Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is the formula format the problem need to be solved #10 di 1 11 Solution: 1.200 D 1.00 S Balance 302 Auditional profit 2.000

this is the formula format

the problem need to be solved

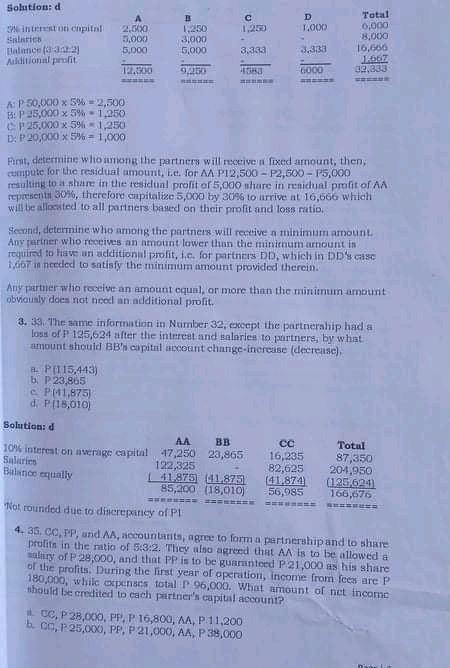

#10

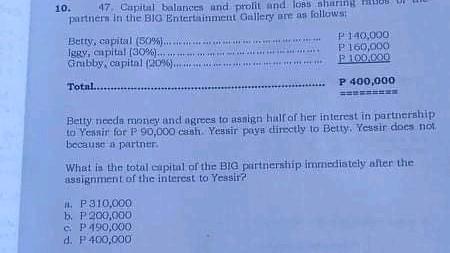

di 1 11 Solution: 1.200 D 1.00 S Balance 302 Auditional profit 2.000 5.000 5,000 31000 5,000 Total 0,000 8.000 16.666 2567 32,333 3.333 3,333 123.0 940 6000 A: P 50,000 x 5% -2,500 55: P 35,000 x 5% -1.250 P 25,000 x 5% -1,250 D: 20,000 x 5% -1,6X0 Forst, determine who among the partners will fixed amount, then compute for the residual amount .. for AA P12,500 - P2,500 - 15,000 resulting to a stare in the residual profit or 5,000 share in rechal profit of AA representat 30%, therefore cupitilize 5,000 by 30% to irrive at 16,666 which will be allocated to all partners based on their profit and loss ratio Sernd, determine who among the partners will retive a minimum amount Any partner who receives an amount lower than the minimum amount in required to have an additional profit, l.c. for partner DD, which in DD's 1,67 in needed to satisfy the minimum amount provided therein Any partner who receive an amount equal or more than the minimum amount obviously does not need an additional profit. 3. 33. The same information in Number 32, except the partnership had a loss of P 125,624 after the interest and salaries to partners, by what amount should BB's capital count change-increase (decrease) - P(115,443) bp 23.865 c P41,875) d P[15,010) Solution: d AA BB Totul 10% interest on average capital 47,250 22,865 16,235 87,350 Salaris 122,325 82,625 204,950 41.875 1875 (41 874 (125,624 85,200 (18,010) 56,985 166,676 ==== Not rounded due to discrepancy of P! 4.36. C, PP, und A, accountants, agree to forma partnership and to share prolit in the nitia of 5:32. They also agreed that AA is to be allowed a salary of P28,000, and that PP is to be guaranteed P21,000 as his share of the profits. During the first year of operation, income from fees are P 180.000, while expenses total 96,000. What amount of net income should be credited to each partner's capital account? C, P 28.000, PP.P 16,800, AA, P.11.200 ho, P25,000, PP, P 21,000, AA, P35,000 Balance sually di 1 11 10. 47. Capital balances und profit and lon nhar partner in the BIO Entertainment Gallery are as follows Betty, capital (30%) P140,000 Igry, capital (30%)... P160,000 Grubby, capital (20%)...... P100,000 Total.. P 400,000 . Betty needs money and agrees to manign half of her interest in partnership to Yennir for p 90,000 cash. Yes sir payu directly to Betty. Yeaser does not because s partner What in the total capital of the BIG pirtnership immediately after the assignment of the interest to Yessit? 1. P 310,000 b. P200,000 CP 490,000 d. P 400,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started