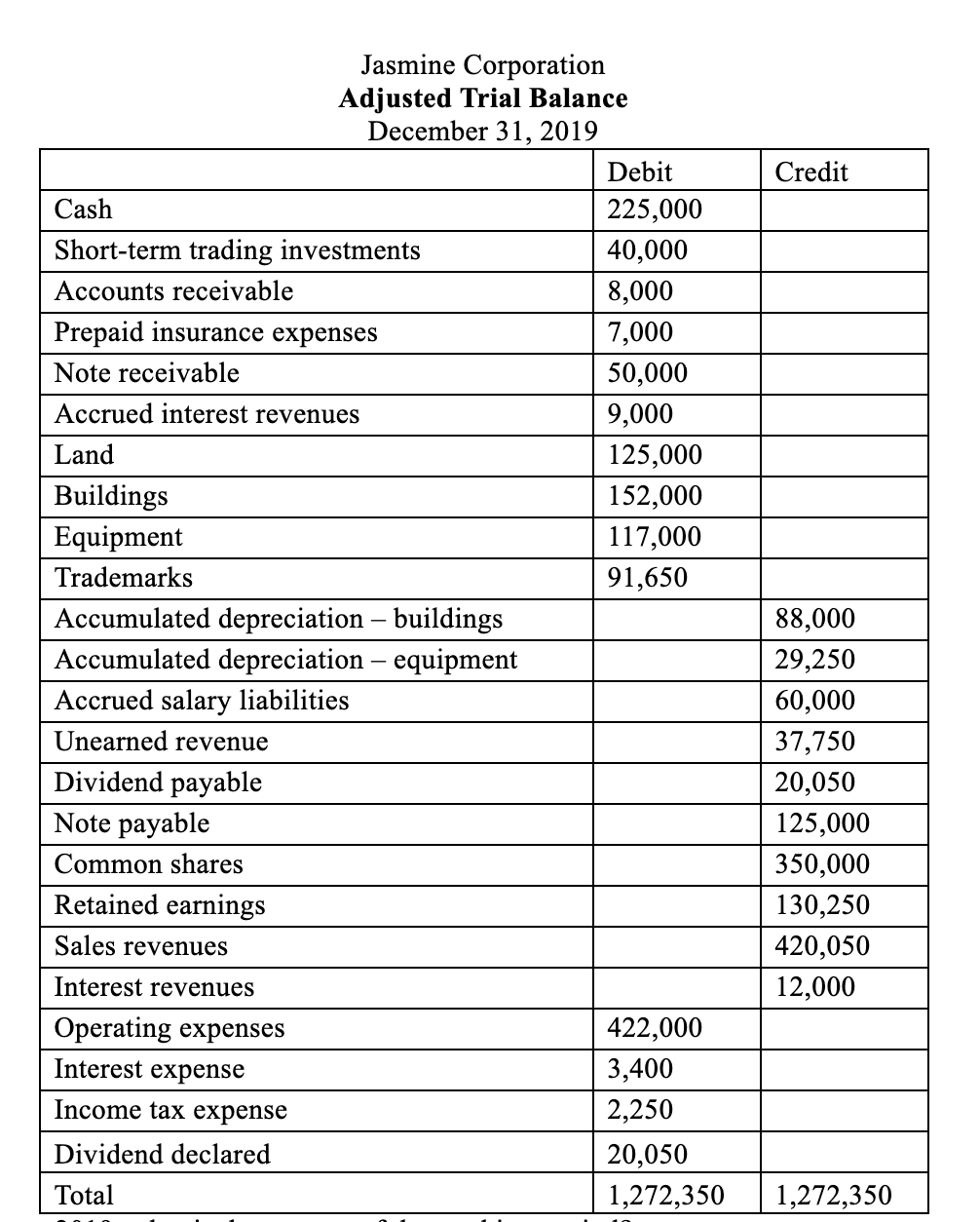

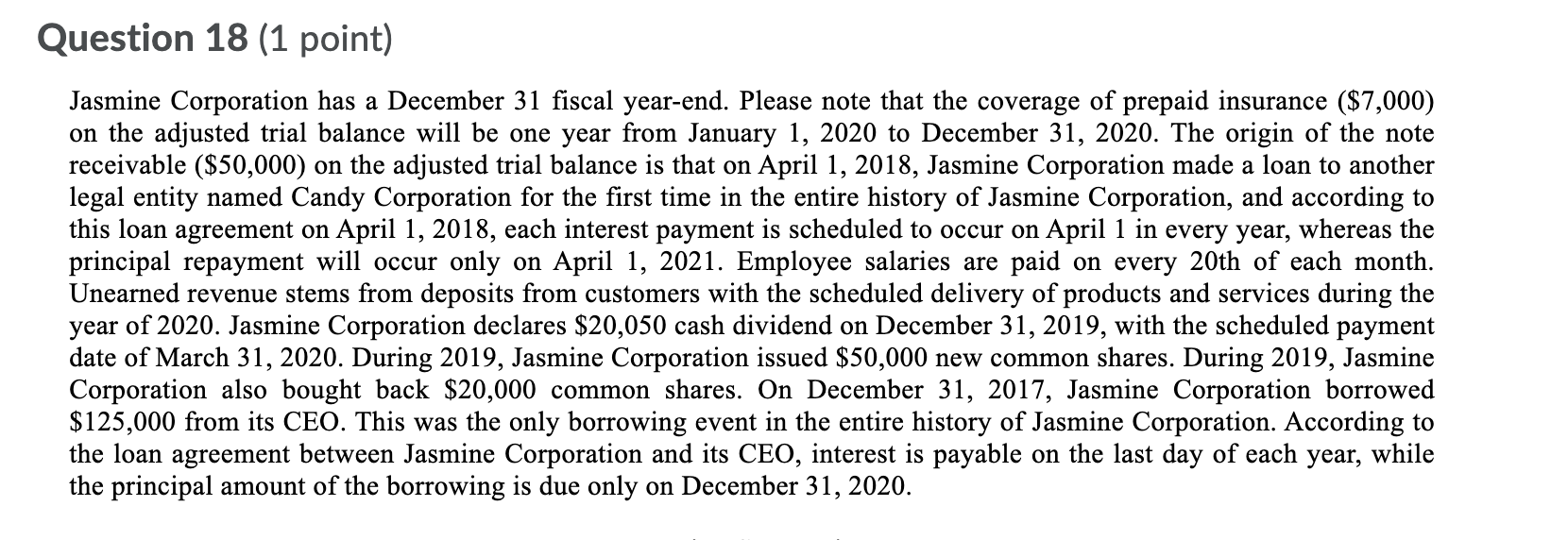

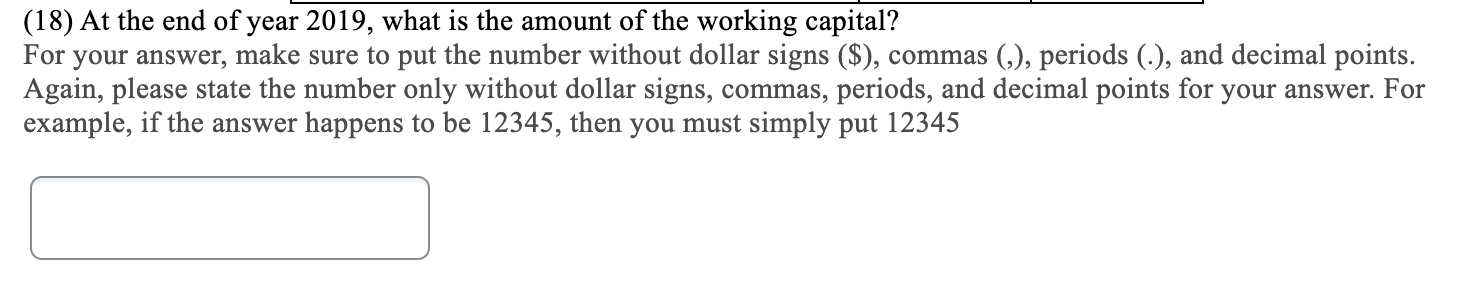

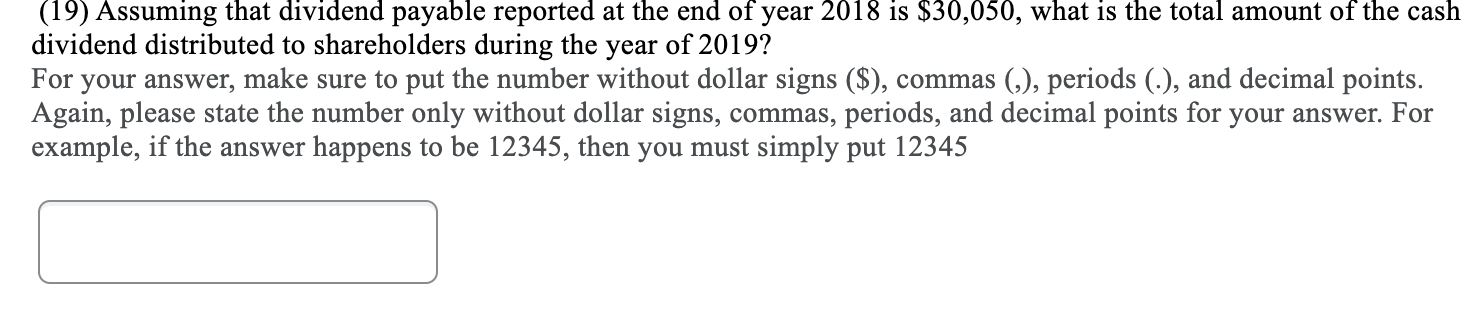

Jasmine Corporation Adjusted Trial Balance December 31, 2019 Debit Credit Cash 225,000 Short-term trading investments 40,000 Accounts receivable 8,000 Prepaid insurance expenses 7,000 Note receivable 50,000 Accrued interest revenues 9,000 Land 125,000 Buildings 152,000 Equipment 117,000 Trademarks 91,650 Accumulated depreciation - buildings 88,000 Accumulated depreciation - equipment 29,250 Accrued salary liabilities 60,000 Unearned revenue 37,750 Dividend payable 20,050 Note payable 125,000 Common shares 350,000 Retained earnings 130,250 Sales revenues 420,050 Interest revenues 12,000 Operating expenses 422,000 Interest expense 3,400 Income tax expense 2,250 Dividend declared 20,050 Total 1,272,350 1,272,350Question 18 (1 point) Jasmine Corporation has a December 31 scal year-end. Please note that the coverage of prepaid insurance ($7,000) on the adjusted trial balance will be one year from January 1, 2020 to December 31, 2020. The origin of the note receivable ($50,000) on the adjusted trial balance is that on April 1, 2018, Jasmine Corporation made a loan to another legal entity named Candy Corporation for the first time in the entire history of Jasmine Corporation, and according to this loan agreement on April 1, 2018, each interest payment is scheduled to occur on April 1 in every year, whereas the principal repayment will occur only on April 1, 2021. Employee salaries are paid on every 20th of each month. Uneamed revenue stems from deposits from customers with the scheduled delivery of products and services during the year of 2020. Jasmine Corporation declares $20,050 cash dividend on December 31, 2019, with the scheduled payment date of March 31, 2020. During 2019, Jasmine Corporation issued $50,000 new common shares, During 2019, Jasmine Corporation also bought back $20,000 common shares. On December 31, 2017, Jasmine Corporation borrowed $125,000 from its CEO. This was the only borrowing event in the entire history of Jasmine Corporation. According to the loan agreement between Jasmine Corporation and its CEO, interest is payable on the last day of each year, while the principal amount of the borrowing is due only on December 31, 2020. (18) At the end of year 2019, what is the amount of the working capital? For your answer, make sure to put the number without dollar signs ($), commas (,), periods (.), and decimal points. Again, please state the number only without dollar signs, commas, periods, and decimal points for your answer. For example, if the answer happens to be 12345, then you must simply put 12345 [: (19) Assuming that dividend payable reported at the end of year 2018 is $30,050, what is the total amount of the cash dividend distributed to shareholders during the year of 201 9? For your answer, make sure to put the number without dollar signs ($), commas (,), periods (.), and decimal points. Again, please state the number only without dollar signs, commas, periods, and decimal points for your answer. For example, if the answer happens to be 12345, then you must simply put 12345 :1