Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is the case study which we have to do this is my friend sample paper please don't copy also don't copy same I need

this is the case study which we have to do

this is my friend sample paper please don't copy

also don't copy same

I need same type of table method and at the end calculations but not exactly same because its just a sample

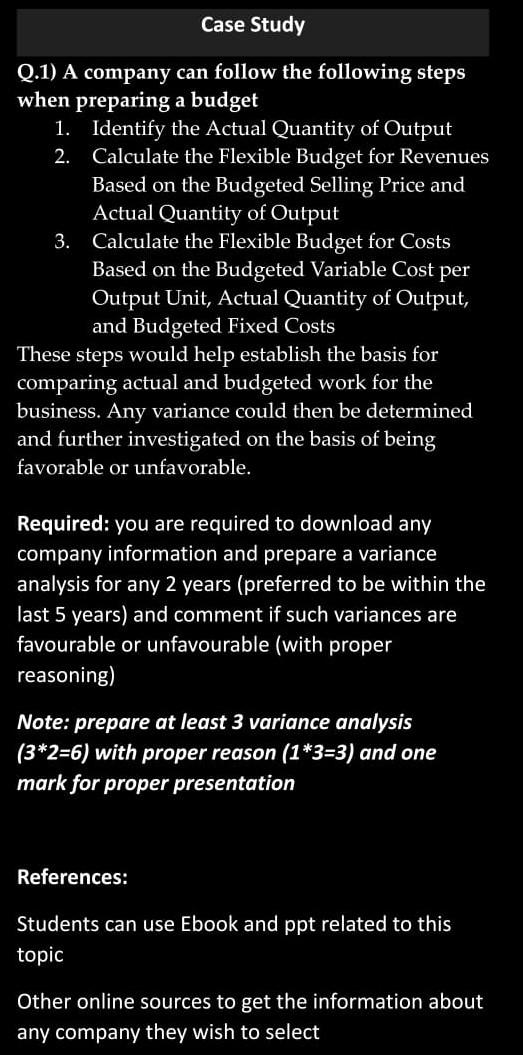

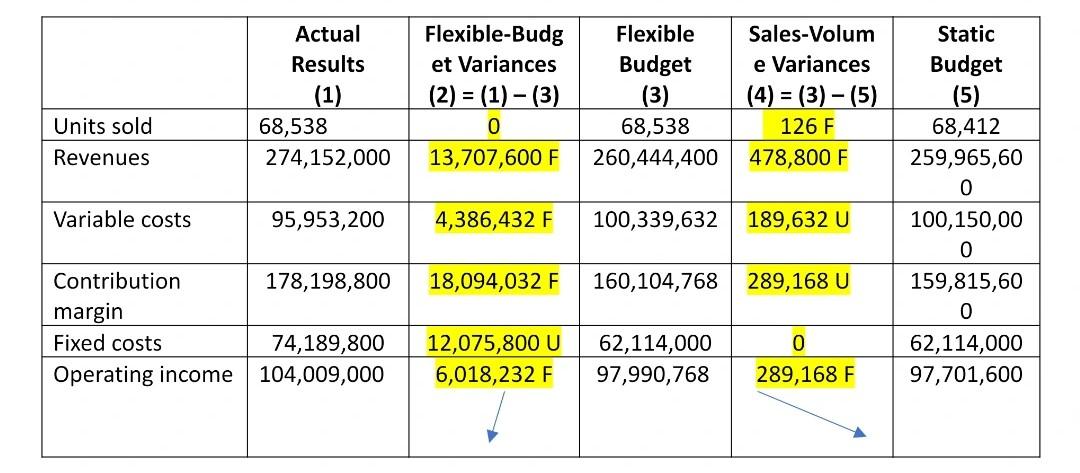

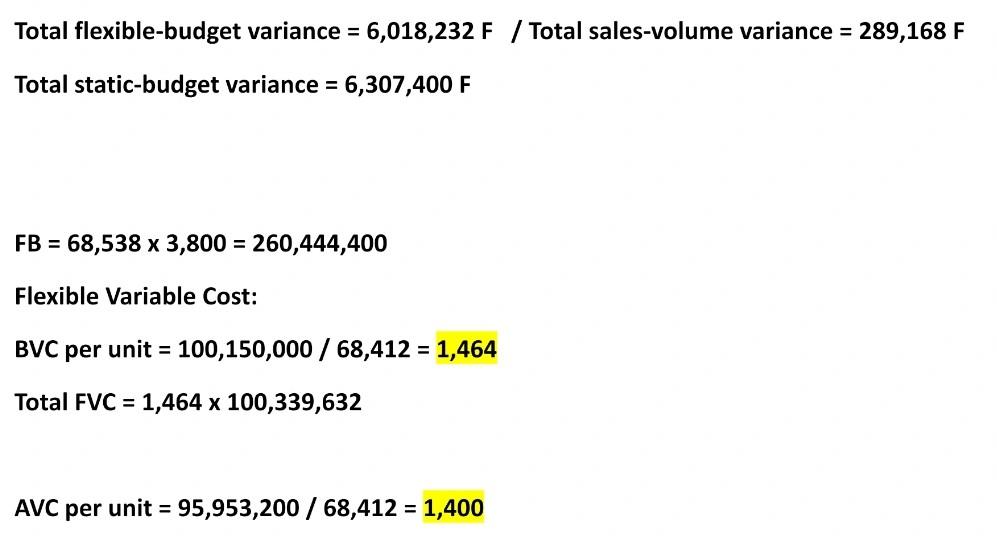

Case Study Q.1) A company can follow the following steps when preparing a budget 1. Identify the Actual Quantity of Output 2. Calculate the Flexible Budget for Revenues Based on the Budgeted Selling Price and Actual Quantity of Output 3. Calculate the Flexible Budget for Costs Based on the Budgeted Variable Cost per Output Unit, Actual Quantity of Output, and Budgeted Fixed Costs These steps would help establish the basis for comparing actual and budgeted work for the business. Any variance could then be determined and further investigated on the basis of being favorable or unfavorable. Required: you are required to download any i company information and prepare a variance analysis for any 2 years (preferred to be within the last 5 years) and comment if such variances are favourable or unfavourable (with proper reasoning) Note: prepare at least 3 variance analysis (3*2=6) with proper reason (1*3=3) and one mark for proper presentation References: Students can use Ebook and ppt related to this topic Other online sources to get the information about any company they wish to select Actual Results (1) 68,538 274,152,000 Flexible-Budg et Variances (2) = (1) (3) 0 13,707,600 F Flexible Budget (3) 68,538 260,444,400 Sales-Volum e Variances (4) = (3) (5) 126 F 478,800 F Units sold Revenues Static Budget (5) 68,412 259,965,60 0 100,150,00 0 159,815,60 0 62,114,000 97,701,600 Variable costs 95,953,200 4,386,432 F 100,339,632 189,632 U 18,094,032 F 160,104,768 289,168 U Contribution 178,198,800 margin Fixed costs 74,189,800 Operating income 104,009,000 12,075,800 U 6,018,232 F 62,114,000 97,990,768 0 289,168 F Total flexible-budget variance = 6,018,232 F / Total sales-volume variance = 289,168 F Total static-budget variance = 6,307,400 F FB = 68,538 x 3,800 = 260,444,400 Flexible Variable Cost: BVC per unit = 100,150,000/ 68,412 = 1,464 = Total FVC = 1,464 x 100,339,632 AVC per unit = 95,953,200 / 68,412 = 1,400 = Case Study Q.1) A company can follow the following steps when preparing a budget 1. Identify the Actual Quantity of Output 2. Calculate the Flexible Budget for Revenues Based on the Budgeted Selling Price and Actual Quantity of Output 3. Calculate the Flexible Budget for Costs Based on the Budgeted Variable Cost per Output Unit, Actual Quantity of Output, and Budgeted Fixed Costs These steps would help establish the basis for comparing actual and budgeted work for the business. Any variance could then be determined and further investigated on the basis of being favorable or unfavorable. Required: you are required to download any i company information and prepare a variance analysis for any 2 years (preferred to be within the last 5 years) and comment if such variances are favourable or unfavourable (with proper reasoning) Note: prepare at least 3 variance analysis (3*2=6) with proper reason (1*3=3) and one mark for proper presentation References: Students can use Ebook and ppt related to this topic Other online sources to get the information about any company they wish to select Actual Results (1) 68,538 274,152,000 Flexible-Budg et Variances (2) = (1) (3) 0 13,707,600 F Flexible Budget (3) 68,538 260,444,400 Sales-Volum e Variances (4) = (3) (5) 126 F 478,800 F Units sold Revenues Static Budget (5) 68,412 259,965,60 0 100,150,00 0 159,815,60 0 62,114,000 97,701,600 Variable costs 95,953,200 4,386,432 F 100,339,632 189,632 U 18,094,032 F 160,104,768 289,168 U Contribution 178,198,800 margin Fixed costs 74,189,800 Operating income 104,009,000 12,075,800 U 6,018,232 F 62,114,000 97,990,768 0 289,168 F Total flexible-budget variance = 6,018,232 F / Total sales-volume variance = 289,168 F Total static-budget variance = 6,307,400 F FB = 68,538 x 3,800 = 260,444,400 Flexible Variable Cost: BVC per unit = 100,150,000/ 68,412 = 1,464 = Total FVC = 1,464 x 100,339,632 AVC per unit = 95,953,200 / 68,412 = 1,400 =Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started