Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is the Given Data and, Please help with A) and B), thanks. You work as a trader for an equity fund. On the first

This is the Given Data

and,

Please help with A) and B), thanks.

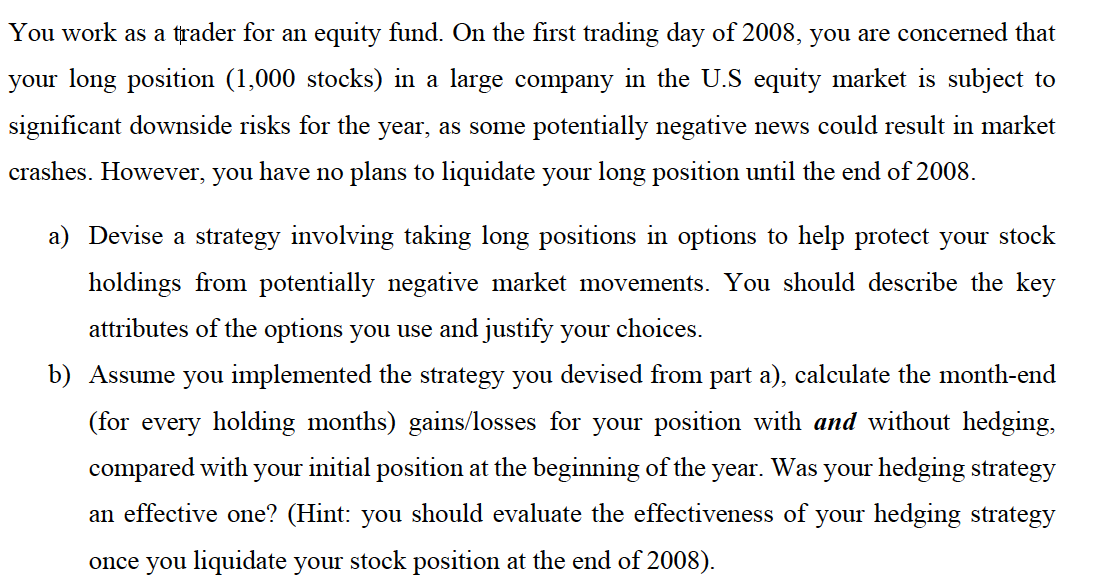

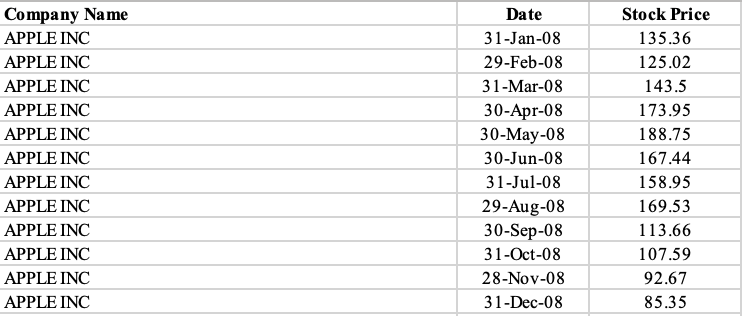

You work as a trader for an equity fund. On the first trading day of 2008, you are concerned that your long position (1,000 stocks) in a large company in the U.S equity market is subject to significant downside risks for the year, as some potentially negative news could result in market crashes. However, you have no plans to liquidate your long position until the end of 2008. a) Devise a strategy involving taking long positions in options to help protect your stock holdings from potentially negative market movements. You should describe the key attributes of the options you use and justify your choices. b) Assume you implemented the strategy you devised from part a), calculate the month-end (for every holding months) gains/losses for your position with and without hedging, compared with your initial position at the beginning of the year. Was your hedging strategy an effective one? (Hint: you should evaluate the effectiveness of your hedging strategy once you liquidate your stock position at the end of 2008). Stike Price Company name APPLE INC Ticker AAPL Date 2-Jan-08 Bid Price - Call 39.3 Ask Price - Call 39.65 Bid Price - Put 36.95 Ask Price Put 37.3 Stock Price 194.84 200 Company Name APPLE INC APPLE INC APPLE INC APPLE INC APPLE INC APPLE INC APPLE INC APPLE INC APPLE INC APPLE INC APPLE INC APPLE INC Date 31-Jan-08 29-Feb-08 31-Mar-08 30-Apr-08 30-May-08 30-Jun-08 31-Jul-08 29-Aug-08 30-Sep-08 31-Oct-08 28-Nov-08 31-Dec-08 Stock Price 135.36 125.02 143.5 173.95 188.75 167.44 158.95 169.53 113.66 107.59 92.67 85.35Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started