THIS IS Q2 THAT NEEDS TO BE ANSWERED

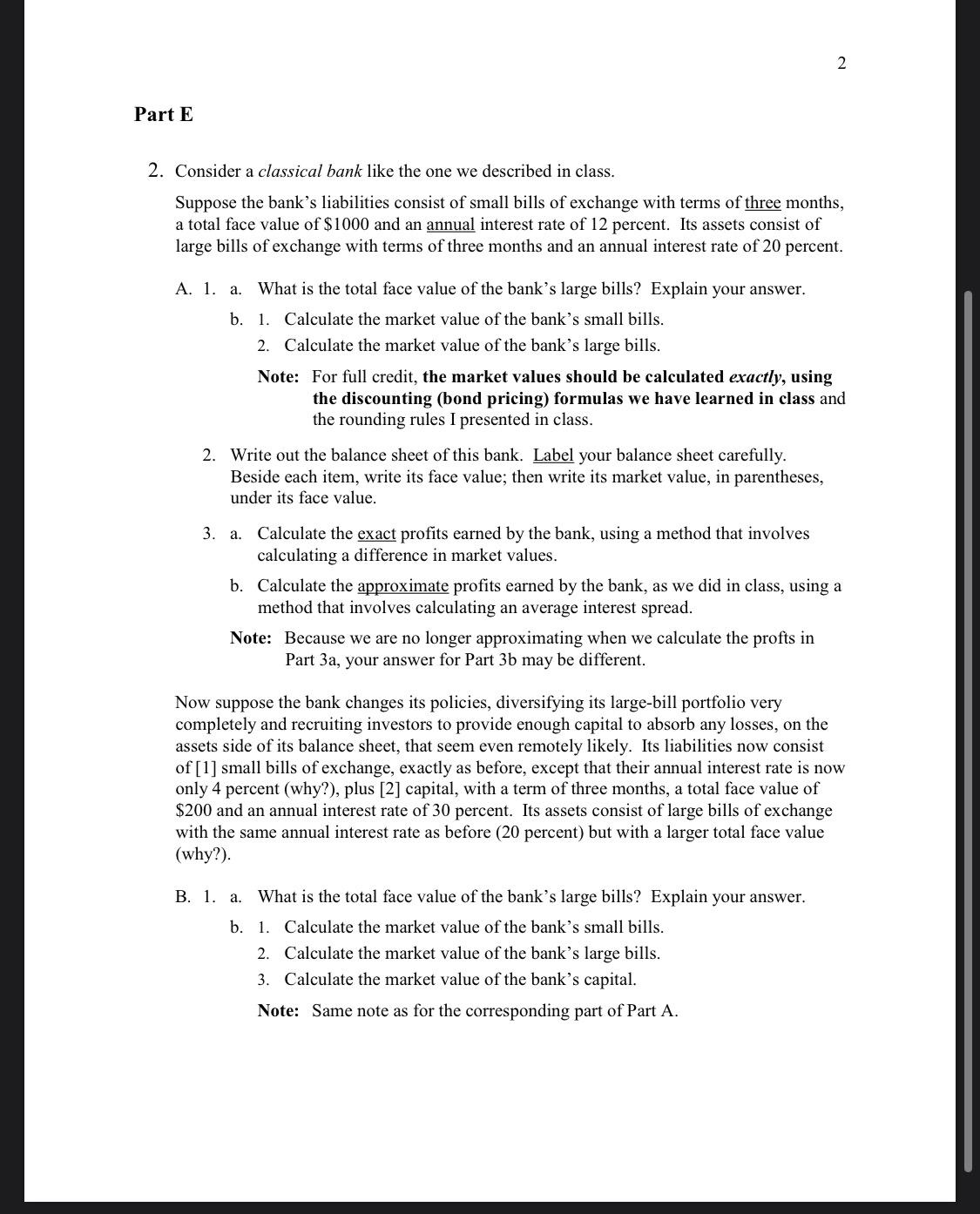

Part E 2. Consider a classical bank like the one we described in class. Suppose the bank's liabilities consist of small bills of exchange with terms of three months, a total face value of $ 1000 and an annual interest rate of 12 percent. Its assets consist of large bills of exchange with terms of three months and an annual interest rate of 20 percent. A. 1. a. What is the total face value of the bank's large bills? Explain your answer. b. 1. Calculate the market value of the bank's small bills. 2. Calculate the market value of the bank's large bills. Note: For rll credit, the market values should be calculated exactly, using the discounting (bond pricing) formulas we have learned in class and the rounding rules I presented in class. 2. Write out the balance sheet of this bank. Label your balance sheet carefully. Beside each item, write its face value; then write its market value, in parentheses, under its face value. 3. a. Calculate the ext profits earned by the bank, using a method that involves calculating a difference in market values. b. Calculate the approximate prots earned by the bank, as we did in class, using a method that involves calculating an average interest spread. Note: Because we are no longer approximating when we calculate the profts in Part 3a, your answer for Part 3b may be different. Now suppose the bank changes its policies, diversifying its large-bill portfolio very completer and recruiting investors to provide enough capital to absorb any losses, on the assets side of its balance sheet, that seem even remotely likely. Its liabilities now consist of [1] small bills of exchange, exactly as before, except that their annual interest rate is now only 4 percent (why?), plus [2] capital, with a term of three months, a total face value of $200 and an annual interest rate of 30 percent. Its assets consist of large bills of exchange with the same annual interest rate as before (20 percent) but with a larger total face value (why?). B. 1. a. What is the total face value of the bank's large bills? Explain your answer. b. 1. Calculate the market value of the bank's small bills. 2. Calculate the market value of the bank's large bills. 3. Calculate the market value of the bank's capital. Note: Same note as for the corresponding part of Part A