Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is to formally inform you that we have accepted your proposal. I am looking forward to your appraisal of our situation, as well as

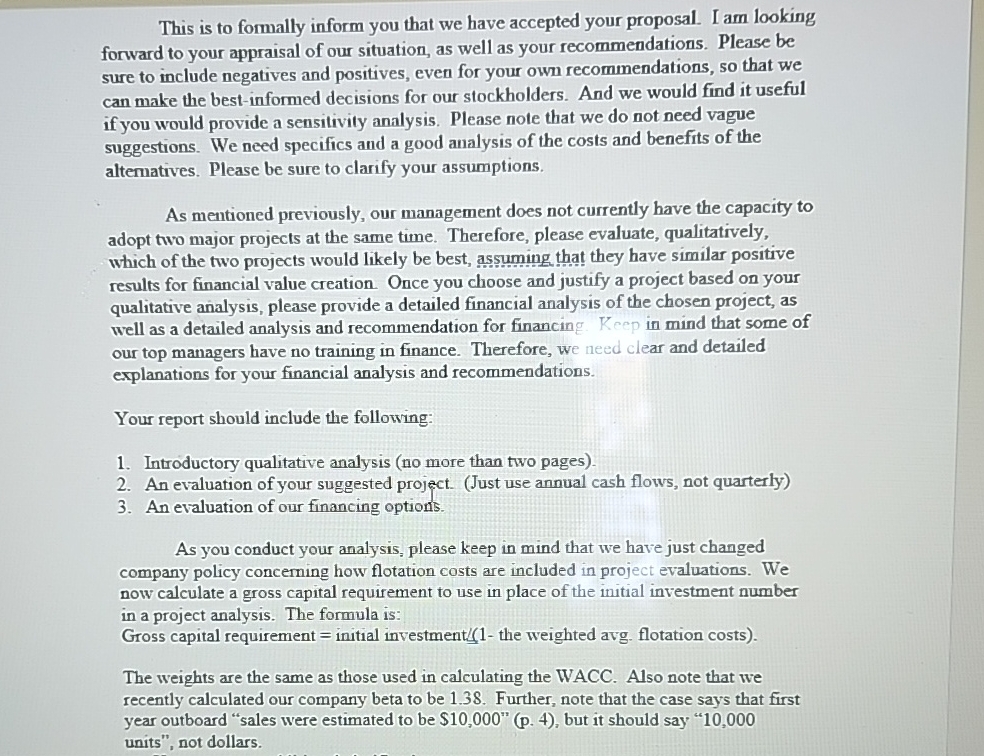

This is to formally inform you that we have accepted your proposal. I am looking forward to your appraisal of our situation, as well as your recommendations. Please be sure to include negatives and positives, even for your own recommendations, so that we can make the bestinformed decisions for our stockholders. And we would find it useful if you would provide a sensitivity analysis. Please note that we do not need vague suggestions. We need specifics and a good amalysis of the costs and benefits of the alternatives. Please be sure to clarify your assumptions.

As mentioned previously, our management does not currently have the capacity to adopt two major projects at the same time. Therefore, please evaluate, qualitatively, which of the two projects would likely be best, assuming that they have similar positive results for financial value creation. Once you choose and justify a project based on your qualitative analysis, please provide a detailed financial analysis of the chosen project, as well as a detailed analysis and recommendation for financing. Keep in mind that some of our top managers have no training in finance. Therefore, we need clear and detailed explanations for your financial analysis and recommendations.

Your report should include the following:

Introductory qualitative analysis no more than two pages

An evaluation of your suggested project. Just use annual cash flows, not quarterly

An evaluation of our financing options.

As you conduct your analysis, please keep in mind that we have just changed company policy concerning how flotation costs are included in project evaluations. We now calculate a gross capital requirement to use in place of the initial investment number in a project analysis. The formula is:

Gross capital requirement initial investment the weighted avg. flotation costs

The weights are the same as those used in calculating the WACC. Also note that we recently calculated our company beta to be Further, note that the case says that first year outboard "sales were estimated to be $p but it should say units", not dollars.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started