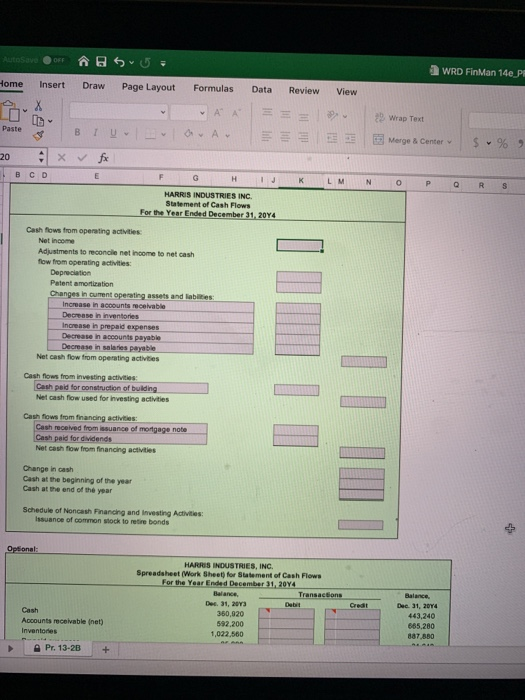

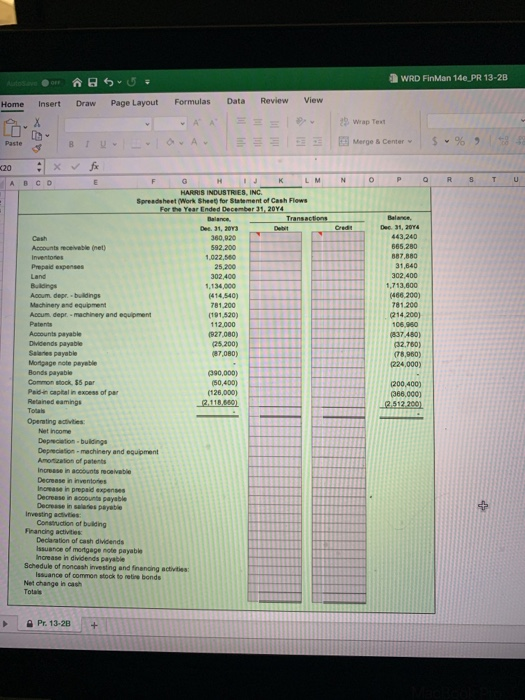

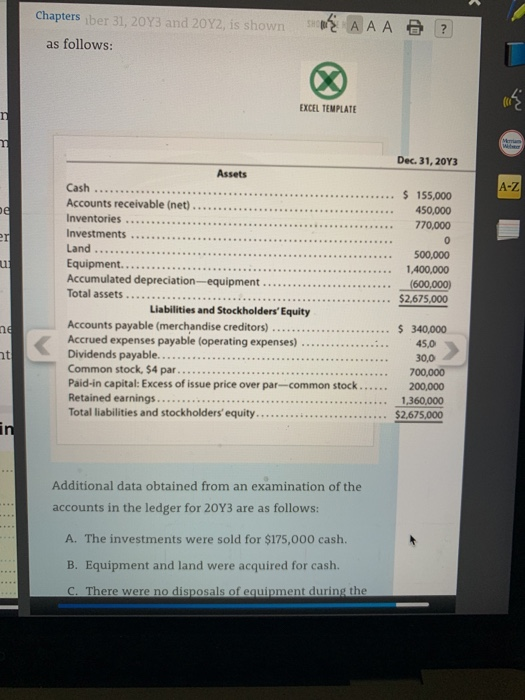

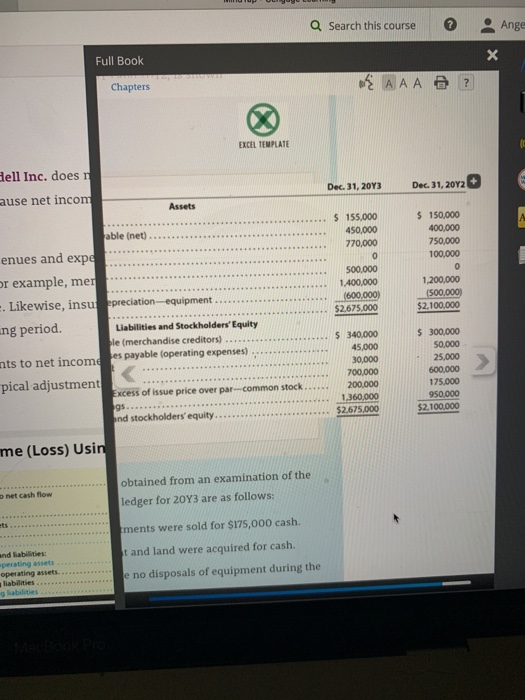

this is the additional informational someone help pls

a WRD FinMan 14e P lome Insert Draw Page Layout Formulas Data Review View 92 Wrap Text !-- d Merge & Center vl $96 , Paste K L M NOPQ R S B CD HARRIS INDUSTRIES INC Statement of Cash Flows Cash fows from operating actvties Net incomme Adjustments to reconcile net income to net cash ow from operating activities: Patent amortization Changes in oument operating assets and lablities Increase in accounts recevable Decrease in inventories Increase h prepaid expenses Decrease in accounts payable Decrease in salaries payable Net cash flow from operating activites Cash flows from investing activtes Cash peild for construction of building Net cash flow used for investing activities Cash fows from financing activities: Cash received from issuance of mortgage note paid for dividends Net cash flow from financing actvities Change in cash Cash at the beginning of the year Cash at the end of the year Schedule of Noncash Financing and investing Activities: Issuance of common stock to retire bonds HARS INDUSTRIES, INC Spreadsheet (Work Sheet) for Statement of Cash Flows Balance, TransacSons Balance, Dec. 31, 20Ys 443,240 665,280 887,880 Des.31, 20Y3 Cash Accounts recelvable (net) Inventodes 360,020 592,200 1,022.560 Pr. 13-2B + WRD FinMan 14e-PR 13-28 Home Insert Draw Page Layout Formulas Data Review View Wrap Text Merge & Center P Q R STU L M Spreadsheet (Work Sheet for Statement of Cash Flows Accum depr-machinery and equipment Paid-n capital in excess of par Issuance of mortgage mote payable Issuance of common stock to retire bonds Pr. 13-2B+ ber 31, 20Y3 and 20Y2, is shown (N2 A A A (3 as follows: EXCEL TEMPLATE Dec. 31, 2OY3 Assets A-Z Cash 770,000 Accumulated depreciation-equipment Total assets .. . 600,000) .. . $2,675,000 Liabilities and Stockholders Equity Accounts payable (merchandise creditors). 5 Accrued expenses payable (operating expenses) .450 $ 340,000 30,0 Common stock, $4 par.. . Paid-in capital: Excess of issue price over par-common stock.... 200,000 700,000 Total liabilities and stockholders' equity...$2.675,000 Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: A. The investments were sold for $175,000 cash. B. Equipment and land were acquired for cash. C. There were no disposals of equipment during the Q Search this course Ange Full Book Chapters EXCEL TEMPLATE dell Inc. doesn Dec. 31, 20Y3 Dec. 31, 20Y2 150,000 750,000 ause net incom Assets S 155,000 450,000 770,000 enues and expe r example, mer Likewise, insu epreciation-equipment ng period. 100,000 1,200,000 2021040 $2675.000 nts to net incomees payable (operating expenses)45,000 Excess of issue price over par-common stock..200.000 Liabilities and Stockholders' Equity 300,000 175,000 1.360,000 and stockholders' equity.... 2.675,000$2.100.000 me (Loss) Usin obtained from an examination of the o net cash flow ledger for 20Y3 are as follows: ments were sold for $175,000 cash. nd liabilities: perating assets operating assets t and land were acquired for cash. no disposals of equipment during the liabilities a WRD FinMan 14e P lome Insert Draw Page Layout Formulas Data Review View 92 Wrap Text !-- d Merge & Center vl $96 , Paste K L M NOPQ R S B CD HARRIS INDUSTRIES INC Statement of Cash Flows Cash fows from operating actvties Net incomme Adjustments to reconcile net income to net cash ow from operating activities: Patent amortization Changes in oument operating assets and lablities Increase in accounts recevable Decrease in inventories Increase h prepaid expenses Decrease in accounts payable Decrease in salaries payable Net cash flow from operating activites Cash flows from investing activtes Cash peild for construction of building Net cash flow used for investing activities Cash fows from financing activities: Cash received from issuance of mortgage note paid for dividends Net cash flow from financing actvities Change in cash Cash at the beginning of the year Cash at the end of the year Schedule of Noncash Financing and investing Activities: Issuance of common stock to retire bonds HARS INDUSTRIES, INC Spreadsheet (Work Sheet) for Statement of Cash Flows Balance, TransacSons Balance, Dec. 31, 20Ys 443,240 665,280 887,880 Des.31, 20Y3 Cash Accounts recelvable (net) Inventodes 360,020 592,200 1,022.560 Pr. 13-2B + WRD FinMan 14e-PR 13-28 Home Insert Draw Page Layout Formulas Data Review View Wrap Text Merge & Center P Q R STU L M Spreadsheet (Work Sheet for Statement of Cash Flows Accum depr-machinery and equipment Paid-n capital in excess of par Issuance of mortgage mote payable Issuance of common stock to retire bonds Pr. 13-2B+ ber 31, 20Y3 and 20Y2, is shown (N2 A A A (3 as follows: EXCEL TEMPLATE Dec. 31, 2OY3 Assets A-Z Cash 770,000 Accumulated depreciation-equipment Total assets .. . 600,000) .. . $2,675,000 Liabilities and Stockholders Equity Accounts payable (merchandise creditors). 5 Accrued expenses payable (operating expenses) .450 $ 340,000 30,0 Common stock, $4 par.. . Paid-in capital: Excess of issue price over par-common stock.... 200,000 700,000 Total liabilities and stockholders' equity...$2.675,000 Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: A. The investments were sold for $175,000 cash. B. Equipment and land were acquired for cash. C. There were no disposals of equipment during the Q Search this course Ange Full Book Chapters EXCEL TEMPLATE dell Inc. doesn Dec. 31, 20Y3 Dec. 31, 20Y2 150,000 750,000 ause net incom Assets S 155,000 450,000 770,000 enues and expe r example, mer Likewise, insu epreciation-equipment ng period. 100,000 1,200,000 2021040 $2675.000 nts to net incomees payable (operating expenses)45,000 Excess of issue price over par-common stock..200.000 Liabilities and Stockholders' Equity 300,000 175,000 1.360,000 and stockholders' equity.... 2.675,000$2.100.000 me (Loss) Usin obtained from an examination of the o net cash flow ledger for 20Y3 are as follows: ments were sold for $175,000 cash. nd liabilities: perating assets operating assets t and land were acquired for cash. no disposals of equipment during the liabilities