Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is the 2nd part of ZG Inc 2. Post the joumal entries to the ledger accounts. 3. Create a trial balance on the worksheet

This is the 2nd part of ZG Inc

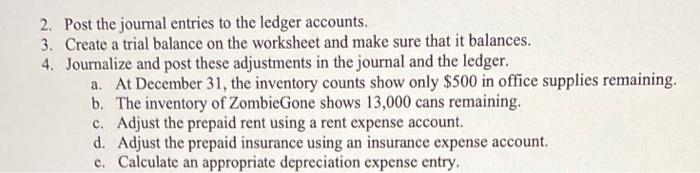

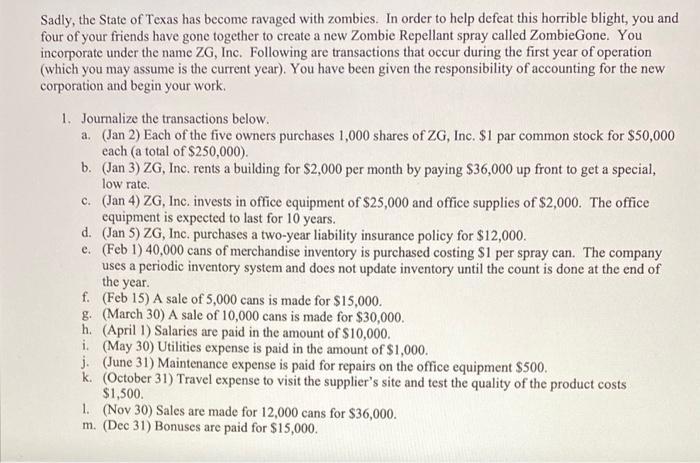

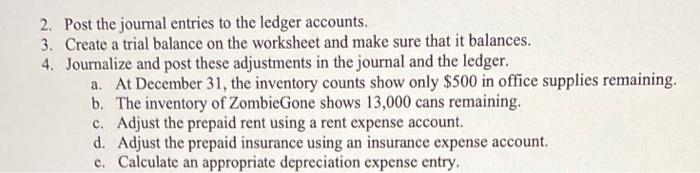

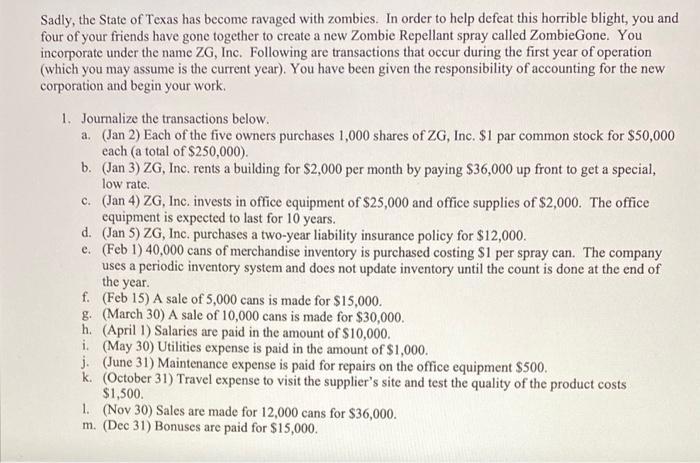

This is the 2nd part of ZG Inc  2. Post the joumal entries to the ledger accounts. 3. Create a trial balance on the worksheet and make sure that it balances. 4. Journalize and post these adjustments in the journal and the ledger. a. At December 31, the inventory counts show only $500 in office supplies remaining. b. The inventory of ZombieGone shows 13,000 cans remaining. c. Adjust the prepaid rent using a rent expense account. d. Adjust the prepaid insurance using an insurance expense account. c. Calculate an appropriate depreciation expense entry. Sadly, the State of Texas has become ravaged with zombies. In order to help defeat this horrible blight, you and four of your friends have gone together to create a new Zombie Repellant spray called ZombieGone. You incorporate under the name ZG, Inc. Following are transactions that occur during the first year of operation (which you may assume is the current year). You have been given the responsibility of accounting for the new corporation and begin your work, 1. Journalize the transactions below. a. (Jan 2) Each of the five owners purchases 1,000 shares of ZG, Inc. $1 par common stock for $50,000 each (a total of $250,000). b. (Jan 3) ZG, Inc. rents a building for $2,000 per month by paying $36,000 up front to get a special, low rate. c. (Jan 4) ZG, Inc. invests in office equipment of $25,000 and office supplies of $2,000. The office equipment is expected to last for 10 years. d. (Jan 5) ZG, Inc. purchases a two-year liability insurance policy for $12,000. e. (Feb 1) 40,000 cans of merchandise inventory is purchased costing $1 per spray can. The company uses a periodic inventory system and does not update inventory until the count is done at the end of the year. f. (Feb 15) A sale of 5,000 cans is made for $15,000. g. (March 30) A sale of 10,000 cans is made for $30,000. h. (April 1) Salaries are paid in the amount of $10,000. i. (May 30) Utilities expense is paid in the amount of $1,000. j. (June 31) Maintenance expense is paid for repairs on the office equipment $500. k. (October 31) Travel expense to visit the supplier's site and test the quality of the product costs $1,500. 1. (Nov 30) Sales are made for 12,000 cans for $36,000. m. (Dec 31) Bonuses are paid for $15,000

2. Post the joumal entries to the ledger accounts. 3. Create a trial balance on the worksheet and make sure that it balances. 4. Journalize and post these adjustments in the journal and the ledger. a. At December 31, the inventory counts show only $500 in office supplies remaining. b. The inventory of ZombieGone shows 13,000 cans remaining. c. Adjust the prepaid rent using a rent expense account. d. Adjust the prepaid insurance using an insurance expense account. c. Calculate an appropriate depreciation expense entry. Sadly, the State of Texas has become ravaged with zombies. In order to help defeat this horrible blight, you and four of your friends have gone together to create a new Zombie Repellant spray called ZombieGone. You incorporate under the name ZG, Inc. Following are transactions that occur during the first year of operation (which you may assume is the current year). You have been given the responsibility of accounting for the new corporation and begin your work, 1. Journalize the transactions below. a. (Jan 2) Each of the five owners purchases 1,000 shares of ZG, Inc. $1 par common stock for $50,000 each (a total of $250,000). b. (Jan 3) ZG, Inc. rents a building for $2,000 per month by paying $36,000 up front to get a special, low rate. c. (Jan 4) ZG, Inc. invests in office equipment of $25,000 and office supplies of $2,000. The office equipment is expected to last for 10 years. d. (Jan 5) ZG, Inc. purchases a two-year liability insurance policy for $12,000. e. (Feb 1) 40,000 cans of merchandise inventory is purchased costing $1 per spray can. The company uses a periodic inventory system and does not update inventory until the count is done at the end of the year. f. (Feb 15) A sale of 5,000 cans is made for $15,000. g. (March 30) A sale of 10,000 cans is made for $30,000. h. (April 1) Salaries are paid in the amount of $10,000. i. (May 30) Utilities expense is paid in the amount of $1,000. j. (June 31) Maintenance expense is paid for repairs on the office equipment $500. k. (October 31) Travel expense to visit the supplier's site and test the quality of the product costs $1,500. 1. (Nov 30) Sales are made for 12,000 cans for $36,000. m. (Dec 31) Bonuses are paid for $15,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started