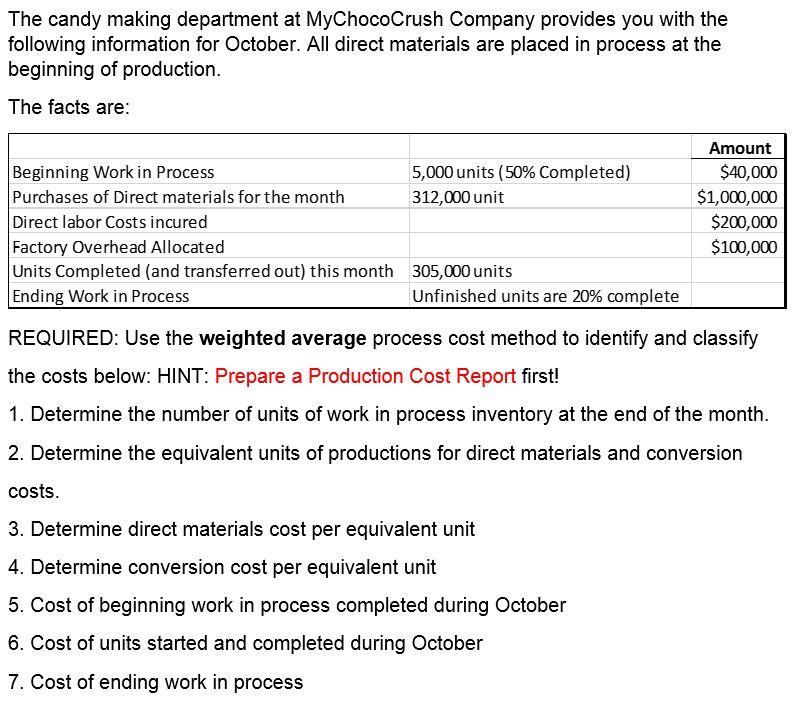

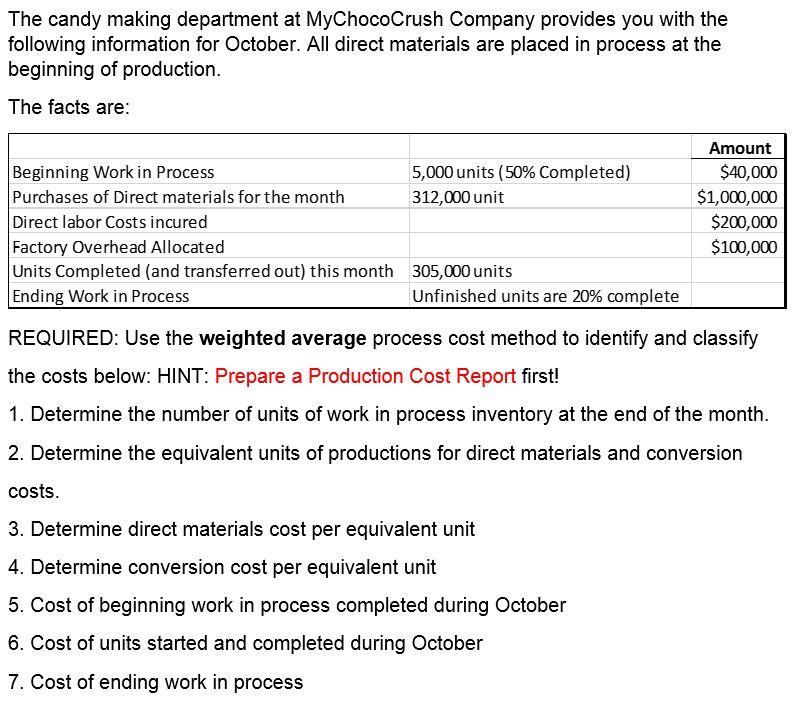

This is the problem we were given:

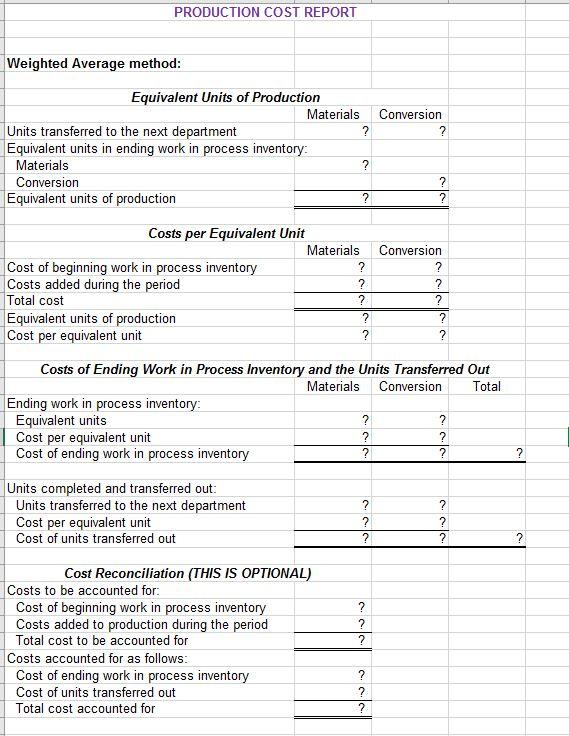

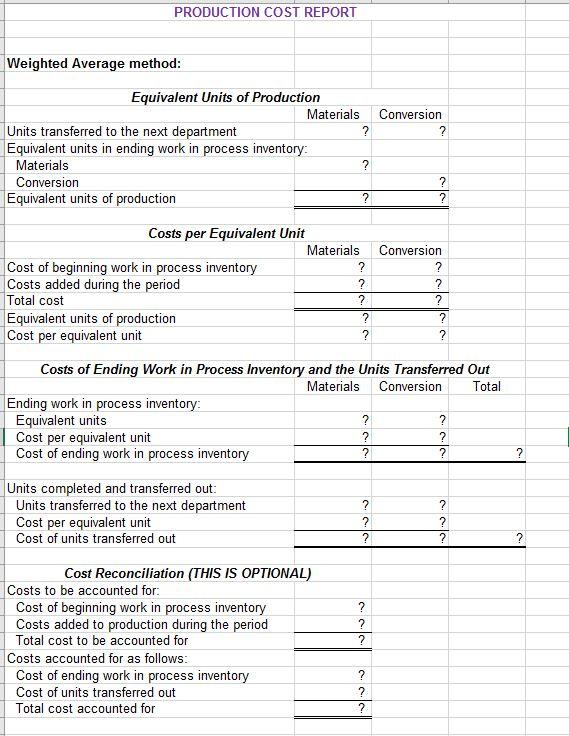

And this is the template we are supposed to follow:

The candy making department at MyChocoCrush Company provides you with the following information for October. All direct materials are placed in process at the beginning of production. The facts are: Beginning Work in Process 5,000 units (50% Completed) Purchases of Direct materials for the month 312,000 unit Direct labor Costs incured Factory Overhead Allocated Units Completed (and transferred out) this month 305,000 units Ending Work in Process Unfinished units are 20% complete Amount $40,000 $1,000,000 $200,000 $100,000 REQUIRED: Use the weighted average process cost method to identify and classify the costs below: HINT: Prepare a Production Cost Report first! 1. Determine the number of units of work in process inventory at the end of the month. 2. Determine the equivalent units of productions for direct materials and conversion costs. 3. Determine direct materials cost per equivalent unit 4. Determine conversion cost per equivalent unit 5. Cost of beginning work in process completed during October 6. Cost of units started and completed during October 7. Cost of ending work in process PRODUCTION COST REPORT Weighted Average method: Conversion ? Equivalent Units of Production Materials Units transferred to the next department ? Equivalent units in ending work in process inventory: Materials ? Conversion Equivalent units of production ? ? ? Costs per Equivalent Unit Materials Cost of beginning work in process inventory Costs added during the period ? Total cost ? Equivalent units of production Cost per equivalent unit ? Conversion ? ? ? ? ? ? Costs of Ending Work in Process Inventory and the Units Transferred Out Materials Conversion Total Ending work in process inventory: Equivalent units ? ? Cost per equivalent unit ? Cost of ending work in process inventory ? ? ? Units completed and transferred out: Units transferred to the next department Cost per equivalent unit Cost of units transferred out ? ? ? ? ? ? Cost Reconciliation (THIS IS OPTIONAL) Costs to be accounted for: Cost of beginning work in process inventory Costs added to production during the period Total cost to be accounted for Costs accounted for as follows: Cost of ending work in process inventory Cost of units transferred out Total cost accounted for ? ? ? (le