This is problem solving question. please can you do it as soon as possible. This is for Finance subject. Thanks.

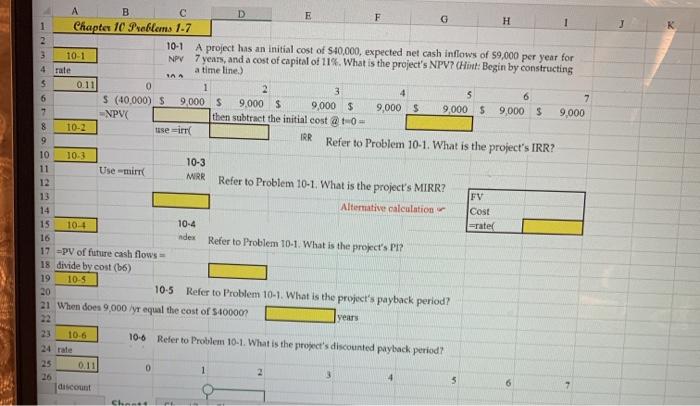

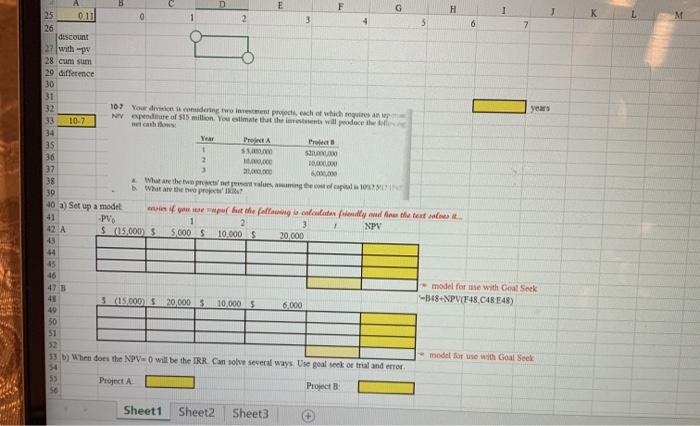

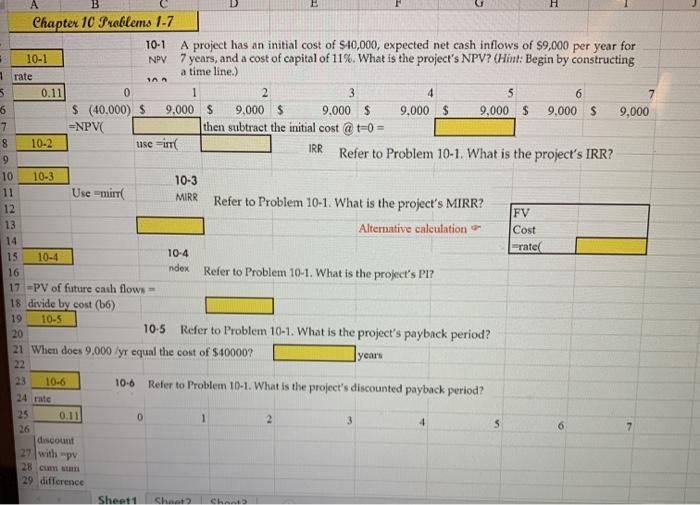

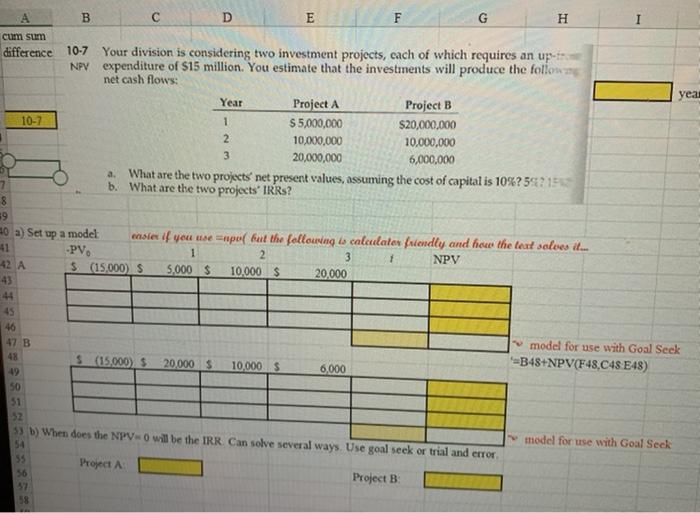

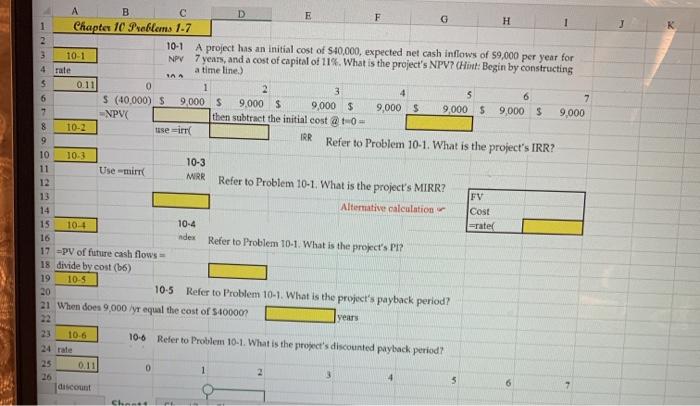

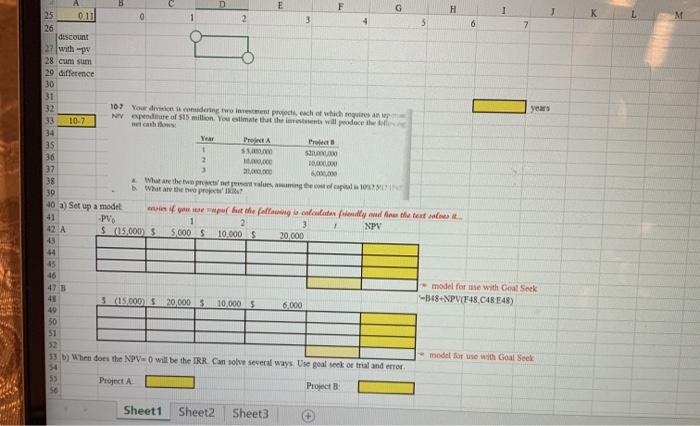

K M E F G H 25 ou 0 2 3 4 5 6 7 26 discount 22with- 28 cum sum 29 difference 30 31 years 32 107 Your division is considering with each of which gives N expenditure of $15 million. You stimate that there will produce the 33 10-7 nei cathos 34 Year PRA Pro 35 1 S. samo 36 2 37 2.000 38 What are the protestues mingecopil 105 What are the project 39 40 a) Set up a model wewpor fut the follow you to the team 41 -PV 1 2 3 NPV 42 A $15.000) $ 5.000 $ 10.000 $ 20.000 43 44 45 46 model for use with Goal Seek -348 NPV(F48.C48E48) 41 3 (05.000 $20,000 $ 100005 6.000 49 50 51 model for use with Goal Seek 33 ) When does the NPV=0 will be the IRR. Can solve several ways. Use goal seek or trial and error 55 Project A Project 1 Sheet1 Sheet2 Sheet3 H rate TAA 6 9 A Chapter 10 Problems 1-7 10-1 A project has an initial cost of $40,000, expected net cash inflows of $9,000 per year for 10-1 NPV 7 years, and a cost of capital of 11%. What is the project's NPV? (Hint: Begin by constructing a time line.) 5 0.11 0 1 2 3 4 5 6 $ (40.000) $ 9.000 $ 9.000 $ 9.000 $ 9,000 $ 9.000 $ 9,000 $ 9,000 7 =NPVC then subtract the initial cost @t-0) - 8 10-2 usein IRR Refer to Problem 10-1. What is the project's IRR? 10 10-3 10-3 11 Use mir MIRR 12 Refer to Problem 10-1. What is the project's MIRR? FV 13 Alternative calculation Cost 14 Fratec 15 10-4 10-4 16 Refer to Problem 10-1. What is the project's Pl? 17-PV of future cash flows 18 divide by cost (56) 19 10-5 20 105 Refer to Problem 10-1. What is the project's payback period? 21 When does 9.000/yr equal the cost of $40000? year's ndex 106 Refer to Problem 10-1. What is the project's discounted payback period? 10-6 24 rate 25 0.11 0 1 2 3 5 7 discount 27 with pv 28 cm suum 29 difference Sheet1 Shaat chants year 1 B D E F G H cum sum difference 10-7 Your division is considering two investment projects, cach of which requires an up- NPV expenditure of S15 million. You estimate that the investments will produce the follow net cash flows: Year Project A Project B 10-2 $5,000,000 $20,000,000 2 10,000,000 10,000,000 3 20,000,000 6,000,000 What are the two projects' net present values, assuming the cost of capital is 10%?5?1 b. What are the two projects' IRRS? 8 39 40 a) Set up a model easier if you use = po but the following is calculator friendly and how the beat saloni 41 -PV. 1 3 1 NPV 42 A $ (15,000 S 5,000 $ 10,000 $ 20.000 a. 44 45 46 47 B 48 42 50 51 S (15.000) $ model for use with Goal Seek -B48+NPV(F48,C48E48) 20.000 $ 10,000 $ 6,000 53 b) When does the NPV will be the IRR Can solve several ways. Use goal seek or trial and error model for use with Goal Seck 55 56 Project A Project B 58